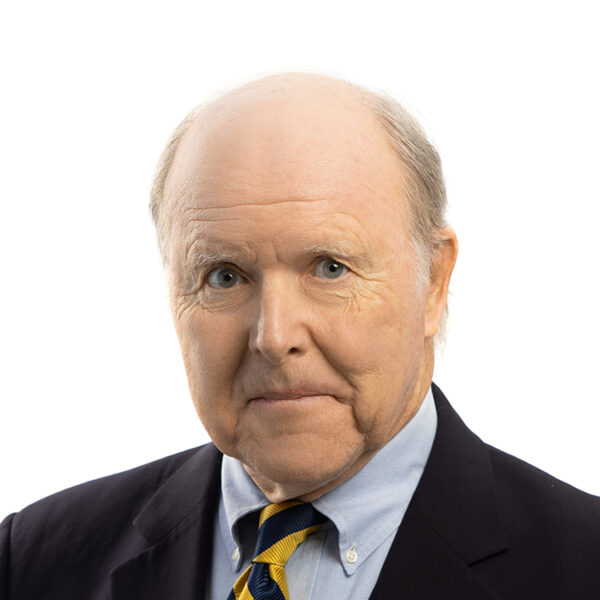

Cornelius K. Hurley

Lecturer

BA, Holy Cross College

JD, Georgetown University

PMD, Harvard University

Biography

Cornelius Hurley has over 35 years of diversified legal, entrepreneurial, and academic experience in the financial sector. His teaching and research interests focus upon the interactions between finance and the real economy. He serves an independent director of Computershare Trust Company, N.A., an element of one of the global leaders in the transfer agent business, and of the Federal Home Loan Bank of Boston, one of the three so-called “GSEs.”

Hurley established the Boston office of The Secura Group, Washington, DC a national financial services consulting firm of which he was a partner. Formerly, he was general counsel of Shawmut Corporation, a regional bank holding company. As assistant general counsel of the Board of Governors of the Federal Reserve System, he was responsible for the Fed’s role in regulating international banking activities. Prof. Hurley also serves as reporter to the American Bar Association’s Task Force on Financial Markets Regulatory Reform.

Hurley was appointed by Boston University’s provost to serve as the first director of the University’s Center for Finance, Law & Policy. The Center is an interdisciplinary initiative drawing upon the deep and varied academic talent of the University to focus upon finance and financial policy issues. He was the director for the Morin Center for Banking and Financial Law and the Graduate Program in Banking and Financial Law from 2005 to 2011.

He is the author of numerous articles and commentaries that have appeared in The Wall Street Journal, The New York Times, Financial Times, American Banker, The Boston Globe and other publications. During the current economic crisis, he has provided ongoing analysis on national and local television and radio outlets.

Hurley teaches Lessons from the Financial Crisis.

- Profile Types

- Banking & Financial Law LLM, Faculty, Lecturers & Adjunct Professors, and Part-Time Faculty

- Areas of Interest

- Banking & Financial Instruments

- Profiles

- Cornelius K. Hurley

Publications

Scroll left to right to view all publications

-

Cornelius K. Hurley, The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences 30 American Bankruptcy Institute Journal (2011) (book review)

Scholarly Commons -

Cornelius K. Hurley & Rebecca Hicks Gallup, The Federal Home Loan Bank System: A Vehicle for Job Creation and Job Retention 30 Review of Banking and Financial Law (2011)

Scholarly Commons -

Cornelius K. Hurley, Paying the Price for Too Big to Fail 4 Ohio State Entrepreneurial Business Law Journal (2010)

Scholarly Commons -

Cornelius K. Hurley, We Have Equity; Now Give Us Oversight American Banker (2008)

Scholarly Commons -

Cornelius K. Hurley & John A. Beccia, The Compliance Function in Diversified Financial Institutions: Harmonizing the Regulatory Environment for Financial Services Firms (2007)

Scholarly Commons

In the Media

Scroll left to right to view all in the media posts

-

CBS News March 27, 2024

Silicon Valley Bank with Massachusetts Branches Seized by FDIC as Depositors Pull Cash

Cornelius Hurley is quoted.

read more -

American Banker March 13, 2024

CBO Report Pegs $6.9B Government Subsidy to Federal Home Loan Banks

Cornelius Hurley is quoted.

read more -

The Hill February 1, 2024

Kudos to Congress for Forcing Bankers’ Hands on Affordable Housing

Cornelius Hurley pens an opinion.

read more -

Fintech Nexus December 14, 2023

Cornelius Hurley, Professor at Boston University School of Law on reform at the Federal Home Loan Banks

Cornelius Hurley is interviewed.

read more -

Reuters December 5, 2023

Life Insurers Binge on US Financing Aimed at Helping Housing

Cornelius Hurley is quoted.

read more -

American Banker December 1, 2023

Federal Home Loan Banks Launch Opposition to FHFA Reforms

Cornelius Hurley is quoted.

read more -

Economics Matters Podcast October 23, 2023

Is Our Next Banking Crisis Here?

Cornelius Hurley is interviewed.

read more -

The Hill September 27, 2023

A Layperson’s Guide to the Federal Home Loan Banks Review

A piece authored by Cornelius Hurley.

read more -

American Banker August 28, 2023

Should the Federal Home Loan Banks Become Public Benefit Corporations?

Cornelius Hurley is quoted.

read more -

Bloomberg June 21, 2023

One Real Estate Deal Uncovers the Murky World of Banks’ Lifeline Lender

Cornelius Hurley is quoted.

read more -

American Banker June 15, 2023

Trouble in Camelot, As the Home Loan Banks Face Scrutiny

Cornelius Hurley pens an opinion.

read more -

Law360 June 14, 2023

Chase’s Epstein Deal Offers Big Compliance Lessons

Cornelius Hurley is quoted.

read more -

Bloomberg June 4, 2023

A $1.5 Trillion Backstop for Homebuyers Props up Banks Instead

Cornelius Hurley is quoted.

read more -

The Hill May 24, 2023

Federal Home Loan Banks Should Not Be Bailing Out Banks

Cornelius Hurley pens an opinion.

read more -

Al Jazeera May 9, 2023

What’s behind the Recent Collapses in the Global Banking Sector?

Cornelius Hurley provides commentary.

read more - View All Articles