How We Track China’s Overseas Development Finance: A Guide to GDP Center’s Four Flagship Databases

By Yiyuan Qi and William Olichney

As China’s overseas financing activities expand across the globe, the need for reliable, detailed and publicly accessible data has grown as well. Researchers, policymakers, civil society and journalists increasingly rely on third-party databases to understand the scale, nature and impact of China’s global lending. A small group of independent third-party entities—including the Boston University Global Development Policy Center (GDP Center)—deploy different methodologies to track varying dimensions of China’s overseas economic engagement. These efforts can seem duplicative to the untrained eye, but by and large each dataset captures a distinct slice of China’s global activity, and collectively they tell a broader story of China’s role in international development finance.

A number of these databases have released updated figures over the past year. To help users more clearly understand the scope of the GDP Center databases and how they relate to other peer sources, this post offers a reintroduction to our four flagship databases at the GDP Center, China’s Overseas Development Finance Database, China’s Global Power Database, Chinese Loans to Africa Database and Global Financial Safety Net Tracker, alongside some of the other main datasets on Chinese overseas economic activity.

Reintroducing GDP Center’s Four Flagship Databases: Purposes, Scopes and Strengths

China’s Overseas Development Finance Database

The China’s Overseas Development Finance (CODF) Database is a global, harmonized, validated and geolocated record of Chinese overseas development finance. Concentrating on the loan commitments from China’s two main development finance institutions (DFIs)—the China Development Bank (CDB) and Export-Import Bank of China (CHEXIM), it compiles project-level information on China’s overseas development activities to governments, inter-governmental bodies, majority state-owned entities and minority state-owned entities with sovereign guarantees.

What distinguishes this database is its integration of visually validated geolocation data for each project with a specific geographic footprint. As of June 2025, the interactive database includes 1,304 loans, detailing each project’s lender, year, amount and sector. Of these 1,304 projects, 861 have precise geographic footprints. By visualizing the exact locations of financed infrastructure, CODF enables users to map China’s development finance in relation to several types of socially and ecologically sensitive territories. This spatial approach supports granular investigations into questions of sustainability, risk and regional development, moving beyond aggregate figures to the lived realities on the ground.

The China’s Global Power (CGP) Database tracks global power plants outside China that are financed by Chinese foreign direct investment (FDI) and/or overseas development finance (ODF). Unlike CODF or CLA (Chinse Loans to Africa Database) which captures a loan that finances the construction of a power plant and the type of energy used for the plant, CGP provides far greater technical detail. This dataset compiles unit-level information for each power plant, including megawatt capacity for each unit within a power plant, annual CO2 emissions produced for those units, when each unit was commissioned, and Chinese FDI in the power sector, which is not covered in CODF or CLA.

A distinctive feature of CGP is its integration of multiple financing channels (ODF and FDI) within a single, sector-specific resource. It focuses exclusively on electricity generation assets, excluding upstream fuel extraction or other non-power infrastructure. The resulting data offers clear insights into the distribution of Chinese-backed renewables, coal, hydro and other technologies across countries and regions. For those examining the intersection of climate, geopolitics and development, the CGP database offers calibrated knowledge for more nuanced analysis.

Chinese Loans to Africa Database

The Chinese Loans to Africa (CLA) Database is an interactive data project tracking loan commitments from Chinese DFIs, commercial banks, government entities and companies to African governments, state-owned enterprises and regional institutions. The database was created by the China Africa Research Initiative at the Johns Hopkins University School of Advanced International Studies (SAIS-CARI) and transferred to the GDP Center in March 2021.

CLA is designed to clarify how Chinese financing shapes Africa’s development trajectory and infrastructure landscape. It does not seek to cover Chinese finance outside Africa or aggregate global flows. Instead, with a broader coverage on the Chinese lenders, it reveals the complexity and diversity of development finance arrangements across African countries and sectors.

Global Financial Safety Net Tracker

The Global Financial Safety Net (GFSN) Tracker is the first global interactive database that measures the annual lending capacity of the International Monetary Fund (IMF), central banks and regional financial arrangements (RFAs), as well as the total amount of financing to combat the COVID-19 crisis through IMF lending and currency swaps. It is designed to map a country’s participation in global mechanisms that mitigate financial crises and liquidity shortages.

GFSN fills a critical gap for researchers interested in understanding how China deploys financial safety nets both bilaterally and through international frameworks. Unlike CODF and CGP, GFSN is not designed to cover project loans or investments. Instead, it focuses on the mechanisms that serve to backstop financial stability and resilience, which is particularly valuable in studying the architecture of emergency finance, systemic risk and the global reach of China’s macroeconomic policy tools.

