Gallagher and GDP Center in Bloomberg Money on China’s Energy Lending

Kevin Gallagher, Director of the Global Development Policy (GDP) Center and Professor of Global Development Policy at the Frederick S. Pardee School of Global Studies was interviewed by Bloomberg Markets for its report on the GDP Center’s newly released research on Chinese overseas finance. The news report, titled “China’s Overseas Energy Financing Plummets to Lowest in a Decade,” was published on February 13, 2020.

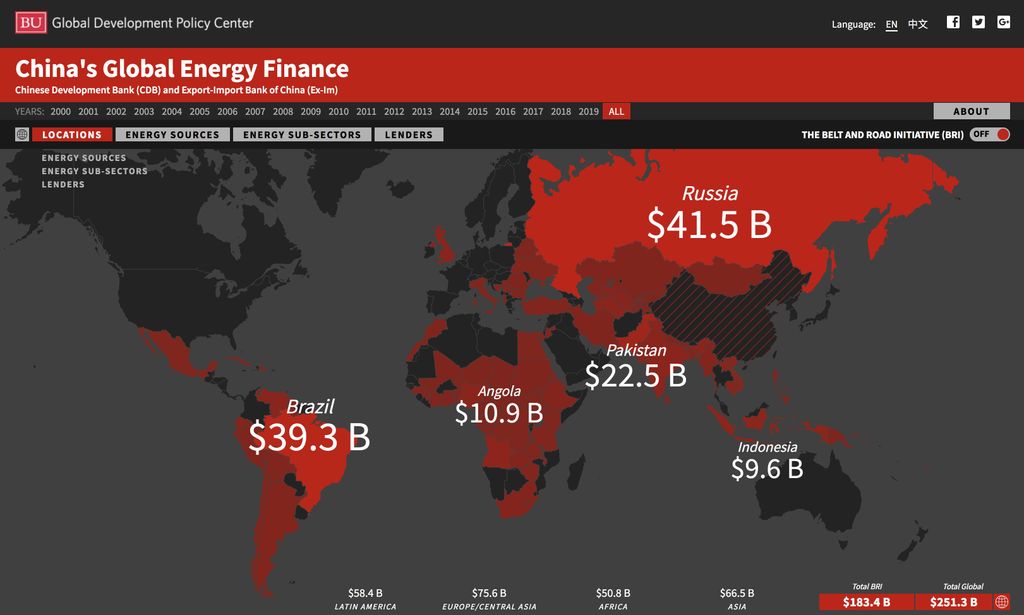

The new GDP Center report finds that “China’s spending on overseas energy projects has dropped to its lowest in more than a decade, as the nation focuses on domestic issues and rethinks its strategy around indebtedness and the world’s energy mix.” It dropped by 69% to $3.2 billion in 2019 and only “three nations received financing for new projects from China’s policy banks last year, compared with five the previous year.”

The Bloomberg article quotes Gallagher as saying, “The Chinese are getting concerned about the debt levels countries have, and want to be more cautious about their lending… I wouldn’t expect a bounce-back in 2020, given the circumstances related to the virus and the general downturn anyway.” It goes on to quote him, as follows:

“We would hope to expect a real shift toward wind and solar and so forth in 2020, but I have to say as an economist there needs to be a supply shift and a demand shift,” Gallagher said. “So if the Chinese are willing to put more solar and wind on offer, of which they have plenty, countries on the demand side need to be asking for that. We haven’t seen too many.”

Read full Bloomberg article here. Read more about the new research from the GDP Center here.

Kevin Gallagher is a professor of global development policy at Boston University’s Frederick S. Pardee School of Global Studies, where he directs the Global Development Policy Center. He is author or co-author of six books, including most recently, The China Triangle: Latin America’s China Boom and the Fate of the Washington Consensus. Read more here.