Sleeping Under the Stars in Style: An Overview of Glamping

By Stacey Dangel, Michelle LaRocca, and Jonathan Jaeger of LW Hospitality Advisors®

Glamping is a relatively new trend in the hospitality industry, blending a camping experience with more traditional lodging services and amenities. Most easily defined as camping involving luxury style amenities and facilities, the term is a portmanteau of “glamorous” and “camping.” Despite the rise of glamping throughout the United States in recent years, many countries around the world have offered this product type for decades. However, El Capitan Canyon in Santa Barbara, California (which opened in 2001) and the Resort at Paws Up in Greenough, Montana (which opened in 2005), were the original properties on record in the United States offering glamping accommodations. Over the past 15 years, the demand for unique lodging facilities and experiences has fueled the rapid acceleration of glamping resorts across the country. The concept has evolved and adapted to target a wider range of experiential travelers by establishing properties in both remote and semi-urban areas (i.e. Dunton, Colorado to Kehena Beach, Hawaii to New York City), and by offering a variety of accommodation types, such as cabins, recreational vehicles (RVs), luxury tents, yurts, treehouses, and more. Glamping properties offer numerous layouts as well, from single room “tiny homes” to multi-bedroom cabins.

Glamping/Camping Industry Data

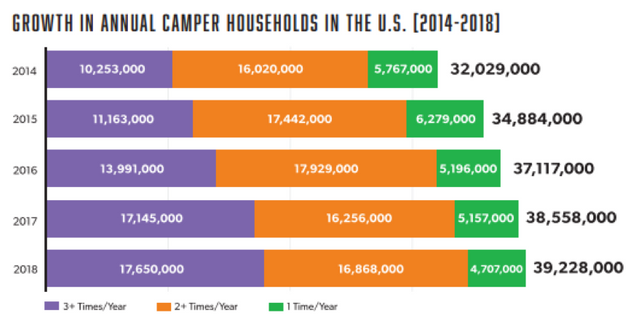

While glamping products seek to provide an elevated outdoor experience relative to traditional camping (via provision of amenities such as front desk/concierge service, spas, restaurants, bars, housekeeping service, etc.), the overall viewpoints of glamping and camping consumers appear to align. According to the 2019 Kampgrounds of America (KOA) North American Camping Report, approximately one million new camper households were added to the category of those who consider themselves annual campers in 2019, resulting in a total of more than seven million new camper households in the United States since 2014. Currently, the total number of camping households in the United States is approximately 78.8 million, and approximately 62 percent of United States residents camp occasionally. The following charts detail camping trends from both the United States and Canada. Of note is the continued growth in the South, Midwest, and Northeast regions during the past five years.

Source: The 2019 North American Camping Report 5-Year Trends®

As summarized within the charts below, since 2014 the number of households that go camping at least once per year has increased each year, while the distance that campers prefer to travel has trended to shorter distances, thereby implying the preference for more accessible options.

Source: The 2019 North American Camping Report 5-Year Trends®

Source: The 2019 North American Camping Report 5-Year Trends®

Glamping allows for an outdoor travel experience without bringing (or buying) equipment, and at certain properties, it also offers luxury amenities and services typical of a hotel. Based on the 2019 North American Camping Report 5-Year Trends® Report, approximately 54 percent of traditional campers prefer to travel within 100 miles of their residence. While glamping demand trends imply that guests may arrive by plane or by car, this indicator exhibits the strength of the drive-to glamping guest.

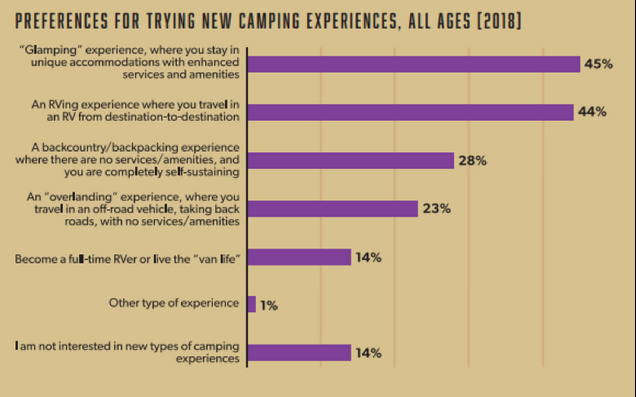

The 2019 KOA Camping Report also analyzed the likelihood of current campers’ interest in trying glamping and other new camping experiences. The data suggested that close to half of all campers surveyed indicated an interest in experiencing glamping in the coming year, a rate that more than doubled over the prior 12 months.

