Weighing the Costs and Benefits: Sustainability Premium for the Early Retirement of Coal Plants with Evidence from Indonesia

By Bahar C. Erbas, Niccolò Manych, Kevin P. Gallagher and Rishikesh Ram Bhandary

Retiring coal-fired power plants (CFPPs) is an effective solution for adhering to the temperature limits of the Paris Agreement. Development finance institutions (DFIs) can play pivotal roles in supporting governments in early phase-down initiatives. These approaches must consider social and environmental aspects to ensure a just, orderly and equitable transition, as agreed upon at the United Nations Climate Change Conference (COP28) in 2023.

However, to this point, there is limited information available on both the costs and benefits that should be taken into account when organizing a CFPP early retirement, for instance regarding how DFIs can engage in retirement initiatives.

Our new working paper, published by the Boston University Global Development Policy Center, delves into the environmental and socio-economic costs and benefits associated with early CFPP retirement and their impacts on DFIs’ financing.

In a first step, we develop a novel holistic cost-benefit analysis (CBA) framework to assess costs and benefits of early CFPP retirement. Secondly, the working paper provides an illustration of the framework using the Tenayan Riau CFPP (aka Tenayan Raya CFPP) in Indonesia. In a third step, the results from the CBA are merged with data on financing mechanisms for the phase-down of plants, allowing for the incorporation of sustainability dimensions with refinancing dynamics of early retirement and a calculated ‘sustainability premium’ that can be integrated into price of carbon credits. This enables DFIs to ensure that their interventions foster just and equitable transitions.

CBA framework

CBA is a welfare analysis tool used in project assessments to measure costs and benefits for various project or policy alternatives to assist decision-making process. It translates environmental, social and economic elements into monetary values to identify welfare implications of projects or policy instruments and to identify the most welfare enhancing option. For each of analyzed scenarios, a CBA allows estimations of net present value (NPV) comprising all future cost and benefits discounted to the present.

The working paper develops a novel holistic CBA framework to assess both the socio-economic and the environmental costs and benefits from the early closure of CFPPs. The framework enables a comparison of a business as usual (BAU) scenario—continuous operation of the plant until the end of its natural retirement age—with one, where the plant is retired early (RE) after seven years of operation in 2023, and one where the plant is equally retired early but replaced with an alternative renewable (AR).

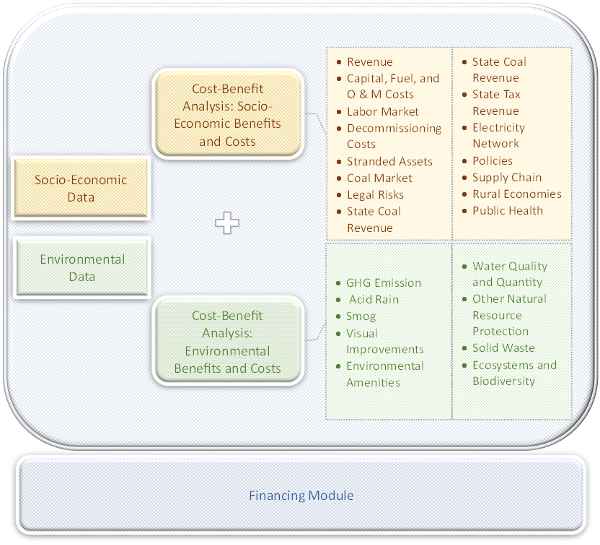

The framework, comprising the cost-benefit elements and the financing module, is displayed in Figure 1. The CBA module results are fed into the financing module. It lists some of the more than 60 items, including social-economic costs and benefits for the labor market and public health as well as environmental ones such as greenhouse gas emissions and water quality. The framework covers all potential local, regional and global costs and benefits that could arise from the continuous operation of the plant, its early retirement and the development of renewable energy capacity.

Figure 1: A General CBA Framework

Tenayan Riau CFPP

The framework allows us to estimate the costs and benefits of retiring a CFPP in a more sustainable way, which we apply to the Tenayan Riau CFPP in Pekanbaru, Riau Province, Indonesia. This CFPP, which has publicly available data to support the analysis, has a total capacity of 220 MW with two units of 110 MW each, built in 2016 and 2017.

Indonesia announced plans to phase out coal by 2056, with a possibility of moving it to earlier date to 2040 if there is an availability of financial assistance from international community. The Indonesian public utility, Perusahaan Listrik Negara (PLN), also committed to reach net-zero emissions by 2060. Therefore, Indonesia’s $20 billion Just Energy Transition Partnership (JETP) deal reinforces these plans by offering blended finance packages to be used through various mechanisms. The Asian Development Bank’s (ADB) Energy Transition Mechanism (ETM) based coal retirement deals are being piloted in Indonesia: a roughly $250 million refinancing to retire the Cirebon-1 plant 15 years early and to retire the Pelabuhan Ratu plant nine years early.

The results can be found in Table 1, showing the costs in brackets in red and the benefits in black for each of the three scenarios. The NPV is the sum of all cost-benefit elements.

