Lodging Update: Greater Boston

By Rachel Rogisnky and Matthew Arrants

Each quarter, Pinnacle Advisory Group will prepare an analysis of the New England lodging industry, which will provide a regional summary and then focus in depth on a particular market. These reviews will look at recent and proposed supply changes, factors affecting demand and growth rates, and the effects of interactions between supply and demand trends. In this introductory issue, we spotlight the Greater Boston area, providing booking pace statistics that serve as a leading indicator for future market performance.

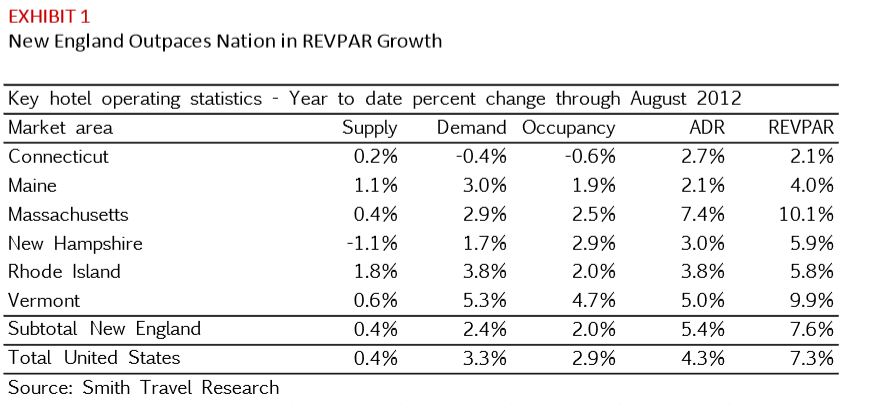

New England Summary

The New England region has outperformed the country as a whole through the first eight months of this year, in terms of growth in revenue per available room (REVPAR). A closer look, however, reveals that only two of the six states in the region exceeded the national average, Massachusetts and Vermont. In fact, much of the region’s strong performance can be attributed to high occupancies and average room rates in the Greater Boston lodging market.

Performance by State

Connecticut

Connecticut experienced the weakest REVPAR growth in the region (2.1%). In fact, it is only one of three states in the country that experienced a decline in demand, albeit a very small one (–0.4%). This decline was partially the result of less government contract activity in areas such as Groton, where government plays a key role in generating lodging demand. A slowdown in casino-related demand also impacted the lodging market in Norwich, where casino revenues decreased 5% through June, as compared to the prior year.

On a brighter note, while demand in the state was down slightly, room rates showed positive trends with average daily rate (ADR) increasing 2.7%.

Maine

As one of the region’s most seasonal states, Maine typically experiences occupancy percentage rates hovering in the mid-to-upper 50’s. So far this year, Maine has been able to capitalize on the improving economy by generating 3% more demand than in 2011. Interestingly, most of the improvement appears to be outside of the Portland area, which is only up 1.3% year to date. The Portland market, however, has seen significant growth in average rates, increasing by 7% through July.

Massachusetts

Massachusetts has the largest hotel supply in New England and is typically the leader for recovery within the region. In 2011, Massachusetts occupancy climbed to 68%, well above the national average of 60%. ADR in the state was $138.87, approximately $37 above the ADR for the nation. For the year to date, as of August 2012, the REVPAR in Massachusetts was up 10.1%, as compared to the prior year, well above the national REVPAR increase of 7.3%.

As will be discussed later, both the Boston/Cambridge and suburban Boston markets are responsible for the lofty results within the state. Outside of Greater Boston, hotels within the state experienced moderate increases in demand, with no new supply. The milder winter and pleasant summer boosted travel to the western region of the state.

As a result of the strong performance in Greater Boston, and moderate improvement in central and western Massachusetts, REVPAR will likely increase 10% to 11% by year end.