Source: The 2019 North American Camping Report 5-Year Trends®

Source: The 2019 North American Camping Report 5-Year Trends®

The current generations producing the most demand for the glamping segment are millennials and baby boomers. The indicators show that millennials seek getaways to disconnect from technology, while baby boomers are drawn to the outdoors and general enjoyment of recreational activities. There is a common misconception of many industry participants that equate the glamping space (as an alternative lodging concept) to the millennial generation, but the baby boomer generation should not be ignored given many of them are at or reaching retirement age. Baby boomers seem to have the time and desire to travel, and experience a new lodging concept that their children are also interested in.

While the overwhelming majority of guests that choose glamping resorts are leisure transient guests, there is a growing segment of corporate incentive travel seeking outings that are more unique and casual in nature than those offered by traditional large-scale resorts. Typically, such incentive travel is generated by companies in the technology sector, examples include Google, Netflix, Uber, and other relatively young, innovative companies such as Warby Parker. Nonetheless, demand for glamping resorts spans other traditional segments and provides an enormous opportunity going forward for further growth.

Glamping Supply

Reportedly, the demand base for glamping resorts primarily consists of millennials and baby boomers who have camped during other stages of their life, but do not currently have access to necessary/traditional camping equipment (nor the desire to purchase it). As such, the glamping product type allows for these guests to arrive sans equipment, and experience camping without the hassle. Furthermore, the nature of glamping as a semi-serviced property gives guests a sense of safety that may otherwise be lacking (or perceived to be lacking) at a traditional campground.

The Resort at Paws Up, which opened in 2005 on 37,000 acres in Montana, was one of the pioneers in blending luxurious accommodations with traditional camping under the tag of “glamping.” In 2019, the resort announced an expansion featuring 12 adult-only accommodations situated in “treehouses”, which is anticipated to escalate the glamping offerings to a new level. Other notable luxury properties include Dunton River Camp in Dolores, Colorado and El Cosmico in Marfa, Texas. These properties demonstrate examples of luxury or ultra-luxury options within the glamping space.

As the alternative lodging space has continued to grow in terms of acceptance and use by travelers, numerous brands have emerged throughout the United States. While a vast number of existing glamping supply is independently operated, several larger players have recently entered the market, such as Under Canvas, Terra Glamping, Collective Retreats, Getaway, and AutoCamp. Service levels at each brand vary widely with several properties offering spa treatments and curated bespoke experiences, while other properties limit interactions with staff to a text message for both check in and delivery services. This wide range of service levels and amenity packages allows the glamping space to cater to a diverse audience in terms of pricing, location, and experience. Several of the major branded glamping players are outlined below:

AutoCamp, an officially licensed partner of Airstream, Inc., offers several accommodation types at three existing properties: AutoCamp Yosemite, AutoCamp Russian River, and AutoCamp Santa Barbara. All unit types are pet-friendly and include custom Airstreams, modern cabins, Luxury Tents (based on seasonality), and Happier Campers. On average, Airstreams comprise approximately 190 square feet of interior space. Airstreams and modern cabins feature bedrooms, living areas including a small kitchenette, and bathrooms, while Luxury Tents and Happier Campers do not offer en-suite bathrooms, but permit access to the Clubhouse facilities (which are a short walk from most tents). All accommodations feature a king or queen size bed, futon sofa, an outdoor dining area, and cookware specific to each unit type. Airstreams and cabins additionally feature televisions and Bluetooth surround sound. Each property also offers a clubhouse featuring community fire pits, lawn games, board games, and hammocks.

Collective Retreats opened its first property in Vail, Colorado in 2015. Since then, four additional properties have opened, including one urban property located on Governor’s Island in New York City. All properties operate seasonally based on weather patterns. Each property’s lodging offering differs slightly, however, all properties feature Summit Tents, which can be disassembled and transported depending on seasonality. The Governor’s Island location also features a larger Journey Tent and five Outlook Shelters, which include a king bed, spa-like en-suite bathroom, and luxury amenities within 225 indoor square feet, accompanied by 175 square feet of outdoor space. Each resort offers a dining element and spa services.

Getaway opened its first property in the Catskills region of New York in 2016 with 12 cabins. Since its inception, the brand has opened eight additional properties through the acquisition of existing campgrounds or vacant land sites. Each property features micro recreational vehicles (RVs) which are referred to as “cabins.” The units are manufactured offsite and retrofitted with the unique Getaway furnishings, and thoughtfully situated throughout the site to create a private “get away.” The cabins feature a “tiny home” layout, comprised of approximately 136 square feet. Each cabin offers one or two queen beds (which are bunked due to space constraints), a large picturesque window, two-burner cooktop, seating area, toilet, shower, and cookware. Guests access each cabin through a key code that is sent via text message on the day of check-in (rather than with a key card provided by staff).

