Lodging Update: Portland, Maine

By Rachel Roginsky and Matthew Arrants

Each quarter, Pinnacle Advisory Group prepares an analysis of the New England lodging industry, which provides a regional summary and then focuses in depth on a particular market. These reviews look at recent and proposed supply changes, factors affecting demand and growth rates, and the effects of interactions between such supply and demand trends. In this second issue, we spotlight the lodging market in Portland, Maine.

New England Summary

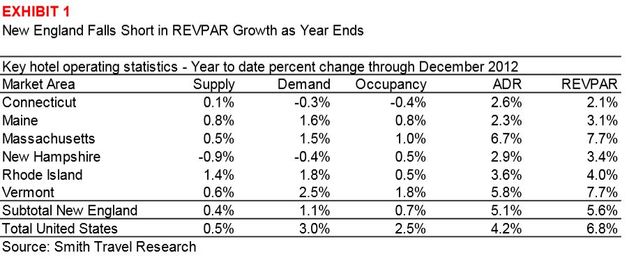

After a strong first eight months of the year, the New England lodging market’s performance slowed considerably. Revenue per available room (REVPAR) for the region had been up 7.6% through August. However, it finished up 5.6% compared to 6.8% for the country as a whole. The slowdown in performance was widespread, with every state in the region experiencing REVPAR growth that was lower than it had been through August. Likely explanations for the slowdown include the effects of ‘Superstorm’ Sandy, concerns over the fiscal cliff negotiations in Washington, and a softer convention period in Boston. On a positive note, the REVPAR growth in both the Massachusetts and Vermont lodging markets exceeded the national annual REVPAR growth.

Performance by State

Connecticut

Room nights sold (demand) in Connecticut declined in 2012 by 0.3%. Fortunately, operators were able to achieve 2.6% growth in average rate, leading to positive REVPAR growth of 2.1%. The decline in demand can be attributed to a variety of factors, but a reduction in government contract demand and softening demand from the casinos are considered to be the primary factors.

Maine

Maine finished the year with an occupancy rate of 56.8%, which was slightly higher than 2011. Although demand growth was modestly positive at 1.6%, the 0.8% supply increase limited the state’s ability to move the needle on occupancy. The average rate for the state grew by 2.3% to $102, less than half the growth rate of the combined New England lodging market. During the first half of the year, the Maine lodging market had reasonably strong REVPAR growth (4.0% as of August 2012), but by year-end the REVPAR growth stalled, ending with 3.1% growth as compared to 2011. Two notable markets that performed well were Bangor, which benefitted from casino and airport related demand, and Portland, which will be discussed in more detail below.

Massachusetts

Lodging performance in Massachusetts, as a whole, is heavily impacted by activity in Boston. More than half of the hotel rooms in the state are located in the Greater Boston area, with approximately one-quarter in the cities of Boston and Cambridge alone. Boston also serves as a critical gateway for the rest of New England, as travelers frequently add extra days to business or convention trips to visit other areas of the region. Very strong convention demand in the first eight months of the year helped increase demand for the state by 2.9%.

However, demand softened significantly in the convention, corporate, and leisure segments during the latter portion of the year, such that demand was up only 1.5% for the year as a whole. One possible explanation is that the market was already operating at or near capacity during those periods, particularly in the peak demand months of September and October.

New Hampshire

The performance of the New Hampshire market in 2012 was surprisingly tepid for an election year. Normally, the state experiences a strong surge in demand and average rate leading up to the presidential primary, as candidate teams and media flood the state. In 2012, however, only the Republican primary was important and the reorganization of the primary calendar likely had an impact. Lastly, tourism was probably impacted by a very mild winter. These factors contributed to minimal change in the statewide occupancy. Operators, however, were able to raise room rates, which resulted in a 2.9% increase in statewide ADR.

Rhode Island

After a strong spring and summer, demand in Rhode Island began to slip during the fall. According to Smith Travel Research, demand in the state finished the year up 1.8% compared to 3.0% for the country as a whole. While average rates grew by a strong 3.6%, they still fell short of the national average of 4.2%. The good news for Rhode Island is that REVPAR has come a long way since 2009, when the state’s REVPAR dropped to $60. However, the state’s $73 REVPAR in 2012 still falls below the peak $78 REVPAR that the state experienced in 2007, and even further from the $83 REVPAR in 2000. The Providence market experienced the strongest lodging metrics, while the Warwick (airport) market continued to experience anemic performance.

