Vision

IMAP aims to develop and disseminate measurement methods and metrics that better reflect and communicate the social and environmental impact of businesses.

We believe these are missing ingredients to bring about more responsible business behavior that would mitigate risks and harness long-term value for all stakeholders—shareholders, employees, and society at large. Although our initial audience is the asset management industry, we expect that our work will extend to communicating with employees, asset owners, consumers, governments, nongovernmental agencies, and consumers.

IMAP Goals

Our mission is to bridge the gaps in ESG criteria through a multi-year program to improve measurement metrics and facilitate rapid uptake within the user communities. Towards this end, we are assembling a stakeholder advisory board with deep expertise and user perspectives to help shape the project from its outset. This board initially will include representatives from corporations who generate the data and asset managers who use the metrics. We believe that collaboration with businesses and investors is critical in identifying the most relevant problems and solutions that are readily implemented in practice.

Agreeing on the correct measurement metrics can become a powerful mechanism for society to internalize the cost of externalities such as carbon emissions and labor practices, that have value not represented on traditional financial reports. Whether it is in public policy, business, or consumer decisions, absence of good measurement tools can lead the conversation astray and lead to distortionary outcomes. What’s more, when the impetus comes from business and consumer decisions, rather than advocacy voices alone, governments take more notice and are more inclined to enact policies that price the externalities.

Our research efforts draw on a wide range of disciplinary excellence from across Boston University. BU is a leader in actionable research at the intersection of sustainability and business. IMAP’s sponsorship by the Ravi K. Mehrotra Institute for Business, Markets, & Society (IBMS) and affiliation with the Institute for Global Sustainability (IGS) provide a solid foundation for our work. IBMS explores the role of business in creating lasting prosperity, advancing societal goals, and solving global challenges. IGS pioneers research to advance a sustainable and equitable future with a focus on planetary and environmental health, climate governance, and energy systems. In addition, where needed, we draw on the broader academic community.

The guiding principles of the program address:

- How can the measurement and communication of these metrics be improved in a way that is accessible to the user communities?

- What is the feasible degree of standardization in the measurement of these metrics versus necessary customization to fit the metric or industry?

- What is the best method of disseminating our results to ensure the ESG user community adopts our research?

Investor interest

Responding to growing demand from consumers, employees, governmental agencies and now, investors, companies around the world are paying increasing attention to the impact of their actions on the natural environment, the communities they serve, and society at large.

