Facilities and Administrative Costs and Analysis

Overview

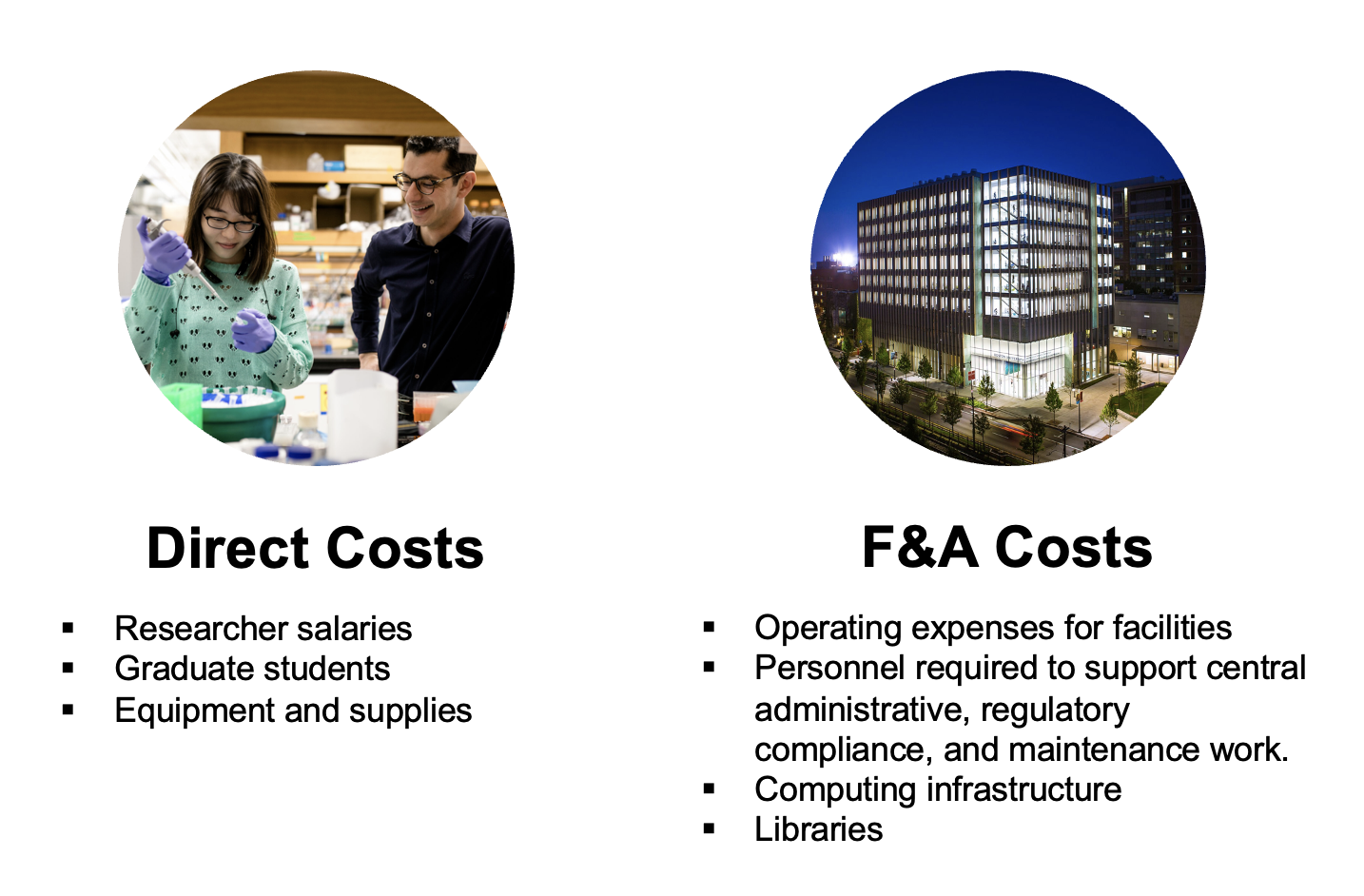

Facilities and administrative (F&A) costs are costs that are not readily identifiable with individual projects, and are also called overhead or indirect costs. They include: library operations, utility costs, depreciation of buildings and equipment, operations and maintenance costs, grant and contract administration and accounting, and general administrative expenses for central offices such as the President, Provost, Human Resources, and Purchasing.