Vermont

Vermont was one of the top performing states in the region, with REVPAR growth of 7.7%. While the state benefitted in the early part of the year from crews related to the cleanup from Hurricane Irene, the drop in demand during the second half of the year was not as significant as might have been expected, leading to an annual demand growth of 2.5% and an annual occupancy of 60.1%. Operators were not shy about increasing room rates during the peak tourist seasons. In fact, average rate growth in the last four months of the year was stronger than during the first eight months, which resulted in a $124 ADR in 2012. Vermont is one of only five states with ADR over $120.

Anticipated Changes

Several markets are poised for changes over the next 12 to 18 months. These include the following.

Providence, RI

Three transactions over the past year are likely to impact the market in future. The Biltmore sold early in the year and a major renovation is underway. The Renaissance Hotel was purchased by the Procaccianti group, the former owner of the Westin. The Westin was recently sold to Omni.

Hartford, CT

The downtown market continues to struggle. In 2012, occupancy declines off-set gains in ADR leading to a slight REVPAR decline of 0.1%. The Ramada that had been the Crowne Plaza is reportedly for sale. The Ramada in East Hartford is now an independent property. Beyond downtown, the developers of the Delamar in Greenwich have reportedly been selected to develop a boutique hotel in West Hartford.

The Berkshires

Demand in this area of western Massachusetts is fairly typical of the resort markets in the region, with occupancies that rarely top 60%, but strong average rates in excess of $150. Owners in the area have been investing in renovations and there is interest in new development.

Brattleboro, VT

There is considerable speculation about the fate of the Vermont Yankee nuclear power plant. If the plant receives the necessary approvals to stay open, then the construction work could prove a boon to the local lodging market. If it is forced to close, then the market will benefit over the short term from contractors brought in as part of the decommissioning process.

Greater Boston

The cities of Boston and Cambridge, and the suburban Boston lodging market, should continue to show very strong numbers in 2013, due to capacity constraints caused by limited new supply. While there are two hotels expected to open in Boston in 2013, market occupancy is expected to remain at or near 78%.

Projections

While demand growth in New England softened in the second half of the year (2.0% demand growth as of August 2012 versus 0.7% demand growth as of December 2012) we remain optimistic about the prospects for the regional lodging market. Boston will have a softer convention year, but many operators have been successful in getting smaller in-house groups to compensate. Moderate economic growth in other areas of the region coupled with limited new supply should help occupancy levels remain at healthy levels and enable operators to continue to increase room rates at or above inflationary levels.

Spotlight on Portland, Maine

The Portland, Maine market is composed of two submarkets, downtown and the mall/airport area. Given their proximity, approximately five miles apart, it is not surprising that many hotels compete in the adjoining area. Nonetheless, these are distinct markets that behave somewhat differently. Leisure travelers generally prefer the downtown location, and as a result average rates are higher.

The Portland market is in the midst of a major change in supply. Helping to drive the change has been a moderately strong economy and the market’s ability to absorb new supply over the last few years.

In 2008, the market added a Courtyard by Marriott (88 rooms) and a Homewood Suites (92 suites) near the Maine Mall. In the downtown area, a Residence Inn (179 rooms) opened in 2009, followed by a Hampton Inn (122 rooms) in 2011. Currently there are four new hotels proposed and a major renovation/repositioning underway.

Supply

The following is a summary of proposed hotel projects.

Courtyard by Marriott

A joint venture including Maine Course Hospitality Group has plans to develop a Courtyard by Marriott (120 rooms) on the J.B. Brown site. This is located on the corner of Commercial Street and Maple Street, on the southern edge of the Old Port District. The project is expected to open in 2014.

Portland Press Herald Site

This proposed development is currently in the pre-planning stages. Near the intersection of Congress and Market streets, an urban rehabilitation project has been rumored. Initial plans include a boutique independent hotel (80 units) on the site. Assuming the developer is able to obtain financing, this project could open as early as 2014.

Eastland Park Hotel

In 2011, Rockbridge Capital purchased the Eastland Park Hotel with plans to completely renovate and re-brand the property as a Westin. The hotel closed in July 2012 for a renovation that is expected to cost in excess of $30 million. It is scheduled to reopen in August 2013. Upon reopening, it will have 290 rooms.

Thompson’s Point

Thompson’s Point is located directly off the I-295 highway, southwest of the downtown area. Two owners of the Maine Red Claws basketball team have rolled out plans for a $100 million multi-use development. Elements of ‘The Forefront’ project include a 48,000 square foot convention center, a 3,500 seat arena, a 700-car parking garage, an unspecified amount of office space, and a 125-room hotel. The project was first introduced in April 2011 and has since been refined. The developers are rumored to have plans for a Homewood Suites with a projected opening in late 2014.

Demand

Market segmentation for the Portland area is approximately 40% commercial, 20% group, and 40% leisure. The following provides an overview of each segment.