Table 1: CBA Results for Tenayan Riau CFPP

| Present Value (Million $) | BAU | RE | AR |

| Social Cost of Carbon | ($7,644.10) | ($1,744.54) | ($1,744.54) |

| Water Use Cost | ($5.15) | $0.00 | $0.00 |

| Smog, Visual Improvements | $0.00 | $124.03 | $124.03 |

| Water Quality (Mercury Reduction) | $0.00 | $190.78 | $190.78 |

| Public Health Damage Cost | ($324.81) | $0.00 | $0.00 |

| Coal Electric Subsidies | ($498.50) | $0.00 | $0.00 |

| Revenue | $842.99 | $0.00 | $842.99 |

| State Coal Revenue | $192.32 | $0.00 | 0.00 |

| Tax Revenue from CFPP/Solar | $106.49 | $0.00 | $106.49 |

| Rural Economies | $5.94 | $2.74 | $5.94 |

| Total Generation Cost | ($358.93) | $0.00 | ($239.13) |

| Total Stranded Assets | $0.00 | ($205.44) | ($205.44) |

| Total Decommissioning Costs | $0.00 | ($15.47) | ($15.47) |

| Labor Market Income Losses/Job Creation | $0.00 | ($9.52) | $23.81 |

| Integration and Grid Cost of Renewable | $0.00 | $0.00 | ($215.34) |

| Fiscal Support for Job Losses | $0.00 | ($0.78) | $0.00 |

| Industrial Zone Income Losses | $0.00 | ($7,484.56) | $0.00 |

| NPV | ($7,683.77) | ($9,142.76) | ($1,125.88) |

Source: Erbas et al, “Sustainability Premium for the Early Retirement of Coal Plants: Evidence from Indonesia” Boston University Global Development Policy Center, 2024.

Some items are costs in all three scenarios, such as the Social Cost of Carbon (SCC), a measure of the long-term damage done by carbon dioxide emissions, as the CFPP operates for seven years even under AR and RE scenarios. Other items only exist under the two scenarios, such as the effect on the Labor Market, which is a cost in the retirement scenario due to lost jobs and benefit for the renewable energy scenario due to job creation in the solar sector. Others, like the Industrial Zone Income Losses, only exist under the retirement scenario, as this is the only scenario where the coal plant capacity is removed and not replaced.

Overall, a few elements have the largest impact on the NPV, including the SCC, Revenue and the Industrial Zone Income Losses. Comparing the scenarios, replacing coal with renewables promises the best outcomes and choosing the AR scenario over BAU leads to the greatest benefits in economic terms.

Obtaining the data for some of the elements in the framework proved to be difficult. The paper thus relies on a subset of items in the framework, merging newly acquired data from various sources with information from existing studies such as on the social costs of Tenayan and the country-wide impacts of early coal plant retirement in Indonesia.

Integrating CBA with financing mechanisms of early retirement

In a third step, the working paper incorporates the CBA results into a refinancing model to calculate the financing costs for the retirement of CFPPs. This allows us to price in socio-economic and environmental costs of early retirement into the calculation of the overall financing that should be provided by DFIs.

The financing model used was developed as part of a 2023 working paper published by the Boston University Global Development Policy Center. The authors calculate the price on avoided emissions so that both debt and equity holders would be able to cover the value of all future cashflows. This translates into the carbon credit price on emissions that is required so that debt and equity holders can be fully compensated and thus agree to the buyout, resulting in the early retirement of the coal asset.

Merging the CBA results with the buyout mechanism yields a higher price of avoided emissions that would help to justify early retirement, assuming the SCC increases steadily overtime, as shown in Figure 2. This ‘sustainability premium’ is the gap between the carbon credit prices for equity or debt and equity with and without the CBA results. The decreasing carbon credit price over time relates to the fewer foregone cashflows as the plant gets older and the envisaged retirement age approaches.

Figure 2: Required price on avoided emissions

The application of the framework to an illustrative CFPP, Tenayan Riau in Indonesia, reveals that replacing the coal plant with solar is the most viable option. Using the results to calculate a sustainability premium for financing of early CFPP retirement shows that the required carbon price to compensate debt and equity holders would increase significantly when other aspects of sustainability is taken into account. Overall, old plants might be more financially viable to retire, but the retirement of younger plants offer larger social welfare gains.

Conclusion

The novel working paper is the first to provide a ‘sustainability premium’ that can be used in refinancing the early retirement of CFPPs and a holistic CBA framework to investigate the sustainability aspects of early retirement. This advancement can help DFIs and other practitioners to operationalize various aspects of sustainability via CBA in the form of sustainability premium. Illustratively, carbon credit prices might encompass the premium to be used in buyout mechanisms. As the policy discussions expand from the rapid scaling up renewable energy to decarbonizing energy systems by unwinding coal plants, DFIs have an opportunity to use innovative instruments to make early coal plant retirement viable. The Inter-American Development Bank is already executing pilots using revenue streams from carbon credits to help coal plants retire early. This paper advances a methodology that could help DFIs roll out early coal plant retirements at scale so that carbon emissions can come down as fast as possible in a manner that is just and orderly.

Sustainability aspects of decisions regarding CFPPs need to be accounted and operationalized to develop successful pathways to reach the temperature limits set by the Paris Agreement. Sustainability premiums are one way of integrating sustainability aspects into existing financial tools of early retirement.

*

Read the Working Paper