New Hampshire

Lodging demand in New Hampshire can also be quite seasonal. While there are pockets of year-round corporate demand, much of the state’s lodging market is dependent on seasonal tourism. A recent decline in supply was caused by the closing last year of the Balsams Resort in the far northern part of the state. On a year-to-date basis, New Hampshire ranks third within the region in REVPAR growth. Modest increases in both occupancy and

ADR were experienced within the state.

Rhode Island

The Rhode Island lodging market has experienced significant weakness in both occupancy and ADR over the past few years. REVPAR was $78.00 in 2007, but dropped to $60.00 in 2009. It has since rebounded somewhat, with REVPAR of $67.27 in 2010 and $70.05 in 2011. So far this year, the state, as a whole, has continued to experience modest gains, however the submarkets within the state differ in performance.

Providence should end up this year with a 12% increase in REVPAR, due to a combination of the improving economy and strong visitation at the Rhode Island Convention Center. The Newport submarket will also experience strong growth in both occupancy and room rate given the success of various summer events, including the America’s Cup this past August. Warwick, on the other hand, experienced a 3.1% REVPAR decline as of August 2012. While demand for lodging in Warwick entered positive territory, the re-opening of the Nylo Hotel superceded positive demand trends.

Year-end results for the entire state are likely to result in a 6% REVPAR increase.

Vermont

Vermont had the strongest growth in demand among the states in the region (5.3%). While the lack of snow hurt many of the resorts, the industry was helped by transient construction workers in the aftermath of Hurricane Irene. The hurricane, which hit in late August 2011, was the fifth costliest storm in American history and claimed 27 lives nationally. Damage in Vermont was particularly severe, due to flooding that wiped out roads and bridges.

Crews remained in the state throughout most of the spring, generating incremental lodging demand in several markets.

Vermont’s annual occupancy in 2012 should reach 61%, and ADR will be above $120.

Anticipated Changes

Pinnacle is monitoring trends and potential developments in the following market areas heading into 2013.

Stamford, Connecticut

The relocation of Starwood’s corporate headquarters to Stamford, along with the redevelopment of the city’s East Side, has helped to spur additional demand in that market. This increased demand, coupled with limited new supply, is expected to lead to growth in average room rates. The recent opening of the J-House hotel in Greenwich is not expected to have a major impact on the overall supply-demand relationship in the market, due to its relatively small size (86 rooms).

Southeast Connecticut

The casinos have continued to suffer, despite recovery in the rest of the region. With the potential expansion of gaming in Massachusetts and Maine, as well as nearby New York State, no significant improvement is expected in the near future.

Burlington, Vermont

Strong performance over the last few years may result in increases to the supply. There are three hotels proposed for this area. Whether these hotels will actually be built and the timing of such construction are uncertainties that may impact the lodging market.

White Mountains of New Hampshire

The closing of the Balsams Resort in September 2011 helped other resorts in the area during 2012. However, new owners are expected to make a significant investment in the property and reopen it during the spring of 2013.

Portland, Maine

The strength of the downtown market, and its ability to absorb new supply over the last few years, has led to further investment. Rockbridge Capital has closed the Eastland Park Hotel, with plans to reopen it as a Westin Hotel during the summer of 2013. In addition, there are three other proposed hotels in and around the Old Port area that could open as early as the fourth quarter of 2013.

Projections for 2013

Based on the year-to-date performance of the New England region, coupled with limited new supply, we are optimistic about the industry’s performance through the remainder of 2012 and through 2013. While the regional economy remains somewhat sluggish, we expect demand to continue to grow modestly, at about 2.5% annually. With the continued growth in occupancies, we expect moderate growth (4%) in average rates.

Spotlight on Greater Boston

The Greater Boston lodging market was one of the top performing areas in the nation during the first half of the year. According to Smith Travel Research, REVPAR for the Boston Metropolitan Statistical Area (MSA) was up 11.2% through August 2012. The market’s performance was driven by combination of a healthy local economy, a strong convention year, and limited new supply. Looking forward, the only significant change anticipated is a softer convention year in 2013. Corporate and leisure transient demand are expected to remain strong, and new supply is not expected to be a significant issue.

