Jump To

November 3, 2025

Boston University Scho0l of Law

Barristers Hall, First Floor

12:45-2pm

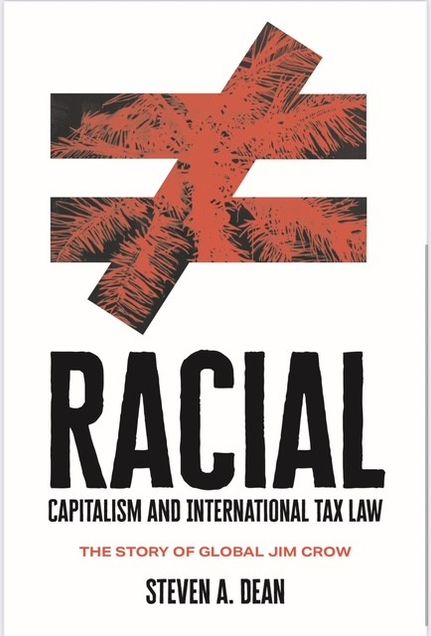

Join us for a compelling discussion on the intersection of race, economics, and global tax policy. BU’s own Koritha Mitchell and Scott Taylor will be joined by Attiya Waris from the UN and University of Nairobi to explore the groundbreaking insights from “Racial Capitalism and International Tax Law: The Story of Global Jim Crow” (Oxford University Press) by Steven Dean.

This timely conversation will examine how international tax structures perpetuate racial inequalities and economic injustice on a global scale. Praised by Ibram X. Kendi as “a fascinating and greatly needed book,” this work challenges us to reconsider fundamental assumptions about taxation, development, and equity in our interconnected world.

Don’t miss this opportunity to engage with cutting-edge scholarship that bridges law, economics, and social justice and learn how tax policy functions as both a tool of economic power and a mechanism that can either reinforce or disrupt patterns of racial capitalism across national borders.

Lunch will be available starting at 12:15pm.

Read the introduction to Racial Capitalism and International Tax Law: The Story of Global Jim Crow here.

About Racial Capitalism and International Tax Law: The Story of Global Jim Crow:

Global tax policy has long determined which states can access the resources necessary to flourish. Today, even the wealthiest states struggle to tax rich individuals and multinationals. Anti-Black racism has enriched affluent states at the expense of marginalized ones and undermined the taxing power of all nations.

In a compelling narrative interwoven with personal storytelling, Racial Capitalism and International Tax Law: The Story of Global Jim Crow connects Dr. Martin Luther King Jr.’s metaphor of the “bad check”-representing unfulfilled promises of freedom and equality to Black Americans-to contemporary anti-Black global tax policies. The book uncovers lost connections, such as those between Edwin Seligman, an architect of our global tax system, and the Dunning School, which laid the foundation for Jim Crow laws, and between Stanley Surrey, a Harvard professor and advisor to President John F. Kennedy, and key moments of the Cold War.

Furthermore, it takes a global view and reveals how racial panic triggered by African decolonization allowed an exclusive club of white countries to deliver a second bad check to newly sovereign states like Kenya and Nigeria. By circumventing the inclusive one-country, one-vote system of the United Nations, the OECD and its double tax treaty dismantled the generous arrangements that helped Europe rebuild after both World Wars.

Racial Capitalism and International Tax Law exposes the surprising role anti-Black racism played in shaping an international tax system that benefits billionaires at the expense of billions of people. This eye-opening account challenges readers to rethink the global tax system and its profound impact on racial and economic justice.

Panelists:

Jessica Silbey, Honorable Frank R. Kenison Distinguished Scholar in Law at BU School of Law, will lead a discussion with:

- Steven Dean, Paul Siskind Research Scholar at BU School of Law, and author of Racial Capitalism and International Tax Law: The Story of Global Jim Crow.

- Scott Taylor, Dean of the Pardee School of Global Studies and Professor of International Relations at Boston University.

- Attiya Waris, UN Independent Expert on foreign debt and human rights, former UN Independent Expert on foreign debt, other international financial obligations, and human rights, and professor of law at the University of Nairobi.

- Koritha Mitchell, Professor of English and African American Literature at Boston University.

Speakers

Connect with law

How to engage with us on social media:

- Follow @BU_Law and tag us in your stories and posts on all platforms

- Post, like, and retweet content, using event hashtag and tagging speaker(s)

- Share event information on social media

- Send registration link to your networks