Active Adult Housing: Back to the Future

By Scott L. Eckstein, Director, Senior Living Concentration and Adjunct Professor, Boston University School of Hospitality Administration

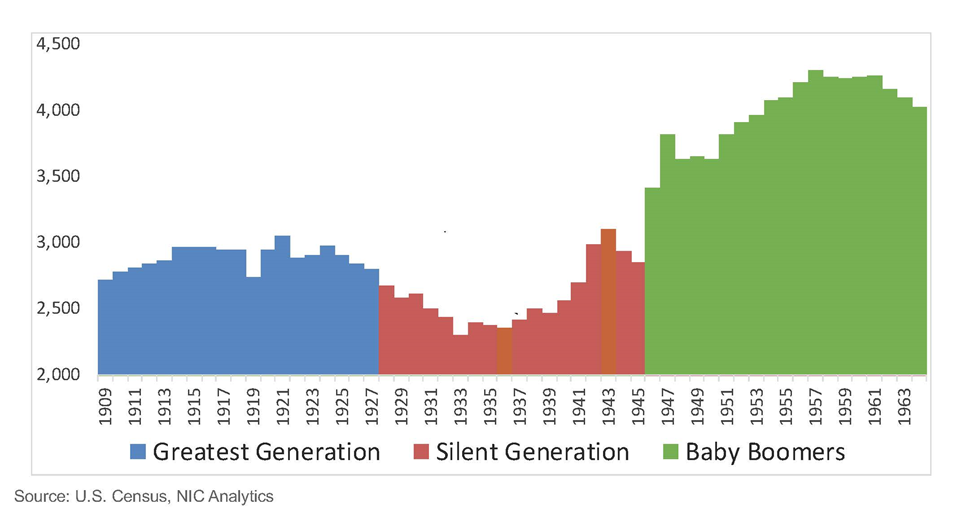

Ask most people in the senior living industry, or at least those with some knowledge of the industry, about the term “active adult,” and Del Webb or the K. Hovnanian Four Season products might initially come to mind. Both, for all intents and purposes, are very good and successful businesses and desirable living communities. However, they are, and have been, master-planned, real estate- and amenity-focused products primarily designed and marketed to the GI, or Greatest Generation (born 1901-1927) and the leading-edge Silent Generation (born 1928-1942).

According to 55places.com and Jelmberg Real Estate of Palm Desert, the first active adult communities opened in Arizona in the late 1950s and early 1960s. As mentioned previously, these were planned communities, similar to the suburbs that were then being built throughout the country, but with these active adult homes, at least one resident had to be over 55 years of age. Although Youngtown, AZ had the first development to have a minimum age requirement, Del Webb’s Sun City Arizona project, which happened to be neighboring the Youngtown project, is the longest-running 55+ community in the country because it still operates as an age-restricted community. The Fair Housing Act of 1968 and the Housing for Older Persons Act of 1995 allow communities to restrict residency to individuals 55 or older (or as we in the industry like to say, 55 or better).

Del E. Webb pioneered the active-adult concept with the idea that retirees should live in a self-sustaining community with access to every amenity and necessity they could ever want or need. The first Sun City, mentioned above, opened on January 1, 1960 and attracted over 100,000 (GI Generation, born 1901 to 1927) visitors on its opening weekend. Those being toured around the active adult community witnessed all the development had to offer, including at least five home models, a shopping center, a golf course, and a clubhouse.

We probably should ask what has changed since the first active adult communities opened. Many people still want to get out of the cold north to warmer weather, amenities, golf…oh, and did I mention warm weather? Del Webb and K. Hovnanian Four Seasons, in this case, have done well with a good product.

