GDP Center Round Up – 27th UN Climate Change Conference (COP27)

By Amanda Brown and Samantha Igo

The 27th United Nations Climate Change Conference (COP27) is underway in Sharm El-Sheikh, Egypt from November 6-18, bringing together policymakers, climate activists, researchers, civil society representatives and more to deliver action on climate change. From reducing greenhouse gas emissions to supporting climate action in developing countries, the conference will build upon previous work to address the multitude of challenges presented by climate change.

For COP27, the Boston University Global Development Policy Center has produced a suite of research aimed at supporting a global, green and just transition. Below, see a selection of the latest research related to climate change and climate negotiations.

Climate Negotiations Database

While it has long been acknowledged that addressing climate change must go beyond reducing greenhouse gas emissions, there is no clear understanding whether UN climate negotiations have expanded to include a broader scope of issues.

While it has long been acknowledged that addressing climate change must go beyond reducing greenhouse gas emissions, there is no clear understanding whether UN climate negotiations have expanded to include a broader scope of issues.

To that end, the Climate Negotiations Database is an interactive public database that categorizes negotiation agenda items starting from the first UN Conference of Parties (COP) in 1995.

Overall, the top ten items on the agenda have remained fairly stable over time. Mitigation and transparency are the two top categories. However, the range of topics discussed has expanded since 2007, broadening the focus to issues beyond reducing emissions. While the volume of work in the negotiations has steadily increased over time, it has not necessarily translated to major agreements or contributions. Explore the data.

What’s On the Agenda? UN Climate Change Negotiation Agendas Since 1995

Since the UN General Assembly launched negotiations on climate change in 1990, a broader understanding of climate change has emerged that has expanded to include issues beyond reducing greenhouse gas emissions. Yet, there is not a sound empirical understanding of how negotiations have evolved to address an increasingly wide range of climate issues.

A new journal article in Climate Policy by Rishikesh Ram Bhandary and Jen Iris Allan attempts to understand what climate talks have focused on and how the volume of work has changed using the new Climate Negotiations Database that categorizes negotiation agenda items starting in the first COP in 1995.

While negotiations have broadened to include a wider range of issues, the authors demonstrate that transparency and mitigation matters traditionally dominate the agendas. This lends support to the call for greater balance among issues. Read the journal article and read the blog.

V20 Debt Review: An Account of Debt in the Vulnerable Group of Twenty

What trends characterize the Vulnerable Group of 20 (V20’s) debt portfolio? Who are the biggest creditors, and when are the biggest payments coming due? And how can debt relief be linked to climate and development goals for a green and inclusive recovery?

In partnership with the V20, a new policy brief provides a detailed look at the scale, composition and distribution of the V20’s debt portfolio by creditors, finding that the majority of the $686.3 billion is owed to private creditors and multilateral development banks (MDBs), followed by Paris Club countries and China. Understanding the components of the V20’s debt profile is critical to devising a global debt workout and coordinated policy response that centers climate change and vulnerable nations.

Ultimately, given the diverse debt portfolio of V20 countries, the authors say comprehensive debt restructuring across all creditor classes is urgently necessary, rather than case-by-case bilateral negotiations with specific creditor classes. Read the policy brief.

Understanding China’s Global Power: 2022 Update

China has financed electric power plants around the world for several decades through foreign direct investment (FDI) and loans from China’s two policy banks, the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM).

The China’s Global Power (CGP) Database, updated with new data in 2022, reveals insights on the state of China’s global power amid a global push for decarbonization. A new policy brief summarizes the state of Chinese-financed overseas power plants as of September 2022, finding estimated emissions for currently operating Chinese-financed plants total 245 million tons (Mt) of CO2 per year, approximately equaling the energy-related CO2 emissions from the entire country of Spain or Thailand on an annual basis. This could cumulatively consume 1.7 percent of the global carbon budget for a 50 percent chance of limiting global warming to 1.5 degrees Celsius. While China has taken steps to decarbonize its overseas investments and shift towards a green BRI, more can be done to decarbonize China’s global power, including a particular focus on decarbonizing Asia, where the most generating capacity is financed by China and over 50 percent is coal-based. Read the policy brief and explore the data.

National Climate Funds Tracker

![]() The Paris Agreement’s nationally-driven structure puts the spotlight on financing strategies at the national level. The role of national funding vehicles in mobilizing climate finance, however, has not received extensive attention, and data is sporadic.

The Paris Agreement’s nationally-driven structure puts the spotlight on financing strategies at the national level. The role of national funding vehicles in mobilizing climate finance, however, has not received extensive attention, and data is sporadic.

