Peer-to-Peer Lending: China’s Overseas Development Finance Pivots to National and Regional Development Banks

For over 15 years, China has been a vital source of development finance for low- and middle-income countries around the world, committing nearly a half-trillion dollars in public and publicly guaranteed (PPG) finance since 2008.

With lending far below peak levels seen in 2015-2017, what is the current status of China’s overseas development finance? And what do these trends reveal about the potential future of China’s overseas lending?

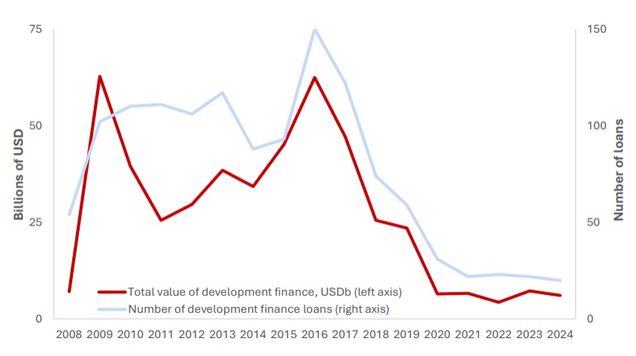

In 2024, the China’s Overseas Development Finance (CODF) Database, managed by the Boston University Global Development Policy Center, recorded $6.1 billion in 20 new sovereign and publicly guaranteed loans. This figure is roughly in line with the trend since 2020, of an average of $6.2 billion through an average of 24 loans per year.

A new policy brief by Rebecca Ray, Diego Morro, Alice Ni, Mengdi Yue and Riza Zhapabayeva shares insights on the state of China’s overseas development finance from 2008-2024 and how borrowers, sectors and loan types have changed over the years. The update shows that for the first time from 2020-2024, China’s overseas development finance is shifting away from direct project finance and toward support of development finance intermediaries, like national and regional development banks.

Figure 1: Chinese Overseas Development Finance, 2008-2024

Launched in 2020, the CODF Database tracks PPG lending from China’s two development finance institutions (DFIs) – the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM) – to governments, inter-governmental bodies, majority state-owned entities and minority state-owned entities with sovereign guarantees. It also includes high-precision geolocation for projects associated with Chinese ODF loans, allowing for analysis of potential economic, environmental, and social benefits and risks. It tracks projects’ overlap with three types of globally defined environmentally and socially sensitive territory: potential critical habitats, Indigenous Peoples’ lands and national protected areas.

Key findings:

- Total number of loan commitments: From 2008-2024, Chinese DFIs committed $472 billion in PPG finance across 1,304 loans and credit lines over $25 million in size. In context, this amounts to 56 percent of PPG finance extended by the traditionally most active DFI, the World Bank.

Figure 4: Chinese DFI and World Bank Sovereign Lending, 2008-2024

- Large-scale loans disappear: Chinese ODF loans have also fallen in average size after 2020. The growth in lending in the early years of the Belt and Road Initiative (BRI) was driven by larger loans, particularly those larger than $1 billion. These large-scale loans nearly disappeared in the 2020-2024 period.

- Project overlap with environmentally and socially sensitive territories: From 2020-2024, projects were more likely to overlap with these sensitive territories than in previous years. Of the 861 precisely geolocated projects, approximately two-thirds of project-specific CODF finance supported projects that overlapped with at least one types of sensitive territory. This finding indicates that even in an era of lower total lending, higher-risk projects still make up significant shares of Chinese ODF portfolios.

Figure 3: Prevalence of CODF Project Overlap with Sensitive Territory Types, by Time Period

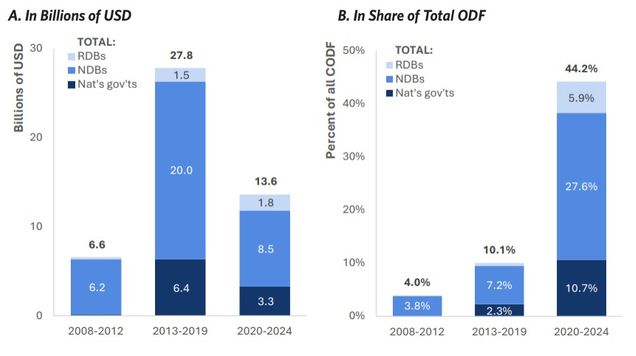

- Changes in sectoral focus: Chinese ODF lending to the financial sector, through which Chinese DFIs do not support specific physical projects but leave project selection and management to regional or local development finance institutions, has increased in importance.

- From 2020-2024, this lending accounted for nearly half (44.2 percent) of the total. In contrast, from 2013-2019, the financial sector accounted for just 10.1 percent of all CODF. Lending to these development finance peers may allow China to avoid the burdens and risks of direct project oversight, and in the case of regional development banks, avoid adding to sovereign debt burdens.

Figure 8: Chinese DFIs’ Financial-Sector Sovereign Lending, by Borrower

- Lending for energy falls overall: Meanwhile, direct lending for energy projects fell to just 10.3 percent of all CODF, with 7.5 percent aimed at transmission and distribution projects. Energy lending accounted for over one-third (37.3 percent) of all CODF in the 2013-2019 period.

Figure 7: Chinese DFIs’ Energy-Sector Sovereign Lending, by Sub-Sector

- No fossil fuel loans: Since Chinese leader Xi Jinping’s 2021 announcement that China would stop supporting new overseas coal-fired power plants and instead ramp up support for renewable energy abroad, Chinese PPG lending has ended for fossil fuel projects overall: oil and gas projects, as well as coal projects, in all stages of exploration, extraction, refining and power generation.

- But renewable energy loans remain small: Nonetheless, lending has not risen for renewable energy projects. Renewable energy projects such as solar and wind generation tend to be smaller in scale than fossil fuel or large hydropower projects, presenting a challenge for China’s very large and geographically distant DFIs. This may indicate a preference to finance renewable energy portfolios through national and regional development banks, which tend to be smaller in scale and based closer to the projects themselves.

In coming years, China’s ODF is unlikely to return to the levels seen during the peak years of 2015-2017. Over the last decade, Chinese foreign direct investment has soared, both in absolute terms and relative to development finance. This shift may reflect a maturation of the BRI, as Chinese firms gain experience overseas and can take on project management themselves.

Explore the Data Read the Policy Brief 阅读政策简报摘要