FFF – November 1, 2019

1) Managing common PO invoice holds

There are several common types of holds that can be placed on Purchase Order invoices. Here is what they are, and how to manage them.

- U-holds are temporary holds placed on invoices under $5,000 that have been processed and are ready to generate payment. These holds will expire after 3 business days and release for payment (according to the vendor’s payment terms), but they can also be released earlier via the Worklist tab in BUWorks. Individuals who lack approval permissions can forward Worklist items to others with the appropriate permissions.

- O-holds are placed on invoices over $5,000 that have been processed and are otherwise ready to generate payment. These must be released via the Worklist tab in order for payment to generate.

- H-holds are manual holds placed by end users from within their Worklist. While an invoice is under a U-hold or an O-hold, the end user has the option to place the invoice on an additional hold if there is a reason for delaying payment. If this action is taken, the only way the invoice can then be released is by contacting Accounts Payable via the Financial Affairs Customer Service Portal, then selecting Open New Case >> Accounts Payable >> AP General Inquiry and submitting a ticket.

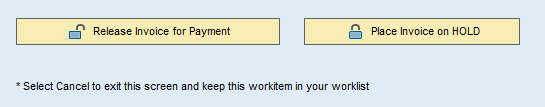

When selecting a Worklist item to view, a new screen will pop up that will include these options:

The left option will release a U-hold or O-hold, and the right option will create the H-hold.

2) AFR Training registration

PAFO will be running two AFR Trainings in early 2020. The dates are February 11th and April 29th. Registration can be done here.

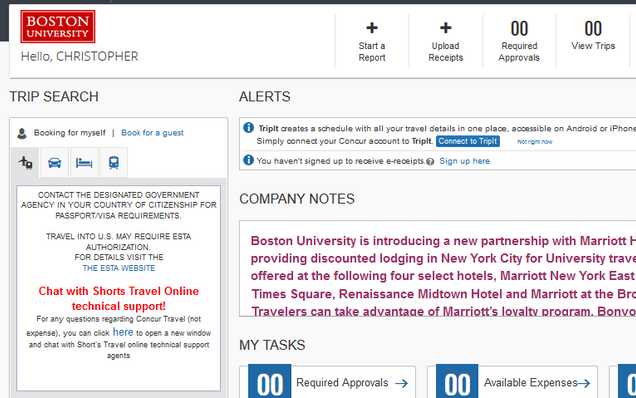

3) New chat function for Concur travel bookings

4) Travel Card and PCard may not be used to pay individuals for services

As a reminder, payments to individuals for provided services cannot be charged to PCards and Travel Cards. These should be paid for either by purchase order or disbursement, depending upon the nature of the services provided.

5) Online W2 election / Address update for mailed copies

As with past years, all BU employees (including student employees) have the option of receiving their 2019 federal W2 tax forms online, as opposed to via paper copies. This can be done by accessing the Employee Self Service/ESS tab in BUWorks, and choosing W-2 Election under the “Benefits and Pay” header. Instructions on how to make this selection can be found here. The benefits to choosing this option are:

- Earlier access to your W-2

- Ability to file earlier

- It can’t ever get lost

- It saves labor and printing costs for the University

- Student employees (numbering roughly 17,000) can still access their forms, even if they’re no longer living in the residence halls, housing, etc on file at the time of the mailing

Surveys of peer institutions have found that the percentages of employees who opt in for electronic W-2s range from 30% to 90% — in 2017, BU employees had an online election rate of 30% of faculty/staff, and 17% of students. This is an area in which a little bit of individual effort across the University can make great contributions toward sustainability, cost reduction, etc.

Additionally, please encourage any faculty/staff who do not elect to online W-2s to confirm their home addresses in BUWorks, and update them as necessary. Instructions to do so can be found here.