Event Highlights: The Economics of the Eurozone Crisis with Stefan Collignon

On Thursday, March 28, we hosted our second luncheon discussion of the semester: “The Economics of the Eurozone Crisis” with German political economist Stefan Collignon, ordinary professor of political economy at Sant’Anna School of Advanced Studies, Pisa, since October 2007, and International Chief Economist of the Centro Europa Ricerche (CER), Roma, since July 2007.

Collignon took the crisis in the Eurozone as his starting point, asking whether the political will to save the European Union still exists. After 60 years of “ever closer union,” has the European adventure come to an end? There is a fundamental contradiction in Europe, Collignon said, insofar as national policies have external effects in other member states, externalities that European policies must address if Europe is to survive, yet “decisions are taken by representatives of partial not general interest.” He devoted considerable time to popular explanations for the crisis, on the premise that how one explains the crisis will shape one’s response: “epistemic divergence” (different understandings of what is wrong) lead to “preference divergence” (what shall we do?). Throughout the talk, he argued that Germany’s (mis)understanding of the crisis has had political reverberations that have made matters worse.

Collignon laid out two common explanations for the crisis in the Eurozone: Fundamentalists, he said, want to say crisis was caused by lack of discipline and excessive deficits, whether public, as in Greece or Portugal, or private, in Spain and Ireland, or macroeconomic unbalances. Where as the monetarists say it is a liquidity crisis, resulting from a series of shocks – the global financial crisis in 2008, the Greek confidence shock – that have accumulated into a crisis of confidence in financial markets.

Disputing the theory that Europe’s crisis is a debt crisis, Collignon compared the Euro Area to Japan, which has higher debt ratios and no crisis.

Examining debt to GDP ratios in individual member states of the European Union before and after the crisis tells a different story:

The two countries that stand out as countries that did not respect fiscal discipline are Germany and France. Not countries in crisis. The charts belie the explanation that the so-called debt crisis was caused by fiscal profligacy and irresponsible borrowing by governments.

The two countries that stand out as countries that did not respect fiscal discipline are Germany and France. Not countries in crisis. The charts belie the explanation that the so-called debt crisis was caused by fiscal profligacy and irresponsible borrowing by governments.

It becomes even clearer looking at Greece:

While it is true that Greece was not following its obligations under the stability and growth pact, according to Collignon, its structural deficit – given the substantial increases in Greek GDP – was stable, or at least not an enormous problem. The real problem started in 2008 with the collapse of Lehman Brothers. At that time, revenues began to fall while expenditures grew for another year. This, Collignon said, was not irresponsible – governments should spend money to compensate shortfalls. But then came the second shock, when true picture of Greek borrowing was revealed. This time the financial markets reacted and European authorities pushed Greece into a negative feedback loop, reinforcing negative growth. With each round of consolidation, output has shrunk, along with revenue, forcing further consolidations. Whereas before the crisis, Greek GDP was growing at 3% a year, it is now down by nearly 20%. This is just one example, Collignon said, of how Germany’s misunderstanding of the crisis as the result of fiscal policy irresponsibility, has exacerbated tensions and reinforced the crisis.

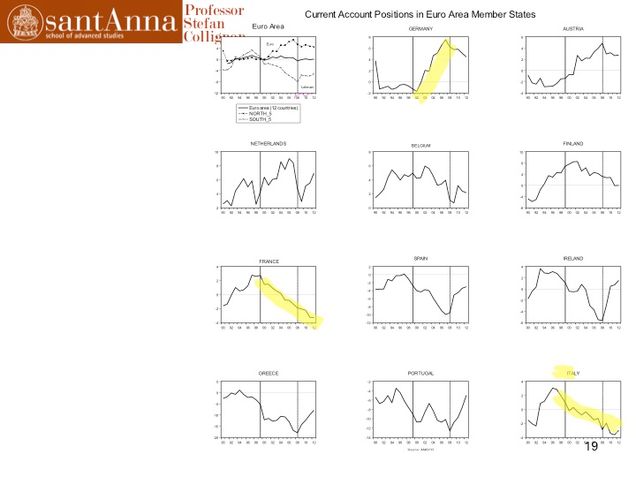

As for the explanation that the crisis is the result of macroeconomic imbalances, Collignon, citing Blanchard and Giavazzi, explained that “they are exactly what theory suggests can and should happen when countries become more closely linked in good and financial markets.” The problem, Collignon said, is that people don’t understand how a monetary union works, i.e., through the “efficient allocation of resources according to comparative advantages.” The notion that policy intervention is required to rebalance current accounts, he said, is intellectually flawed, because we are talking about domestic debt, not foreign debt. This becomes obvious if we compare current account deficits in individual member states to the Euro Area as a whole:

As Collignon explained it, current account positions depend on government deficits and the savings investment balance. To reduce the current account deficits, you either have to reduce the budget deficits, as the fiscal fundamentalists advise, or reduce investment and increase savings. But such policies, he explained, further reduce demand in countries that are already having problems with demand, worsening the crisis.

