Capacity Builders, Market Shapers and Financiers: The Three Roles of Development Finance Institutions in Supporting Coal Plant Phase-Down

In the past, coal has been a pivotal driver of electrification and economic development. However, the social costs of coal-fired power plants—in terms of air pollution, public health and climate change—now outweigh the benefits and a rapid phase-down is required to adhere to the temperature limits set by the Paris Agreement.

Consequently, at the 2023 United Nations Climate Change Conference in Dubai (COP28), countries agreed to phase down unabated coal power and transition away from fossil fuels in a just, orderly and equitable manner while tripling renewable energy capacity and doubling energy efficiency.

Development finance institutions (DFIs), such as multilateral development banks (MDBs) and national development banks (NDBs), play a pivotal role in the economic development of low- and middle-income countries. With their ability to supply concessional finance, experience and expertise working in the energy sector, they are well-positioned to assist countries in capitalizing on the benefits from scaling up renewable energies and reducing the usage of coal plants.

While many DFIs have pledged to halt public finance for new coal-based electricity generation, decarbonization of existing coal plants is yet to receive sufficient attention. In November 2023, the Boston University Global Development Policy Center conducted a workshop for practitioners and researchers to discuss and foster greater understanding regarding options for DFIs to engage in coal phase-down activities around the globe.

A new report by the Boston University Global Development Policy Center synthesizes the workshop discussion, outlines key findings and provides policy recommendations. It explores how DFIs can support holistic and financing options for early coal plant phase-down in a manner that proactively supports development goals, enables investments and unlocks employment and growth opportunities.

To achieve these objectives, it will be crucial for DFIs to make a just, orderly and equitable phase-down of existing coal infrastructure a centerpiece of their climate strategies assisting governments, support the policy and market conditions that enable coal plant decarbonization and use scalable strategies built around concessional and grant financing mechanisms.

A holistic support plan

According to the report, all coal phase-down efforts should be embedded in holistic support plans where DFIs assist governments in each step of the energy transition. A 2023 World Bank report introduces a virtuous cycle of policies and institutions, shown in a slightly adjusted version in Figure 1. This cycle can guide DFIs in their decision-making and planning process to accelerate low-carbon transitions in low- and middle-income countries.

DFIs can support governments at each stage of the cycle, for instance by increasing technical assistance to strengthen the capacity of governments and utilities for the transition and enhancing energy security through power sector planning. In addition, DFIs can fund pre-feasibility studies to support renewable energy projects at an early stage and mitigate risks associated with clean energy to attract public and private investment.

Figure 1: A virtuous cycle to accelerate the transition of the power sector and avenues for DFIs‘ support

The many forms of coal plant phase-down

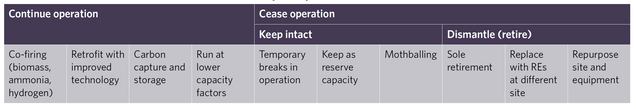

The premature phase-down of coal plants constitutes a vital element in DFIs’ holistic transition support plans. Phasing down coal plants can take several forms as highlighted in Table 1. Some measures allow for the continuous operation of the respective plants, including retrofitting the coal unit with cleaner and more efficient technology or utilizing carbon capture and storage (CCS) technology. Because these measures incentivize the prolonged operation of plants and divert attention from ceasing operation of coal units, they are suboptimal from a development, climate and public health perspective.

The measures that cease the operation of coal units can be categorized into either keeping the plant intact and connected to the grid or dismantling it. Those measures that keep the plant functional include a temporary break of operation and deactivating but not retiring the plant, a practice known as ‘mothballing.’ In contrast, other measures imply the retirement of plants—permanent decommissioning—promising the greatest emission savings. One such approach is the sole retirement of the coal plant, while another is to repurpose the existing coal plant site or the equipment for various end uses, such as solar plants.

Table 1: Measures to reduce emissions from coal-fired power plants

The choice of a specific approach largely depends on the barriers to phase-down (Table 2), which require careful consideration. The barriers are financial, legal, socio-economic, political and include the internal policies of DFIs. Concerns regarding DFIs’ policies relate to hurdles that might render their support unfeasible, such as coal exclusion lists that may prevent the utilization of the full range of retirement options. Financial barriers encompass the costs for the owner of a plant and potential cross-border repercussions. Legal barriers pertain to contractual agreements and risks that could follow coal asset closure, such as complaints by investors. Socio-economic barriers include negative impacts on workers and communities, posing risks to local, regional and national economic development. Political barriers arise from the political economy in place, which translates into vested interests of powerful actors that can resist coal transitions.