The question remains though: what is active-adult living today? Are the master-planned communities of the Del Webb’s and the K. Hovnanian’s of old where the Baby Boomer generation will, or will want to be, living? More than likely, the answer is no, at least in their original form. Along with the generational shift to the Baby Boomer Generation, comes the advent of second and third careers as well as other “repurposement” in this stage of their lives. The basic definition of retirement is to stop…and Boomers aren’t stopping. “Repurposement” better describes what Baby Boomers are doing instead of “retiring.” Boomers, who have changed everything they have touched throughout their lives, are changing what post-career (at least first or main career) life is and are looking for smaller, more unique, service-enriched, wellness and experientially-focused communities in not only destination locations, but more urban or even university-adjacent settings. They want access to all the services they know and demand: their friends, family, health services, education, entertainment, health and wellness services, and other unique programs targeted to their desires. The Boomer is not a one-size-fits-all cohort, and they need to be looked at, serviced, and marketed to as such. On the financial side, according to Chris Guay, Founder and CEO of Vitality Living, “In the next five to ten years, I see the Active Adult community being a residential living opportunity for older adults who want to unlock real-estate equity, reduce the burdens of traditional home maintenance and ownership, and maintaining a safer level of independence while living in a community that keeps them socially connected.”

Of particular importance is that there is not one type of Boomer/active adult. The cross-section of the Boomer cohort is diverse, to say the least. Either way, they are demanding. While age-restricted (active adult) housing is described as 55 plus, the average age of the residents has historically been in the mid to late 70s to early 80s. With the right mix of design, amenities, programming, and services, we may see those ages come down. Even if the ages don’t decrease, the “new” 75+ cohorts are still looking for very different attributes and accommodations in their living situation than this age cohort has looked for in the past. Developers and operators must take note.

Bob May, Managing Partner of Avenida Partners, and active adult developer, articulates, “It’s really important to emphasize that there is no one definition for a ‘Boomer’ or a resident of an Active Adult community. Our average age is 74, but the range is 55 to 95 years, so within our tenant base, there are many ‘sub-segments’ by age and interest. He adds, “I can foresee that the stratification will become more pronounced with time, as any particular building will take on a less homogeneous character. Some buildings will become known as the highly active building where others may be mid-activity level, and others as lower physical activity, but perhaps greater social or intellectual emphasis.”

Where the GI Generation, in general, was looking for sun and amenities, the Boomer (born 1946-1964) generation is moreso looking for lifestyle, curated experiences, and the ability to pursue the “next” thing in their lives. Whether that be a second or third career, volunteer opportunities, hobbies, learning something new, a first or additional degree, and focusing on their health and wellness. Boomers also want the convenience of a low-maintenance lifestyle with the right amenities in that service-enriched environment.

What do all these desires mean for the active-adult product type? The active-adult community, such as Del Webb, has been defined as “age-qualified, market-rate, multifamily rental properties that are lifestyle-focused; and where base rents do not include meals” by the National Investment Center for Senior Living. A new definition will likely be closer to that of a boutique resort (think Canyon Ranch), a Class A urban hotel (think NoMad/Soho Grand) or a high-end residential building (think Turnberry). A new definition might look like “age-qualified, services-enriched, lifestyle-focused multifamily rental properties where base rents may, or may not, include meals,” with the middle-market product adjusted accordingly.

As boomers further define the market, as they have done with everything they have touched in the past, the product they want comprises experiences, services, and decent pricing. The active adult product of Del Webb was once a “one-size-must-fit-all” that even Del Webb is trying to adjust. Active adult product moving forward is a more custom, person-centered, and service-enriched, which developers and operators need to continually tweak. Add in senior tech/age tech and, according to Guay, “With improvements in technology and supportive services that allow aging adults to maintain a level of independence longer, this space will continue to grow.”

Looking at some of the newer active adult communities, they have added services that allow those communities to better create a broad variety of experiences and address multiple lifestyle options that the residents might be missing if they were to remain living in their present homes. The added level of hospitality and programs, such as Centers for Healthy Living as designed by firms that include Perkins Eastman, allows active-adult community team members to craft a standard of living that is designed to promote engagement, socialization, and above all, purpose for residents. David Freshwater, Chairman of Watermark Retirement Communities, says that “promoting engagement, socialization, and building a sense of community are the very most important aspects (by far),” though, in turn, indicates “the second most important aspect is the quality of the design of common areas to support the former.”