Supply

In the Boston/Cambridge market, there are no new hotels expected to open during 2012. However, there are some renovations planned that would result in higher room counts at some existing hotels. There are also two Residence Inn hotels under construction (120 suites and 175 suites), which are expected to open during the second half of 2013.

While these new hotels may impact the performance of some individual properties in the surrounding neighborhoods, they are not expected to have a material impact on market performance as a whole.

In the suburban market, two new hotels came online in 2012. The Hyatt Place in Braintree (204 rooms) opened in May, and the Residence Inn in Chelsea (128 suites) opened in August. There are also two new hotels expected to open next year, a Residence Inn in Needham (128 suites) and a Hampton Inn in Gloucester (102 rooms). In addition to the new hotel openings, the recent trend of conversions or repositioning’s is expected to continue. For example, the Crowne Plaza Danvers is becoming a Doubletree, and the Holiday Inn Woburn is converting to a Crowne Plaza.

Demand

In the Boston/Cambridge market, demand is fairly evenly distributed between group, corporate transient, and leisure transient. Due to the seasonality of demand in this market, we consider 78% to be the peak occupancy achievable, barring extenuating circumstances. In 2011, a year that was generally considered to be soft for conventions, the market finished with an occupancy rate of 77%.

For 2012, we are projecting market occupancy to exceed its normal capacity threshold and reach 79%. This is due to a very strong convention year, a warm winter, playoff games by the Patriots, Celtics and Bruins, and several leisure events, such as the Tall Ships.

The suburban market is more reliant on corporate demand than the Boston/Cambridge area Limited new supply, coupled with strong growth in corporate demand and overflow demand from downtown, have helped the suburban market achieve strong growth in both occupancy and rate during 2011 and 2012. For 2012, we are projecting that the suburban market will gain two points in occupancy, finishing at 68%.