Table 2: Barriers to coal plant phase-down

Existing coal phase-down initiatives

Several DFIs and governments have embarked on initiatives to support coal plant phase-down, particularly retirements, and have gained valuable experience. Some programs foster coal transitions more broadly, without explicitly targeting coal plant decarbonization. One such initiative is the European Just Transition Mechanism, which provides support for coal transitions in Europe by helping the most affected regions, industries and workers. The recently launched Just Energy Transition Partnerships (JET-Ps) with South Africa, Indonesia, Vietnam and Senegal similarly assist these countries in their transition efforts without explicitly targeting coal units.

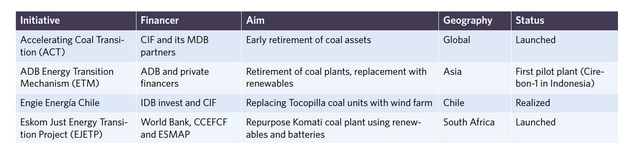

Four DFI-led initiatives have evolved in recent years explicitly targeting the phase-down of coal units, as highlighted in Table 3. The Climate Investment Funds (CIF) has instituted the Accelerating Coal Transition (ACT) program, a global investment initiative crafted to facilitate coal transitions, with a specific emphasis on replacing coal power generation with renewable sources ACT. The Asian Development Bank (ADB) initiated its Energy Transition Mechanism (ETM) in 2021. The primary objective of the ETM is to expedite the retirement of coal-fired power plants and replace them with low-carbon energy sources using concessional and commercial capital. IDB Invest, the private sector arm of the Inter-American Development Bank (IDB) Group, played a vital role in supporting the retirement of coal units in Chile. In 2022, the World Bank Group approved the $497 million Eskom Just Energy Transition Project (EJETP) to retire the Komati coal plant in South Africa, operated by Eskom.

Table 3: Existing DFI-led coal phase-down initiatives

Forging ahead: Three roles for DFIs

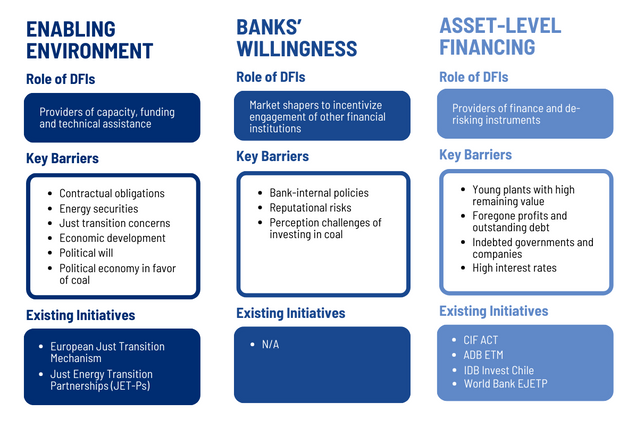

DFIs can use a variety of policy options to support low- and middle-income countries in their efforts to curb emissions from coal plants. Figure 2 shows that the first set of policy options centers on supporting enabling environments in recipient countries (DFIs as capacity building providers), the second on banks’ willingness to support coal plant phase-down endeavors (DFIs as market shapers) and the third set of policy options focuses on the direct funding of phase-down projects (DFIs as asset-level financiers).

Figure 2: DFIs’ roles derived from key challenges to early retirement

Note: Climate Investment Funds (CIF) Accelerating Coal Transition (ACT); Asian Development Bank (ADB) Energy Transition Mechanism (ETM); IDB invest, the private sector arm of the Inter-American Development Bank (IDB) Group; World Bank Eskom Just Energy Transition Project (EJETP). While those initiatives that provide funding for the phase-down of coal plants

DFIs can increase their efforts to foster an enabling environment to cease operation of coal units through different forms of funding and assistance. In terms of technical assistance and planning, DFIs can assist governments in addressing legal barriers that need to be overcome and support the development of transparent and holistic long-term retirement frameworks. In addition, DFIs can help to assess the costs and benefits of phase-down, for instance through a cost-benefit analysis (CBA) framework. Anticipating undesirable social and economic aspects resulting from coal plant phase-down before they emerge is pivotal to ensuring a just transition. DFIs play a key role in helping governments prepare economies and communities to adjust successfully to the energy transition, for instance, through funding retraining opportunities for workers in the coal industry and promoting new economic activities and economic diversification. DFIs can also assist countries in eliminating policies that support coal and introducing new policies that facilitate the phase-down of coal assets such as a country wide coal phase-out commitment and carbon markets.