Where golf and tennis were the main draws of the GI generation, the Boomer active adult is focused on entrepreneurial endeavors, golf simulators, volunteerism, continuing and advanced education, travel groups, Pilates, and don’t forget pickleball! These are just some of the focus and interests of this generation of active adults. The maintenance-free lifestyle is the same, but with the additional focus on experiences that are at least partially fostered by social engagement and technology, including age tech.

The focus on wellness, and the enabling and integration of technology, is crucial to the next generation of active adult living environments. While older Boomers might have more similarities compared to the Silent Generation (born 1928-1945) most, but especially trailing-edge Boomers (1956-1964), are looking for tech-enabled communities. The active adult client is also tech-enabled. According to May, “Technology and the integration of smart personal devices will become ubiquitous and all-encompassing as applications for convenience, health, unintrusive monitoring of vitals and connectivity with friends and family and will be on 24/7. The changes will result in far greater awareness of the resident’s ‘wellness’ factors and the efficiency in which they are able to set and reach their goals. It will be as if they have a life-coach with them at all times.”

Tech concierges, integrated wearables, virtual assistants (AI (Alexa & Siri)), fiber-optics, telehealth capabilities, automation, and even robotics for simple things like deliveries. The Boomer generation is much more comfortable with tech in communities and will support it. It is reasonable to think that such tech will foster longer stays and the ability to age in place. This will also allow operational efficiencies to be brought to the next level, and operators will be rewarded for it in the long run, plus in the length of stay. The more residents are comfortable with technology, the more efficient a community’s operations can be. This does not take away from the need, benefit, and desire for interpersonal communication and service.

While assisted living and memory care are labor heavy businesses, and the new active adult communities might be a little more labor intensive than the original active adult communities, they are a lot less labor intensive than assisted living communities of any kind. Michael Hartman, Principal of Active Living at Capital Senior Housing, suggests “the reduced service operating model (no food service or transportation) requires an onsite staff of five to eight employees compared to 50+ employees in higher acuity seniors housing setting.” Adding in the services and programming of more service-enriched communities, those staff numbers probably escalate to eight to eleven. New active adult communities, due to their service-enriched nature, have additional labor needs, but nothing as significant compared to traditional assisted living which can essentially reach 1:1 staffing. Positions such as General Manager, concierge, housekeeping staff, maintenance or engineering staff, food service or dining staff, Wellness Manager or Coordinator, a Technology Concierge, and even an Events Coordinator are staff and positions we see, and will continue to see, in new active adult communities.

Some of these roles are new or relatively new. There are roles in older, more traditional lines of work that can easily transition to positions in active adult living, such as Wellness Coordinator. Social workers, for one, have the skill set to transition into positions such as Wellness Coordinators or Managers. The work is essentially about the same objectives: keeping people well, identifying needs, working with their strengths, and assisting them in determining their goals and using support networks, referrals, and other resources at their disposal or in partnerships within the community to help residents achieve their goals. Guay also sees “the opportunities for these types of roles to participate earlier in the aging cycle and being able to focus more on wellness, social interactions, and aging well vs. the reactive and treatment-based approaches that happen at the higher healthcare levels. For healthcare professionals focused on wellness and lifestyle, senior living will give them the opportunity not regularly seen in higher levels of long-term care services.”

While the active adult product type started and was coined in the United States, it is by far not exclusive to the United States. The active adult market is growing outside the U.S. as well. Developers in Spain, the U.K., parts of Asia, and beyond are putting their spins on yet another American classic. They are, in many ways, fortunate not to be encumbered by U.S. regulations, cultural norms, preconceived notions, history, and labor costs, so we are seeing some exciting and unique projects that touch more on areas of urban co-living (i.e., The Embassies) and destination concepts (i.e., Otium Phuket).

The “new” active adult community is, indeed, new! In addition to the environmental aspects, sustainability, real estate, amenities, services, and convenience, the new community is about promoting health, wellness, engagement, socialization, and purpose. Truly enabling these critical components of successful aging is at the heart of the new active adult housing product, which is now all about providing Boomers with the services they want, so they can have the lifestyle they desire moving into the future. This allows them to age in place while improving their health span, with the goal of extending their lifespan, ideally within their wealthspan.

References