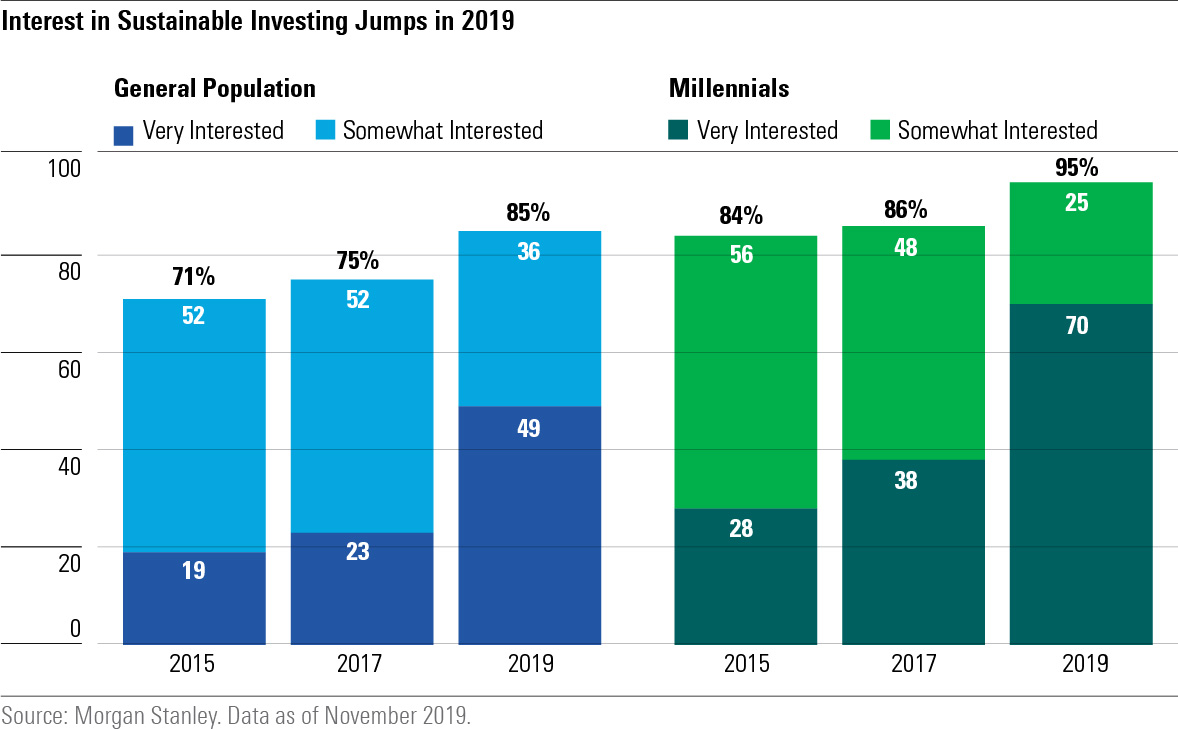

Growing interest in sustainable investing among investors with millennials leading the way…

With more than 5,000 asset managers as signatories of the UN PRI, it is estimated over $89 trillion in assets under management (AUM) are following some sort of responsible investing strategies, ESG has become part of the mainstream in the asset management industry.

Why? Adoption of ESG analysis by investment managers and asset owners is motivated by several powerful motivations:

- It is potentially a powerful mechanism to align corporate behavior with the growing investor desire for responsible corporate behavior.

- ESG data can be a valuable source of forward-looking information on risks and opportunities with predictive power on the performance of companies.

- High ESG performance signals a company’s ability to comply with evolving laws, regulations, and social norms.

Reasons behind the rise in investor interest

![]()

More and more assets owners are seeking sustainable investments

![]()

Prepare companies for better compliance with evolving rules, regulations, and social norms

![]()

ESG data may bring new information and identify hidden risks and opportunities

A challenge for investors is how to embed sustainable factors as a way to see the risks in a portfolio, whether by providing early signs of a scandal or by identifying where the cost of pollution or climate change may come back to bite. What’s more, as has been highlighted during the COVID-19 crisis, today’s business value chains depend on highly interlinked global networks that extend deep beyond the traditional boundaries of a firm. In order to properly price these broad impacts of a business, we need better-quality data, more transparency, and consistent metrics that allow for more meaningful comparisons than those available in current company reports.

Check out this 2021 webinar moderated by IMAP Executive Director, Susan Fredholm Murphy, and hosted by the Boston University Office of Alumni & Friends on the topic of sustainable investing and this rapidly evolving field. Speakers included: Robert Fernandez, Director, ESG Research at Breckinridge Capital Advisors and Carol Jeppesen, Head of US, Principles for Responsible Investment (PRI).

Video courtesy of the BU Alumni Association.

Integration of ESG metrics is the solution. But there are big gaps to fill.

ESG metrics are the solution. But there are still big gaps to fill. Although ESG criteria are gaining popularity in asset management, the lack of clarity and consistency within ESG data have reduced their effectiveness. There is concern about the quality and integrity of the underlying data and how this data is sourced and aggregated to create meaningful metrics. Much of the data is sourced from a variety of voluntary and fiduciary disclosures by companies. The challenge is exacerbated by competing frameworks and standards — e.g., Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) — that are designed for different audiences. Central to solving this problem is having accurate, reliable, and widely accepted metrics to measure responsible behavior.