Sponsored Awards Issued in Foreign Currency

Purpose

To establish guidelines for Faculty who receive Sponsored Research Awards from and provide Subaward funding to non-US entities.

Covered Parties

This policy applies only to sponsored projects funded directly by and provide Subaward funding to non-US entities.

Definitions

Exchange Rate

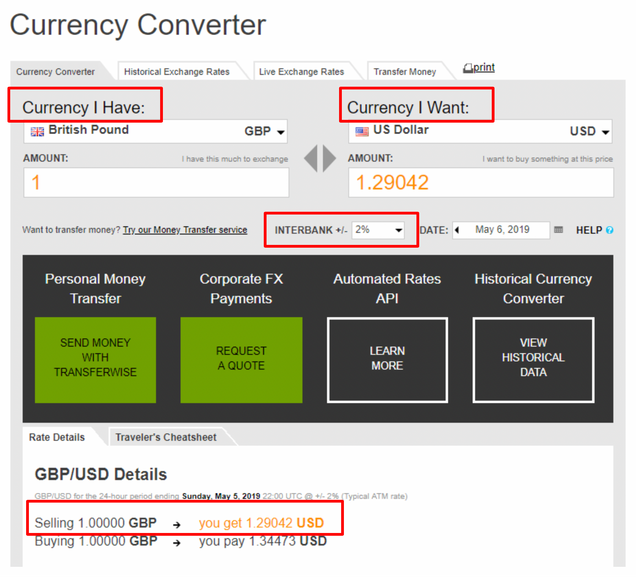

The relationship between the value of the U.S. dollar and the value of a unit of foreign currency at any point in time; the exchange rate is used to convert a given foreign currency amount to a U.S. dollar equivalent amount. When calculating the exchange rate, BU Departments and Subawardees must use www.oanda.com, +/- 2%, Selling Price. Please see below for step by step instructions.

Escrow

A financial instrument held by a third party on behalf of the other two parties in a transaction. The funds are held by the escrow service until it receives the appropriate written or oral instructions or until obligations have been fulfilled.

Hedging

Making an investment to reduce the risk of adverse price movements in an asset.

University Policy

As a U.S. dollar based institute, the University seeks to minimize its exposure to foreign exchange risk. Entering into research contracts denominated in foreign currencies is strongly discouraged. Principal Investigators should be aware of the associated risk when entering into these types of agreements. The leading risk is that the foreign exchange rate will drop during the life of the award. Any drop in the rate may adversely affect the University’s ability to complete the project within the funds available.

Should negotiation of an award result in funds being provided in a foreign currency, Boston University will work with the department to determine the best available option to minimize the risk of potential currency loss. Available options described below include: Advance Payments, Escrow Accounts and Hedging.

Advance Payments

The Sponsoring Agent should pay Boston University the projected award total in advance, eliminating any risk relating to fluctuation in currency exchange rates.

Escrow Accounts

The Sponsoring Agent would put the full amount of the projected award total in an escrow account based on the exchange rate at the time of negotiation. Boston University would invoice the Sponsoring Agent as needed, wherein payment would be paid from the Escrow Account eliminating any fluctuation in currency exchange rates.

Hedging

Depending on the risk associated with the grant currency, a strategy to hedge the currency risk may be an option. Following a hedging strategy, at the beginning of the grant, the University would enter into contracts in the financial markets to purchase dollars with the grant currency at a fixed price, over the life of the grant. Working with Treasury and Risk Management, Sponsored Programs and the PI can develop a strategy as to the amount, timing and cost of hedging, based on the expenditures expected to take place in local currency, expenditures that will be in US dollars, and when these expenditures would take place. The cost of hedging would be a direct cost of the grant and should be incorporated in the grant budget, or funded by the department. Depending on the volatility of the grant currency, hedging can be an expensive option; if this option is being considered, Treasury and Risk Management should be consulted early in the negotiation process.

In addition, the grant agreement could incorporate language providing the PI and the University with the right to modify the statement of work, should currency exchange rates fluctuate outside of certain parameters. Treasury and Risk Management can assist in determining how the proposed parameters should be set.

If the options for advance payment, creation of an escrow account, or modification of contract language cannot be negotiated, and a hedging strategy is determined to be impractical, and the University and the PI have determined there is still benefit to entering into the agreement, the award will be set up on the University’s system with a fixed budget based on the currency rate at the time the award was executed. Unless Sponsor terms and conditions differ, if an exchange rate gain is realized, the associated department will be credited with the funds. If an exchange rate loss is realized, the associated department will need to work with their Sponsored Programs Pre-Award Officer to contact the sponsoring agent about amending the award. If the University is unsuccessful in amending the award, the exchange rate loss will be absorbed by the department and/or college of the Principal Investigator.

Responsible Parties

| Subject | Contact | Phone |

|---|---|---|

| Preparing Proposal Budgets | Sponsored Programs, Pre-Award | 617-353-4365 |

| Fiscal Budget Oversight | Sponsored Programs, Post-Award | 617-353-4555 |

| Exchange Rate | Debt and Treasury Management | 617-353-2290 |

History

This policy was adopted in May 2017; updated May 2019; updated June 2022.

Step-by-Step Instructions

Go to www.oanda.com

Click on “Currency Converter” as outlined in the Red Box

Click on “Converter” as outlined in the Red Box

Change the “Currency I have” and “Currency I want” accordingly.

Ensure the “Interbank +/-“ references 2%

The Selling Price is the converted amount you should use. In this example 1 GBP = $1.29042 USD