Erik Noyes – Boston University

Dr. Erik Noyes, a recent doctoral graduate of the School of Management, has been working for the past five years on novel research which analyzes how company positions in interlocking boards affect risk-taking and entrepreneurial behavior among the largest U.S. companies.

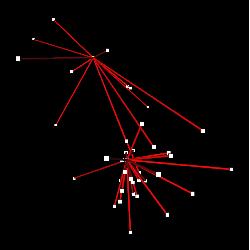

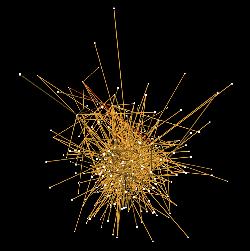

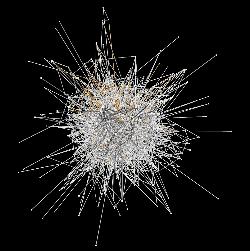

An interlocking board occurs when a board member of one firm also serves on additional company boards — thereby creating a “tie” between two or more companies. For example, IBM and Intel may “share” a board member who sits on both of their respective boards, such that information about each company’s respective industry or market environment may be accessed through that director. Structural Hole Theory predicts that a company’s connections — and more specifically its absence of certain connection — will shape its access to unique information, i.e., information which other companies may struggle to obtain based on their position in a firm network. Dr. Noyes analyzed a study sample of thousands of firms and tens of thousands of directors spanning a period of eight years, in order to observe the effect of interlocking boards on investments in new corporate ventures, a major source of growth and innovation for large companies (for context: Intel invested over $3 billion dollars in new corporate ventures between 1996 and 2006!).

To illustrate his research Dr. Noyes collaborated with Boston University’s Scientific Computing and Visualization group (SCV). Ray Gasser, a senior graphics programmer with SCV, is working with Dr. Noyes to develop a software application for interactively viewing large graphs of the social network data in order to demonstrate the effects of interlocking boards. Once the software is finalized the visualization of Dr. Noyes’ research will be enhanced by using the Deep Vision Display Wall. This high-resolution stereo display wall allows the viewer to see and interact with the data in three dimensions by using stereoscopic glasses. As a result of the customized software, Dr. Noyes is now able to demonstrate specific first and second level connections between companies’ interlocking boards (see figures on right) as well as interact with the data in ways not possible using earlier tools. What makes the collaboration between Dr. Noyes and SCV interesting is that the visualization consists of business data and not the more traditionally scientific research areas such as physics, chemistry, and biomedical engineering. The collaboration between Dr. Noyes and the SCV group at Boston University has successfully created a tool for interacting and visualizing three dimensional models of firm positions in interlocking boards and new venture investment activity.