Visualizing the Range of Third-Party Datasets of China’s Global Economic Activity

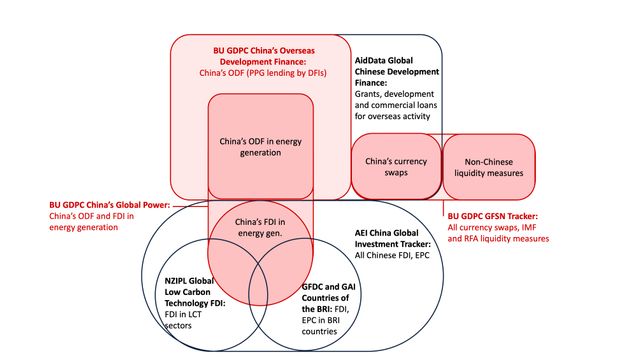

To help users navigate various datasets on China’s global finance activities, our Venn diagram offers a visual map of how key resources overlap, and where each stands alone.

Figure 1: A Snapshot of Chinese Global Finance and Investment Databases

The CODF database covers Public and Publicly Guaranteed (PPG) lending by China’s two main DFIs, with particular emphasis on energy generation projects. With its unique geolocation data, CODF maps China’s development finance in relation to several types of socially and ecologically sensitive territories: Indigenous peoples’ lands, national protected areas and critical habitats.

The CGP database sits at the intersection of ODF and FDI in energy generation assets. This allows users to answer specific questions about China’s role in the global energy transition.

The GFSN dataset represents another specialized focus: mapping China’s contributions to the global financial safety net, in the context of other central banks’ swaps, regional financial arrangements and the IMF. Unlike project-level finance databases, GFSN addresses how China operates in the context of global liquidity and crisis management, setting it apart from tools cataloguing infrastructure loans or energy investments.

There are other databases with different focus on China’s global finance. For instance, AidData’s Global Chinese Development Finance Database (GCDF) covers projects for low- and middle-income countries financed by loans and grants from official sector institutions in China; Aiddata’s recent China’s Global Loans and Grants Dataset widens the scope of GCDF by including high-income countries; the American Enterprise Institute (AEI)’s China Global Investment Tracker records all Chinese FDI and Engineering, Procurement and Construction (EPC) projects; Johns Hopkins University’s Net Zero Industrial Policy Lab (NZIPL) databases focus on foreign direct investment flows in low-carbon technologies (LCT); Green Finance and Development Center’s Countries of the BRI tracks Chinese investments and construction projects based on BRI membership status.

The CLA database is beyond the scope of this Venn diagram, which excludes region-specific databases such as the Lowy Institute’s Pacific Aid Map, the Red ALC-China’s China OFDI Monitor in Latin America and the Caribbean and others.

By visually highlighting these intersections and boundaries, the diagram equips users to select the dataset best matched to their research needs.

Why These Distinctions Matter for Research, Policy and Public Debate

Despite China’s influential role in the global economy, Chinese government, lenders and investors do not provide a comprehensive data source for its overseas lending deals or investments. Multiple research institutions help bridge this gap by maintaining databases that offers empirically based understanding of Chinese overseas finance. Each institution naturally captures a monetary scale of China’s engagement, but each database differs in scope, methodology and what questions its data can help answer.

Since Chinese overseas finance tends to be opaque, and various research institutions provide different information on the topic, researchers in the field may wonder why these databases and resulting insights differ for seemingly similar topics. While differences in data collection methodology can contribute to discrepancies, the scope and unique focus of each institution’s database(s) is the central reason why no single database can be a one-size-fits-all source.

Without understanding the nuances among these databases, it may appear that the research on Chinese overseas finance is plagued by data inconsistencies and contrasting narratives that need to be ironed out before meaningful insights can be drawn. However, these distinctions are a strength, not a weakness. The variety of databases allows researchers to choose the source most aligned with their specific question, dig deeper into specialized questions, or synthesize complementary sources for a more comprehensive view. Rather than seeing these differences as obstacles, recognizing the clarity each database brings makes it possible to generate more precise, credible insight into China’s role as a driving force in global development.

Clarity Over Redundancy

In a field as complex and fast evolving as China’s overseas development finance, clarity is paramount. The GDP Center’s databases each address different questions about Chinese development finance. CODF embodies a narrative of China’s lending to other countries for global development by focusing on China’s development financial institutions. CLA narrows the lens to Africa, providing a detailed regional case study while documenting a wider array of Chinese creditors. CGP deepens the analysis within the power sector by tracking unit-level characteristics of Chinese-financed power plants worldwide. The GFSN Tracker shifts the focus to international crisis-response mechanisms such as China’s currency swaps and IMF lending.

The GDP Center encourages users to select databases thoughtfully, matching their research objectives to the scope of each tool. As conversations around China’s global financing activities continue to evolve, we welcome questions, feedback and collaboration from our user community. Our commitment remains to creating accessible and comprehensive open-knowledge tools for policymakers, reporters, researchers, civil society, students and others to explore and draw insights on China’s development finance.

*

Explore Our Databases