Under Canvas originally opened as four tents in Montana. The brand has since expanded to feature seven properties, primarily located outside of National Parks. Seasonal tents are constructed annually, which provide minimal impact to the surrounding area and have a low environmental impact. Guests have access to daily housekeeping, an adventures concierge, indoor and outdoor fire pits, complimentary activities, and on-site dining options. Each resort’s tent set up varies slightly, but generally feature a wood stove, en-suite bathroom, king bed, and leather queen sofa-bed.

In addition to those described above, there are a vast number of other glamping options available in the market today across the country, but most offer only one independently operated property. However, over the past several years, institutional investors have deployed capital into the brands highlighted above, displaying confidence in the trajectory and positioning of the glamping industry in the United States.

Investing in the Glamping Space

In 2019, it was announced that AutoCamp raised $115 million through a partnership with Whitman Peterson. The funds are anticipated to be used to purchase additional development sites and to purchase and customize more Airstream trailers. The agreement outlines a provision for potential expansion funding of an additional $115 million. Reportedly, eight additional properties are in the brand’s current pipeline, although no details such as locations or opening dates have been released.

Additionally, in 2017, Getaway announced a $15 million strategic growth investment from L Catterton, the largest consumer-focused private equity firm in the world. Subsequently, in June 2019, the company announced an additional $22.5 million of Series B funding.

Given the lack of data currently available within the glamping space, underwriting a new development or acquisition opportunity is difficult. However, based on research conducted by LW Hospitality Advisors® for both proposed and existing glamping resorts throughout the country, we have assessed a substantial amount of unaccommodated demand. For the relatively few glamping resorts that are currently operating, we have observed strong occupancy and average daily rates. Other advantages of investing in the glamping space include the following:

- Low staffing models compared to traditional hotels;

- Strong operating/profitability margins given the limited amenities and services that are offered at most glamping properties;

- Relatively low cost to develop/construct given the typically rural locations and lack of traditional brick and mortar structures;

- Given the typical locations, most taxing municipalities assess glamping properties as campgrounds or similar, thus reducing the real estate tax burden compared to traditional hotels;

- Lack of similar property types/competition in most parts of the country.

In addition to the advantages listed above, of course, any investment also comes with disadvantages. Given the lack of sales transactions for glamping properties, any early investors in the space are taking a risk. While no major sales have yet occurred, there are several institutional investors that are underwriting exit cap rates similar to traditional full-service hotels. Another risk for potential investors and/or lenders is the downside scenario. For example, if the specific concept does not work or meet expectations in a certain location, the alternative uses for that property are limited.

Conclusion

The glamping industry is anticipated to continue to experience growth throughout the United States in the foreseeable future. Per the data summarized above, both the number of campers and interest in glamping have continued to increase over the past several years. The majority of demand is generated by guests seeking reprieve from dense urban areas and/or busy schedules, who wish to reconnect with nature without the hassle of traditional camping.

While glamping products may not be as widely understood to more traditional hospitality investors at this time, the traction that the segment has gained in recent years indicates an opportunity for the future. We anticipate the trajectory of glamping to remain strong, particularly as brands differentiate themselves through a variety of creative offerings and accommodation types, and as consumers find their niche within the space.

13 comments

Hey goodexample you have shared with us

Great post I was reading whilst sitting on top of my wall with stunning stone veneer

Thank you Final Camping

Thanks For Sharing The Overview of Glamping Sleeping Under the Stars in Style Very Deeply helpful Information keep it up. also, Visit:- https://www.magespark.com/career/seo-executive/?utm_source=bu-edu&utm_medium=blog-comment&utm_campaign=september-2022

I am also a person who loves doing household chores and taking care of them. Game slope unblocked belongs to the series of games that improve your reflexes and help you relax after hours of stress.

Thanks For Sharing The Overview of Glamping Really Helpful Blog & Information. Also, Visit:- Custom Shopware Development Services

Thanks for the good blog post, I have been looking for this as a student. But students might also look for help with programming assignment. Programming is one of the most demanding and challenging fields. This is why programmers need help when they are stuck or when they need to understand a new concept. Global Assignment Help is a company that provides programming assignment help to programmers who are struggling with their assignments. They provide programming homework help, programming project help, and programming tutoring services.

Huluadblocker is a browser extension that helps block advertisements while streaming content on the platform, it prevents ads from playing during TV shows, movies, and series that allow you to watch your favorite programs and shows without any disruptions.

Excellent information! Continue to motivate others. I’m sure I’m not the only one who finds inspiration in your site. It’s incredibly motivating to see how much effort and enthusiasm you put into each post. I appreciate you sharing your wisdom and thoughts with the world, and I’m excited to see what ideas you’ll have next. If you want to read about hotmail you can visit the website