Next, DFIs can help to shape the market, encouraging and enabling other banks to support DFI-led initiatives or commence their own phase-down approaches. This can be achieved by effectively addressing some of the aforementioned barriers through various policy options. The first set of options addresses the perceived challenges for banks, notably those related to their reputation and financial feasibility, including by offering guidance on the credibility of financing and providing clear details on the valuation approach and loans specifics. The second set centers on solutions to overcome banks’ internal barriers, such as financial reporting and exclusion lists. The third set aims to establish precedent and demonstrate the viability of early coal plant closures. Through these efforts, DFIs can incentivize other banks, in particular those from the private sector, to replicate such initiatives.

In addition, DFIs can be instrumental in financing the early phase-down of coal units as first-movers and have a diverse set of promising tools at their disposal. As ceasing operation of plants before they reach their envisaged lifetime without adequate financial support would result in foregone profits for asset owners, and therefore pose risks for lenders, plants are unlikely to close without financial support. Financing mechanisms, i.e., financial products and services, can alleviate the burden on asset owners and mitigate risks for involved banks. The available financing mechanisms can be grouped into three categories (or a mix thereof). Two of them aim at bringing down the weighted cost of capital by lowering either the costs of debt, such as refinancing using low-cost capital, or the cost of equity, including the use of managed transition vehicles or portfolio acquisitions. The third group builds on maximizing future cash flows, e.g., delivering alternative or additional revenues.

Key considerations and governance principles

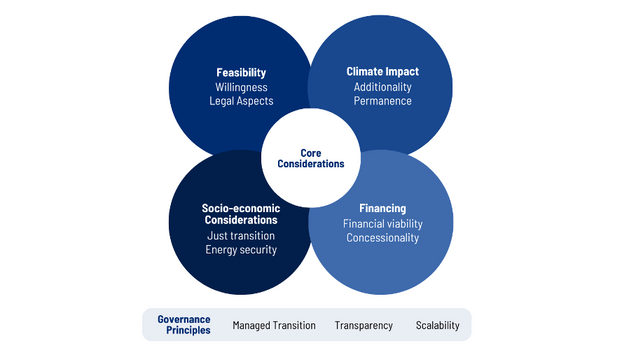

DFIs that engage in early phase-down efforts should take eight essential considerations and three principles into account, as shown in Figure 3. The considerations can be grouped into feasibility, climate impact, socio-economic aspects and financing.

Figure 3: Considerations and governance principles

A prerequisite for coal transitions is the feasibility of ceasing the operation of coal units, a determination significantly impacted by the legal, socio-economic and political barriers to transition. Two primary considerations involve the willingness of key actors like governments and plant operators and the prevailing political and legal contexts.

One of the main motivations for phasing down coal is its positive impact on the climate. The avoidance of emissions resulting from lower capacity factors or closure of a coal unit significantly impacts CBA outcomes, thereby shaping the determination of the value of financial support. The soundness of the proposition to phase-down coal plants early, from an emissions mitigation perspective, hinges on two critical factors: the additionality of emissions reductions or avoidance, and their permanence.

Coal phase-down can potentially have detrimental effects on workers, communities, regions and even nations. Consequently, it is imperative to carefully consider social and economic aspects before engaging in asset closure. These considerations should focus on aspects like just transition and securing a reliable power supply.

A key component of DFI transition support is financing the phase-down of coal plants at the asset-level, with various mechanisms available as outlined above. Concessionality plays a pivotal role for each of these mechanisms, especially considering the high debt levels of coal dependent state-owned enterprises’ (SOEs) such as in South Africa and Indonesia. Low-cost debt and equity can render coal phase-down economically attractive for operators and owners, thereby facilitating significant emission reductions.

The effective governance of phase-down financing relies on three core principles to ensure the desired outcome and broader benefits to transition efforts. These guiding principles encompass a managed transition following elaborate retirement plans and transparency at every step such as the rationale behind the selection of a particular coal unit and the chosen financial mechanisms. Lastly, scalability should be a core principle which involves guaranteeing that the approaches can be replicated for other plants within the same market and in different contexts, such as in other countries.

Policy recommendations

Three key policy recommendations emerge for DFIs in terms of supporting governments in phasing down coal plants and bolstering low-carbon and climate-resilient development:

- A just, orderly and equitable phase-down of existing coal infrastructure should form a centerpiece of DFIs’ climate strategies supporting governments accelerate renewable energy generation and economic diversification.

- DFIs should support an enabling environment for coal plant phase-down and shape the market for other financial institutions to engage in coal plant decarbonization.

- Strategies for the phase-down of coal plants should be scalable and built around concessional and grant financing mechanisms.

In line with these recommendations, DFIs can make use of their expertise and experience to assist countries in their low-carbon transition endeavors while ensuring economic development through support in the early phase-down of coal units. DFIs can thereby fulfill their responsibility to promote sustainable development while demonstrating climate leadership.

*

Read the ReportNever miss an update: Subscribe to the Global Economic Governance Newsletter.