Group Demand

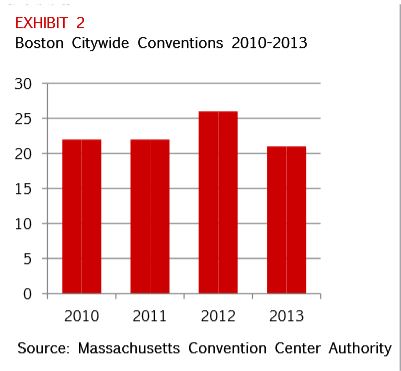

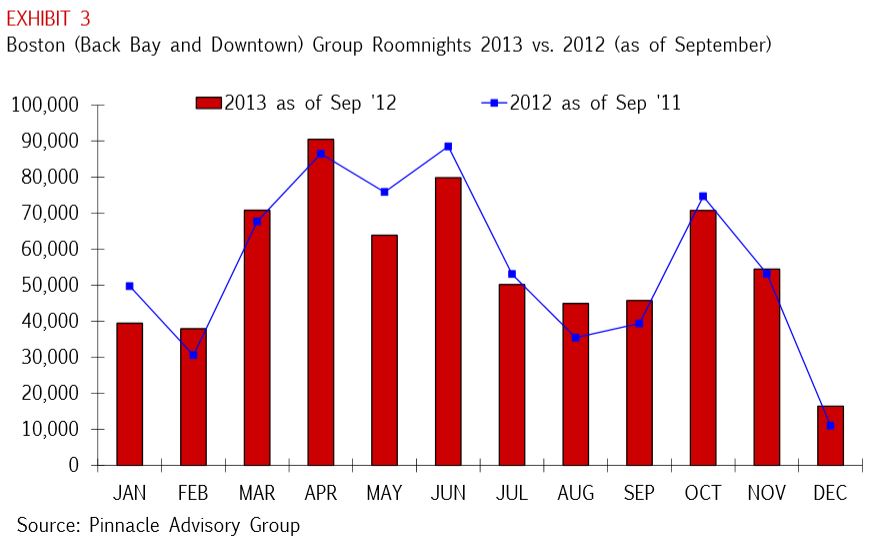

Groups related to conventions represent approximately 30% of group demand in the Boston/Cambridge market. The remainder of group demand in the market is generated by corporate, social, and tour groups. Due to its relatively long booking window (the period between the time that rooms are blocked and occupied), group demand serves as an excellent leading indicator of market performance. When analyzing group demand, it is useful to look at citywide conventions (those with more than 2,000 rooms on peak) and the group booking pace.

○ Citywide Conventions– There are 21 citywide conventions on the books for 2013, compared to 26 in 2012. The decline next year, while significant, will have more limited impact than might be suspected. For several years, the Massachusetts Convention Center Authority has been focused on selling smaller conventions with less than 2,000 rooms on peak. Therefore, the reduction in citywide conventions does not correlate perfectly with a reduction in convention room nights, and the overall loss of room nights is smaller than the decline in citywide conventions might otherwise convey. In addition, we note that the projected difference in occupancy rates between 2012 and 2011 is relatively minor (2.6%) compared to the change in citywide conventions (26%). As a result, we now focus more on group booking pace data as a leading indicator that tracks all group demand on the books at the largest group hotels in Boston.

○ Group Room Night Pace– The group booking pace reports for the Back Bay and Downtown districts present slightly different pictures. The Back Bay set currently has 1% more definite group room nights on the books for 2013 than it did one year ago. However, the Downtown set is currently down 3% compared to the same time last year. Due to the relative size of the two sets, the combined projections are flat compared to 2012. The variance in the two sets can be attributed to the fact that 2013 will be a stronger year for the Hynes Convention Center. In addition, the large group hotels in the Back Bay have been anxiously watching the citywide convention situation and have actively worked to put smaller in-house group business on the books. Group demand for 2013 is near that of 2012, with the exception of May, which is down approximately 16%. May was a particularly strong month last year, with two large citywide conventions.

The decline in citywide conventions will result in a drop in citywide related group demand. However, much of that deficit will be replaced at the larger downtown hotels by smaller in-house groups. The negative impact is likely to be on hotels outside the central business district of Boston. Due to their size, citywide conventions create compression, pushing group and transient demand throughout the city to the suburbs. In 2013, due to the drop in citywide conventions, we expect to see a minor drop in overall group demand for the market.

Corporate Transient

Corporate transient demand has continued to grow over the last three years. Unemployment has declined, office vacancy rates are down, and the area’s major industries (including technology, healthcare, and education) are all flourishing. Most economists are projecting continued moderate growth in the economy, and corporate travel planners do not anticipate a drop in travel to the area. As a result, we expect corporate travel to continue to grow through 2013.

Leisure Transient

The strength of the Boston/Cambridge market has started to push transient leisure demand out to the suburbs. Specifically, leisure travelers have been forced out of downtown, due to higher prices and lack of availability. When the market is operating at or near capacity, as it has been for the last two years, operators are able to drive room rates during peak demand periods. In addition, peak leisure demand periods overlap with corporate demand periods (spring and fall) resulting in limited availability and higher prices. While there has been much concern about the potential impact of the European economic situation, operators in our sample report that international demand remains strong.

Demand Conclusion

Lodging demand in the Greater Boston area is expected to continue to remain strong through 2013.In the Boston/Cambridge market, a decline in convention demand will be partially mitigated by increased demand from smaller groups, as well as corporate and leisure demand. Corporate and lei sure demand will grow with the improving economy. However, in the Boston/Cambridge market, we expect a slight decline in accommodated demand, as there are several factors that occurred this year that are not likely to repeat in 2013. These include a mild winter, a strong citywide convention calendar, playoff runs by multiple sports teams, and several one-time leisure events.