Unpacking F&A Costs

Boston University’s current F&A rate is 65%. Why?

F&A costs are not readily identifiable with individual projects. F&A is designed to partially reimburse the University for the costs of using its facilities and administrative structure in carrying out research.

Since it would be extremely difficult to identify the appropriate rate associated with each research project the rate is established through negotiation with the US Department of Health and Human Services based on actual audited costs historically incurred by the university in the course of carrying out its research portfolio.

How much of this is for facilities and how much for administration?

Facilities costs make up 60% of our F&A. Facilities costs include utilities, maintenance and repairs, and depreciation of the cost of acquisition, construction, and improvements to University buildings.

Administrative costs make up 40% of our F&A. They include 3 components: departmental administration, general administration, and sponsored programs administration. Departmental administration is the largest component of the administrative rate at approximately 19%.

Government regulations recognize that to the extent the faculty and staff in schools and departments have research-related administrative responsibilities, their salaries and related costs are costs of research. So, there is a mechanism provided to recover these costs, through the “Departmental Administration” portion of the F&A rate. An estimate of the amount of time (and related salary) spent on administration related to research in academic departments is captured in calculating this part of the rate.

General Administration includes all the central functions that facilitate research and is 12.4% of the University’s administrative rate.

The largest component of General Administration costs, Information Services & Technology (IS&T), includes functions entirely dedicated to the support of research, such as Research Computing Services and Research Administration Systems, as well as underlying network infrastructure and desktop computing support services for faculty.

Finally, sponsored programs administration makes up 6.94% of the administrative component and is used to support Sponsored Programs, Research Compliance, and other support which is provided through the Office of Research.

Federal F&A Rates

Boston University’s Federal Facilities and Administrative costs (F&A) rates are established through negotiations with the U.S. Department of Health and Human Services. These rates are fixed for a specified period of time and should be used for all grant or contract applications to sponsors, unless there is a restriction prohibiting indirect costs or designating another rate for a special program.

Rate determinations are based on “predominance of effort” when there may be more than one site involved and work is being performed on-campus and off-campus at locations remote from BU, as in the case of field work. When more than 50% of the work is performed off-campus, the off-campus rate is used for the entire project. When more than 50% of the work is performed on-campus, the on-campus rate is used for the entire project.

F&A costs are charged to a project by applying a percentage to the total direct costs of the project. For all federal sponsors, the total direct cost is modified to exclude capital equipment (any non-expendable equipment estimated to cost $5,000 or more and with a useful life of one year or more), rent and utilities, tuition costs, patient care expenses related to “standard of care” (the cost for in-patient and out-patient care, but not payments to human subjects), graduate research assistant tuition costs charged directly to the project, and subcontract expenditures in excess of $25,000. This rate is known as the Modified Total Direct Cost rate (MTDC). In addition, other sponsor and/or award-specific restrictions may also apply. For example, NIH limits F&A for Genomic Array supplies. If a project is carried out in space leased by the University and the rent is charged to the grant or contract, the off-campus rate is applied. Otherwise, if the lease is capitalized by the University, the on-campus rate will be applied.

Non-Federal Overhead Rates

Non-Profit Organizations

For non-federal agencies, such as the American Cancer Society and similar non-profit organizations, generally if a sponsor has a written policy that limits the allowable rate of indirect costs, BU will accept these rates. See the rates.

Waiver or Reduction of F&A

Overhead Assessment of indirect costs to a sponsored project allows BU to recover some of its contribution to the support of the project. Therefore, assessment waivers are rarely given except in exceptional circumstances. Waiver requests should be directed to the Associate Provost and VP for Research on the CRC, and to the Deans on the MED campus, using the form provided in the waiver policy.

Facilities Cost Analysis

The Facilities Cost Analysis group calculates and negotiates Boston University research rates used for sponsored funding. Our team also develops and maintains databases for facilities management, property management, and space management. We handle indirect cost accounting inquiries from government regulators and auditors and manage external surveys related to sponsored research reporting.

Resources

- Current BU F&A/Fringe Rates

- Guidelines on Facilities and Administrative (F&A) Reductions or Waivers

- BU Budget Template

- Convert Percent Effort to Calendar Months

- Cost Sharing

- F&A Cost Reimbursement Policy and System