Tuition Remission & Your Taxes

The Tuition Remission (TR) value for graduate classes numbered 600 and above is considered to be additional taxable earnings to you by the Internal Revenue Service. Taxation does not apply to undergraduate courses.

Employees are exempt from $5,250 each calendar year. Employees must pay tax on all graduate level TR which their spouses receive. The tax is deducted from employee paychecks according to the following schedule:

| Semester | Months of Taxation |

| Spring | January through May |

| Summer | June through August |

| Fall | September through December |

Example 1 – Spouse of monthly paid employee taking 8 credits in the Spring semester

Jason’s spouse is taking two graduate level classes in Spring semester 2023. The total tuition charge is $5,928, and 50% is covered by the Tuition Remission benefit. The total TR for Spring 2023 is $2,964. There is no annual exemption for spousal TR, therefore, the entire $2,964 is taxable during the Spring semester months of January, February, March, April and May.

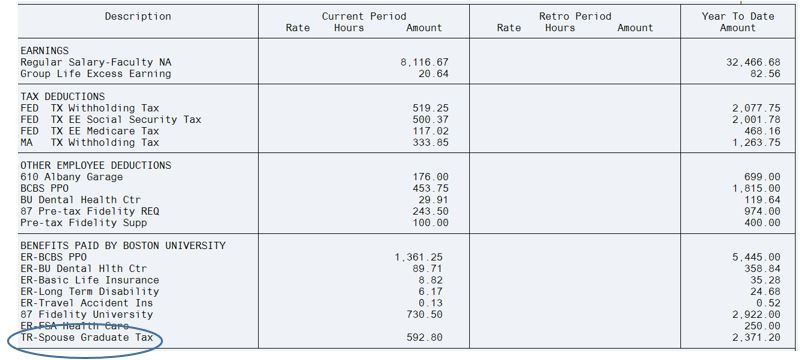

$592.80 is the additional amount that will be added as taxable income to Jason’s paycheck each month. He will see a notation on his Pay Statement under “Benefits Paid By Boston University”. The line is titled “TR-Spouse Graduate Tax” and shows the amount that is being taxed. This is not the amount that is deducted from the paycheck! The taxes deducted are part of the “Tax Deductions” section. They are not shown on a separate line.

Example 2 – Weekly paid employee taking 4 credits in Summer Term

Paolo takes 1 graduate level class in Summer Term 2023. The cost for the class is $3,280. These first four credits are covered 100% by Tuition Remission Benefit. His total TR benefit for Summer 2023 is $3,280.

He has already taken several graduate classes in calendar year 2023, and has met the $5,250 exemption in the prior semester. His Summer 2023 graduate classes will be fully taxable during the Summer Term weekly paychecks in June, July and August. Paolo is paid weekly, and the total taxable amount is divided equally over the thirteen weekly pay periods.

$252.31 is the additional amount that will be added as taxable income to Paolo’s paycheck each week. He will see a notation on his Pay Statement under “Benefits Paid By Boston University”. The line is titled “TR-EE Graduate Tax” and shows the amount that is being taxed. This is not the amount that is deducted from the paycheck! The taxes deducted are part of the “Tax Deductions” section. They are not shown on a separate line.

Example 4 – Semi-monthly paid employee taking 8 credits in the Spring semester

Jennifer takes 2 graduate level classes in Spring semester 2023 in the School of Public Health. These are the first classes she is taking in calendar year 2023. The cost for each class is $5,928. The first four credits are covered 100% and credits 5 to 8 are covered 90% by the Tuition Remission Benefit. Her total TR benefit for Spring 2023 is $11,263.20.

After deducting the $5,250 exemption, $6,013.20 remains to be taxed during the Spring semester months of January, February, March, April and May. Jennifer is paid semi-monthly, and the total taxable amount is divided equally over the ten semi-monthly pay periods.

$601.32 is the additional amount that will be added as taxable income to Jennifer’s paycheck each month. She will see a notation on her Pay Statement under “Benefits Paid By Boston University”. The line is titled “TR-EE Graduate Tax” and shows the amount that is being taxed. This is not the amount that is deducted from her paycheck! The taxes deducted are part of the “Tax Deductions” section. They are not shown on a separate line.

Example 5 – Spouse of semi-monthly paid employee taking 8 credits in the Spring semester

Jason’s spouse is taking two graduate level classes in Spring semester 2023. The total tuition charge is $5,928, and 50% is covered by the Tuition Remission benefit. The total TR for Spring 2023 is $2,964. There is no annual exemption for spousal TR, therefore, the entire $2,964 is taxable during the Spring semester months of January, February, March, April and May. Jason is paid semi-monthly, and the total taxable amount is divided equally over the ten semi-monthly pay periods.

$296.40 is the additional amount that will be added as taxable income to Jason’s paycheck each month. He will see a notation on his Pay Statement under “Benefits Paid By Boston University”. The line is titled “TR-Spouse Graduate Tax” and shows the amount that is being taxed. This is not the amount that is deducted from the paycheck! The taxes deducted are part of the “Tax Deductions” section. They are not shown on a separate line.