In the suburbs, we expect there to be a slight decline in overflow demand from Boston/Cambridge, due to fewer citywide conventions. However, we anticipate that overall growth in demand will more than compensate.

Average Rate

Group

In Boston/Cambridge, we expect minimal growth in group rates. Operators report that, due to the soft convention calendar, they were eager to put business on the books and were thus quicker to discount.

In the suburban markets, the citywide situation is expected to have less of an impact, although we do expect there to be less overflow demand, and therefore, some discounting.

Transient Corporate

Operators in our sample reported that they expect to increase prices for their negotiated corporate accounts between 4% and 8% in 2013. In addition, we expect operators to push their underlining pricing structure.

Transient Leisure

In the Boston/Cambridge market, the lower number of high demand periods created by citywide conventions is expected to limit slightly the ability of operators to drive rates. In addition, operators may resort to lower-rated distribution channels in order to compensate for the lack of convention demand. We anticipate that the net result will be a curb on rate growth in this segment relative to 2012.

The suburban Boston market will be affected by the citywide situation, but the impact will be limited. Therefore, we expect managers to face less of a challenge driving rate in this segment.

Projections for 2013

The performance of the downtown Boston/Cambridge market is expected to be slightly more measured in 2013 than in 2012. Specifically, due to capacity constraints, we expect market occupancy to finish at 78%. If the market finishes 2012 at 79%, as we are currently projecting, then the result would be a 1% decline in occupancy. Less demand pressure, coupled with operator efforts to put group business on the books, are expected to temper rate growth in 2013. Specifically, we are expecting rates to grow 6% from $215.07 to $227.97.

All indications suggest that the suburban Boston market should continue to see moderate to strong growth in both occupancy and average rate. Specifically, we expect occupancy to grow from 68% to 69% and average rates to grow 5.5% from $111.16 to $117.28. In total, REVPAR is projected to grow by 7.1%.

ABOUT THE RESEARCH

Pinnacle Advisory Group tracks performance measures for more than 60 hotels in the Greater Boston area. Each month, many of these hotels send us the definite group room nights they have on the books for the next six years. This proprietary data set is supplemented by information that is publicly available (such as government reports) and data that are available within the industry (such as reports from Smith Travel Research). By comparing what is currently on the books against historical data, and then adjusting based on economic factors and our judgment, we are able to make reasonable predictions about future market performance.

ABOUT THE GEOGRAPHY

The Boston Metropolitan Statistical Area, also known as Greater Boston, is located in the eastern part of Massachusetts. This includes the City of Boston, plus a multitude of adjacent cities and towns that are incorporated as separate political entities. The City of Boston, which forms the core of economic activity and population for the region, is further divided into several neighborhoods. These include the Airport, Back Bay, Beacon Hill, Downtown, Financial, Seaport, and Waterfront districts. Although lodging performance measures are often interrelated due to proximity, each of these areas represents a distinct lodging micromarket that behaves somewhat differently. In some cases, neighborhoods of the City of Boston share more in common with adjacent cities, such as the City of Cambridge, than other neighborhoods in the City of Boston.

Rachel J. Roginsky, ISHC, is the owner of Pinnacle Advisory Group. She has more than 30 years of experience in hospitality consulting. Ms. Roginsky is a board member of numerous organizations related to hospitality, is a regular guest lecturer at the Cornell Hotel School, and is co-editor of five leading hotel investment books. Email rroginsky@pinnacle-advisory.com

Matthew Arrants, ISHC, is the Executive Vice President of Pinnacle Advisory Group. Prior to joining Pinnacle, Mr. Arrants worked in operations with Four Seasons Hotels and Rock Resorts.

He holds a master’s degree in hotel administration from Cornell University, and a bachelor’s degree in political science from Hartwick College. Email marrants@pinnacle-advisory.com