As Collignon explained it, current account positions depend on government deficits and the savings investment balance. To reduce the current account deficits, you either have to reduce the budget deficits, as the fiscal fundamentalists advise, or reduce investment and increase savings. But such policies, he explained, further reduce demand in countries that are already having problems with demand, worsening the crisis.

According to Collignon, in a monetary union, the current account between countries or regions doesn’t really matter as long as it is financed. He recommended a better analytical tool than current accounts would be “flow of funds.” If we look at the Euro area as a single economy, he said, we see that the external relationships are balanced: for the Euro area as whole, households have been saving, companies have been borrowing, and governments have been borrowing. It is nevertheless important, he conceded, to examine the separation between north and south, in particular, in the years preceding the crisis when the corporate sector in the north, instead of borrowing, became a net lender. While it may have been sustainable, within a monetary union, which is a closed system, it created the regional imbalances in terms of employment and economic growth that are plaguing Europe today. It is, however, impossible to say the southern countries were acting irresponsibly, all on their own; the boom in the south was financed by lending in the north.

Collignon similarly dismissed the argument that the crisis is a liquidity and banking crisis. He defined a liquidity crisis as follows: “a local liquidity shock causes a deterioration in a specific class of asset values, which spills over into banks, which need liquidity. Banks get distressed because the deteriorating asset prices put their balance sheets into difficulties and reduce bank capital. Finally, the crisis spills over into the real economy.”

Here, Collignon explained, government bonds play a key role insofar as they determine financing conditions in the banking system. When uncertainties affect sovereign bond markets, they feed negative expectations regarding the conditions of local banks and borrowers. The reason being is that government securities are used as collateral, which banks use in order to obtain liquidity from the central bank. In Europe, tensions in the sovereign debt markets, reduced the collateral base of banks contributing to the “freezing” of the interbank market. As market dried up, the ECB became lender of last resort to banking system as a whole, enabling Europe to weather the crisis.

The fragility in the banking system is depicted in the following slide, which shows the balance sheet exposure of banks in different members states to southern debt:

Collignon argued that the “negative spillover” from the sovereign debt crisis into the real economy was exacerbated by the “no-bailout” principle. It is not, he said, simply because the markets were short-sighted before the crisis. More serious has been the so-called “home bias,” which he described the home bias as the “tendency to keep a considerable share of assets in domestic equities despite the purported benefits of diversifying into foreign equities.” Simply put, local banks will often hold disproportionate amounts of debt issued by their own governments. This regional segmentation in Europe’s financial markets has become a source of increased financial vulnerability for Europe as a whole.

Collignon argued that the “negative spillover” from the sovereign debt crisis into the real economy was exacerbated by the “no-bailout” principle. It is not, he said, simply because the markets were short-sighted before the crisis. More serious has been the so-called “home bias,” which he described the home bias as the “tendency to keep a considerable share of assets in domestic equities despite the purported benefits of diversifying into foreign equities.” Simply put, local banks will often hold disproportionate amounts of debt issued by their own governments. This regional segmentation in Europe’s financial markets has become a source of increased financial vulnerability for Europe as a whole.

The “no-bailout” principle was, Collignon said, conceived as a market mechanism to ensure fiscal discipline – the idea being that the financial markets would “punish” excessive borrowing on the part of governments by raising interest rates. In practice, however, the principle the negative impact on balance sheets of banks and borrowing conditions more generally, causing local banks to suffer disproportionately from deterioration of local economic conditions. If the “no-bailout” principle had been valid, Collignon argued, a rise in government bond yields would not have led to a credit crunch in affected markets. In fact, the resistance of “certain authorities” to bailouts has made things worse.

Collignon laid out his own understanding of the dynamics of the crisis, arguing that the markets are reflecting political chaos and resistance:

- Global financial crisis reduces asset values.

- Greek confidence shock affects Greek bonds.

- Germany resists bailout.

- Banking system deteriorates further.

- Crisis spills over into real economy.

- Other countries are affected.

- Europe’s way of dealing with it, through inter-governmentalism, creates gridlock.

Evaluating policy responses, he claimed that it has been measures taken by the ECB as lender of last resort to European banking system that have helped to stabilize financial markets. Contradicting worries that monetizing government debt will lead to inflation, he pointed to examples of central banks around the world that have intervened in crises. In Europe, he said, government bond purchases remain a very small percent of ECB assets.

He argued that the best remedy would be issuing Eurobonds; it would solve the “home bias” problem and it would provide a benchmark to the rest of the credit markets. Unfortunately, he said, Germany has blocked proposals put forth by the European Commission. And this, Collignon stated, is the core problem facing Europe today, namely, who controls what. He suggested a number of policy responses to address the institutional dimension of the crisis, notably, strengthening of fiscal surveillance, coordination of national budget plans, creation of a fiscal compact, and finally, imposition of financial sanctions. To address the macroeconomic imbalances, he said that the European Commission has developed a surveillance mechanism aimed at preventing and correcting such imbalances.

In conclusion, Collignon said that Europe will take the “Federalist leap” or it will disappear as a global player and sink into irrelevance – in either case, Europe’s future is a matter of political will.