Corporate Transient

Corporate demand represents the largest segment. This market is primarily comprised of executives visiting their respective offices, traveling consultants and salesmen, and employees traveling to the local area for training purposes. The largest demand generators in this category are TD Bank, Idexx, Unum, National Semiconductor, and WriteExpress. The commercial individual traveler demand is characterized as follows:

◦High degree of single occupancy;

◦Average length of stay one to three days;

◦Efficient check-in and check-out procedures required;

◦Frequently books rooms via corporate travel agents;

◦Desires high quality accommodations; and

◦Requires proximity to place of business and accessibility to major transportation routes.

Within the two geographic submarkets, more senior executives stay downtown, which is considered more desirable and room rates are generally more expensive. There are no major events that are expected to dramatically impact corporate demand in the near future, and therefore we expect only moderate growth in the segment.

Group

Group demand represents the smallest source of room nights in the competitive market, accounting for approximately 25% of total demand. Group demand in Portland is comprised of corporate groups, convention-related groups, business training sessions, state and regional associations, trade shows, tour groups, and SMERF (Social, Military, Educational, Religious, and Fraternal) groups. This segment can be characterized as follows:

◦Discounted room rates required;

◦Prefers being proximate to tourist destinations;

◦Flexible meeting and banquet facilities of-ten required;

◦Quality on-site food and beverage service preferred; and

◦Variety of room configurations required.

Portland has four primary hotels that cater to groups. These are the Marriott Sable Oaks, the Doubletree near the mall and the airport, the former Eastland Park (soon to be a Westin), and the Holiday Inn by the Bay. Due to the limited supply of function space in the market, some groups have reportedly been forced out of the area. The attractiveness of the destination to leisure travelers has helped to generate demand from tour groups and SMERF organizations. Demand growth in the group segment is expected to be moderate to low until the opening of the Westin.

Leisure Transient

Portland is a popular leisure destination during the warmer months. The major demand generators for the Greater Portland area include the Casco Bay Islands, the Old Port in downtown Portland, the Maine Mall, the Freeport Outlet Shops, and general weekend travel. Leisure traveler demand is strongest on weekends in the spring, summer, and fall months. This demand segment can be characterized as follows:

◦High incidence of weekend occupancy;

◦Average length of stay one to two nights;

◦Highly seasonal; and

◦A relatively high percentage of multiple occupancy.

Demand growth in the leisure segment has been very strong in recent years, as new hotel product in the downtown area complemented the development and marketing of the city as a culinary and arts center. During the warmer months, most of the leisure demand comes from New York and southern New England. In the shoulder and off-season months, lower rates attract leisure travelers from other parts of Maine and northern New England. There are no major attractions or developments planned that are likely to dramatically increase leisure demand in the near future. However, the civic center is being renovated and new restaurants, galleries, and breweries continue to open at a fast pace.

Demand Conclusion

Lodging demand in the Portland market is expected to continue to remain robust into the foreseeable future. Due to the strong seasonality of demand and limited function space, there appears to be significant unaccommodated demand in the group and leisure segments. Corporate demand is expected to experience slow growth in the absence of any major corporate relocations or expansions in the market. In 2012, lodging demand growth in the Portland region was approximately 1%. We expect similar growth in 2013. Most of the growth is expected to occur in the leisure segment during the shoulder and off-season periods.

Average Rate

Transient Corporate

Rate growth in the corporate segment is expected to be limited into the foreseeable future. The local companies remain price sensitive and have leverage during the shoulder and off-season months. With occupancy levels for the region below 60% on an annual basis, operators are not willing to give up demand during the winter months, when group and leisure demand are weakest. As a result, local negotiated rates will only increase between 1% and 3%.

Group

Growth in group rates will benefit from the reduction in supply that resulted from the closing of the Eastland Park Hotel. Following its re-opening as a Westin, the market will benefit, as the new product will dictate higher room rates. In 2013, we expect group rates to grow by 2% to 4%.

Transient Leisure

Rate growth in the leisure segment has been very strong in recent years, as new higher quality product in the downtown market has warranted higher room rates. In addition, capacity constraints due to the seasonality of demand have also helped operators achieve strong increases in this segment.

Looking forward, we expect rate growth in this segment to be the strongest. Specifically, we project that rates in this segment will grow between 3% and 5%.

Rachel J. Roginsky, ISHC, is the owner of Pinnacle Advisory Group. She has more than 30 years of experience in hospitality consulting. Ms. Roginsky is a board member of numerous organizations related to hospitality, is a regular guest lecturer at the Cornell Hotel School, and is co-editor of five leading hotel investment books. Email rroginsky@pinnacle-advisory.com