Chart of the Week: How Data Exclusivity Laws Impact Drug Prices

By Rachel Thrasher

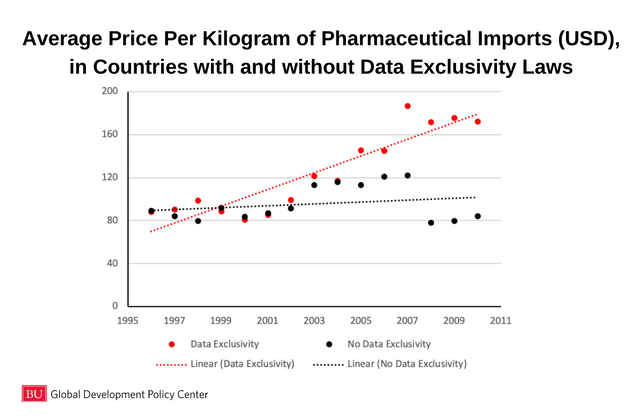

As a recent working paper by Michael Palmedo shows, countries that have enacted data exclusivity into their intellectual property laws have faced increased pharmaceutical import prices over the past 20 years:

Data exclusivity is a form of intellectual property protection that applies specifically to data from pharmaceutical clinical trials. While innovator firms run their own clinical trials to gain marketing approval, generic manufacturers typically rely on the innovator’s clinical trials for the same approval. Data exclusivity rules keep generic firms from relying on that data for 5 to 12 years, depending on the specific law. Data exclusivity operates independently of patent protection and can block generic manufacturers from gaining marketing approval even if the patent has expired or the original pharmaceutical product does not qualify for patent protection.

Although data exclusivity laws are matters of domestic legislation, the United States, the EU and others increasingly demand in their free trade agreement (FTA) negotiations that their trading partners protect clinical trial data in this way. Data exclusivity is just one of a host of “TRIPS-plus” treaty provisions designed to raise the overall level of intellectual property protection for innovator firms. Although the WTO’s Agreement on Trade-Related Intellectual Property Rights (TRIPS) does require Member states to protect clinical trial and other data from “unfair commercial use,” it does not require exclusivity rules that block the registration of generic products.

“TRIPS-plus” rules, more severe protections that go beyond what is required in the TRIPS Agreement, generally increase the monopoly power of branded pharmaceutical producers by extending the period they have exclusive access to the market. Many experts have attempted to find out whether, in fact, this increased monopoly power actually causes prices to rise and, correspondingly, reduces access to those medicines. Predictive studies which attempt to determine price changes prior to a proposed policy change largely show that stricter intellectual property rules lead to higher medicine prices, as well as increasing medicine expenditure by states and individuals and, consequently, lower availability of those medicines. Studies which measure the impacts of a particular FTA on medicine prices have found smaller effects, in part due to the time required for the resultant policy changes to make real impacts and mitigating policies that countries have put in place to dampen the impacts of longer monopolies. On the other hand, studies which have looked at the impact of specific TRIPS-plus – patent term extension, protection of test data and the like – have often found significant impacts on prices or availability of medicines. Still, many of these studies focus only on one country or pharmaceutical process.

Palmedo’s research conclusively shows that data exclusivity, a measure required in all FTAs with the United States, is associated with increased prices across pharmaceutical imports for 41 countries. Countries on the brink of initiating negotiations with the United States should be on notice that the TRIPS-plus rules preferred by the United States negotiators may have real impacts on the affordability and accessibility of medicines for their constituents.

Read the Working Paper