The National Climate Funds Tracker, updated with new data, presents the first inventory of national climate funds (NCFs) across 52 countries and tracks their major attributes, including scope, legal form, host country and more. A new blog by Rishikesh Ram Bhandary highlights the new data, examining case studies of national climate funds in Brazil and India. Bhandary says the experiences of these funds show that a focus around raising revenue alone is not sufficient. Governments must make the allocations to spend the money wisely, and the entity charged with programming how to spend it, needs to make the investments. Read the blog and explore the data.

Climate Physical Risk, Transition Spillovers and Fiscal Stability: An Application to Barbados

Beyond climate physical risks, countries can also be negatively affected by a disorderly introduction of climate policies and regulations, known as transition risks. In particular, countries in the Caribbean region, and among them Barbados, are a an example of climate risk exposure and vulnerability as well as challenges to accessing and deploying climate finance.

A new technical paper from Régis Gourdel and Irene Monasterolo for the Task Force on Climate, Development and the International Monetary Fund assesses the macroeconomic, public finance and sovereign risk implications of both physical climate risks and transition spillover risks in Barbados.

Barbados faces a potentially significant reduction in GDP due to transition spillover risk. Implementing domestic climate policies may decrease greenhouse gas emissions by up to 75 percent, with economic costs smaller than that of unabated climate change. In response, the authors suggest that climate policies should be implemented early while actively planning for potential disruptions of the tourism revenues. Read the technical paper.

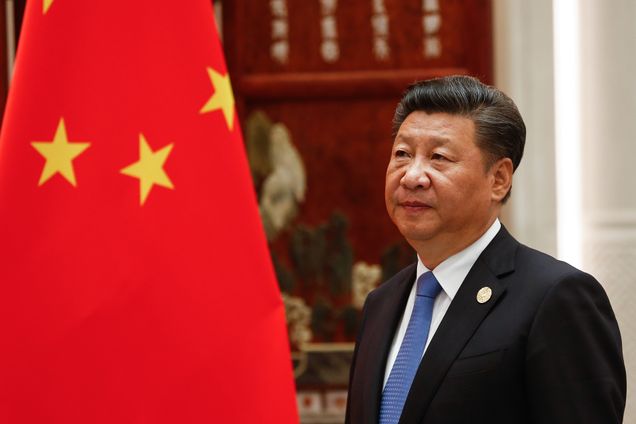

To Make Xi’s Clean Energy Vows a Reality, China Must Strengthen Its ‘Green’ Belt and Road and Overseas Coal Ban

One year ago, Chinese leader Xi Jinping captured headlines at the 76th UN General Assembly when he declared that China would stop building new coal-fired power plants overseas. The announcement was notable, as China was the largest provider of public finance for overseas coal-fired power plants.

One year later, where does Xi’s commitment to support more green and low-carbon energy and not build new coal plants in developing countries stand? In the South China Morning Post, Cecilia Springer writes that an ambitious vision for a green and low-carbon Belt and Road Initiative, codified in policy, has started to emerge. Read the op-ed.

An Analysis of the IMF’s International Carbon Price Floor Proposal

With the goal of enhancing global climate action, the International Monetary Fund (IMF) has proposed an international carbon price floor (ICPF) arrangement, developed from the global carbon price and designed to complement existing policy regimes by focusing on price floors, rather than price levels.

A new technical paper from Ma Jun, He Xiaobei and Zhai Fun for the Task Force on Climate, Development and the International Monetary Fund conducts an analysis of the burden-sharing effects of an ICPF arrangement, finding that, while the ICPF may be an efficient and effective means of reducing emissions, it would place additional responsibilities of emissions reductions, as well as additional economic costs, on developing countries.

While an ICPF arrangement, even for just six large emitters, can be an efficient and effective approach to scale up action on climate mitigation globally, the design of the IMF’s ICPF must be improved to incentivize participation from low- and middle-income countries. Without this consideration, it is unlikely that the ICPF would be accepted by many developing countries in practice, and given the potential abatement impact, it is essential that China and India participate in any ICPF arrangement. Read the technical paper.

Demanding Development: The Political Economy of Climate Finance and Overseas Investments from China

In 2022, China’s National Development and Reform Commission released new guidelines on greening the BRI, fleshing out China’s approach to promoting clean energy in greater detail. This policy development marks a break from the past, as prior research found that China has not incentivized finance for renewable energy projects through its overseas financing and investment policies.

A new journal article in Energy Research & Social Science by Rishikesh Ram Bhandary and coauthors examines the drivers of Chinese overseas financing in renewable energy and the political economy factors in recipient countries that steer this finance toward climate-friendly projects. The article finds that finance from Western multilateral development banks and Chinese financial institutions, among others, will be necessary to pursue decarbonization across developing countries. As this study underscores the importance of host country policy drivers, supporting developing countries to formulate, implement and enforce policies that can attract both finance and technology suppliers will be vital. Read the journal article.

*

Never miss an update: Subscribe to the Global Economic Governance Newsletter.