RevPAR May Be Back This Year, but the Industry Looks Much Different Than It Used to

By Rod Clough, President, Americas, HVS

As much as we want the pandemic to be in the rearview mirror, the hotel industry is still facing lingering challenges. Group cancellations and reduced group room block pick-ups during the first weeks of 2022 are taking steam out of the recovery and extending the time to a full return of the group market. And while transient travel would normally fill the gap, its demand only goes so far in the early weeks and months of the year, even in the best years.

With many central business districts (CBDs) and suburban office parks still saddled with empty offices, transient demand has not been quick to return in all parts of the country. We should start to see life breathed back into most offices this year, gaining the most momentum this summer, but hybrid work is here to stay. Ultimately, office buildings will be less vibrant and occupied; future leases will likely be downsized, and with new capacity coming to the market within existing buildings, new office space construction is sure to diminish. It is important to note that this does not necessarily translate into less travel and is not as significant a threat for the hotel industry as it may be for the office sector. It does, however, result reduced ancillary revenues for restaurants and bars that relied on significant office population business pre-pandemic.

The silver lining for hotel operators is that when group business starts to increase, and it certainly will, it will be much more short-term in nature. On-the-fly meetings will be critical to jumpstarting initiatives and strengthening training and onboarding. This trend will give hotels significant pricing power, as these meetings will need to happen quickly, and meeting planners will not have the flexibility to push initiatives to dates with lower pricing.

Mask and vaccine mandates are another factor to consider. As these requirements are increasingly being lifted, we see the return of corporate and meeting-related travel as well. Until recently, it has been difficult to manage larger groups with varying and ever-changing mandates, coupled with a mixed population of the vaccinated and the unvaccinated. These simple realities have prevented the full return of groups.

The pandemic-related Great Resignation has had a profound impact on the economy but could be a boon for the hotel industry. Companies have faced significant turnover in the last year, and forward progress will only be possible with a newly hired, invigorated, and trained staff. Much of the training and onboarding business will return to hotels, booked on a short-term basis, over the coming months and years.

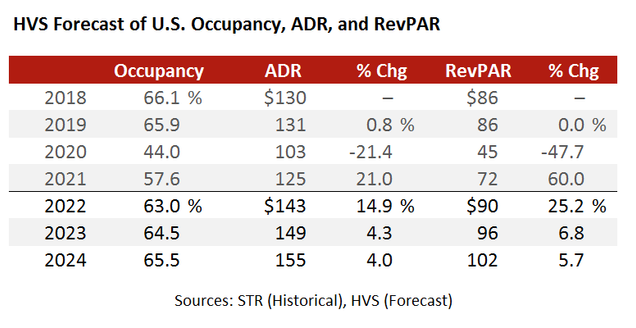

Our forecast of occupancy, average daily rate (ADR), and revenue per available room (RevPAR) reflects all of these realities. Our annual forecasts are based on monthly projections we have made for each month of the next three years. We are pleased to report that with January now behind us, our January projections (not shown) were spot on. We see the industry’s full occupancy recovery still two years away (2024), but ADR will easily surpass the prior 2019 peak in 2022 and will likely reach even greater heights in 2023 and 2024 as lagging areas of the sector catch up with the already rebounding segments.

HVS Forecast of U.S. Occupancy, ADR, and RevPAR

Sources: STR (Historical), HVS (Forecast)

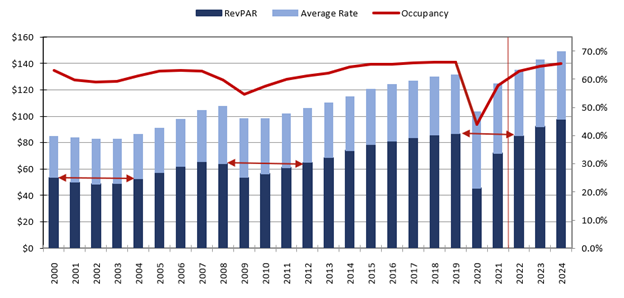

Outside of the CBDs, many suburban, highway, and small city markets are fully recovered and have moved well beyond 2019 RevPARs. These higher limited-service RevPARs are balancing the still struggling RevPARs of some larger CBD and suburban properties, ultimately lifting the U.S. RevPAR level to the 2019 point by the end of the year. But this RevPAR looks much different than its 2019 counterpart when all sectors of the industry, limited-service and full-service alike, were performing relatively well. The fast rebound and strength of the limited-service and extended-stay sectors, coupled with the record performance of the resort and leisure segment of the industry, have fueled a RevPAR recovery that has been much faster than the prior two recessions.

Pandemic Era Forces Two Years of Low RevPAR vs. Three Years in Prior Downturns

Source: STR – Historical (Through 2021), HVS – Projected (2022-24)

ADR is quickly rising, and while inflation is playing a part, there is more to the story. In January, ADR was just a couple of dollars from the 2019 mid-$120 level, gaining roughly $30 from the 2021 low point. As the month progressed, hotels were increasingly more confident in raising rates. Higher rates are especially being achieved in resort destinations that have benefited from strong holiday travel. Holiday travel on the Martin Luther King Jr. Day weekend was also strong with high rates. This rate momentum should continue to build in 2022 with spring break travel and special events and festivals returning in the late spring and summer. As groups start to return in greater force this year, many booked without significant notice. Hotels will benefit from rates booked at prevailing levels, rather than at discounts.

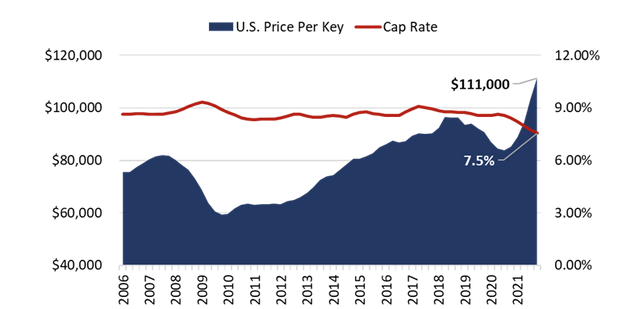

For hotels experiencing a strong trailing-twelve-month period (T12) and an even better forecast for year one (2022), buyers are increasingly comfortable considering fairly aggressive, forward-looking cap rates. We became accustomed to averages in the 8.5% to 9.0% range in the years following the Great Recession, but the current dynamics of recovering net operating income (NOI) coupled with a plentiful pool of buyers are driving cap rates to new average lows, well below 8.0%.

Cap Rates Falling to New Lows

Source: Real Capital Analytics

The combination of excess liquidity and favorable financing terms are driving up asset values. More lenders are receptive to the hotel industry as it recovers. New sources of debt capital are coming into the hospitality lending space, filling the near-term void created by traditional debt providers; however, most traditional lenders are expected to return by mid-year. Fewer lenders will remain on the sidelines in 2022. Nevertheless, obtaining full-loan proceeds from a single source remains challenging, as lenders are carefully limiting loan-to-value ratios (LTVs) and managing their exposure during the recovery. Larger deals are structured with multiple sources of funding, including senior loan plus mezzanine or preferred equity pieces to backfill the gap.

As long as interest rates remain low and inflation remains high, there will be an incentive for borrowers to borrow, which further fuels asset pricing. The Federal Reserve announced that it will be tightening and increasing interest rates this year, so it will be interesting to see the corresponding impact on the market, especially during the second half of this year.

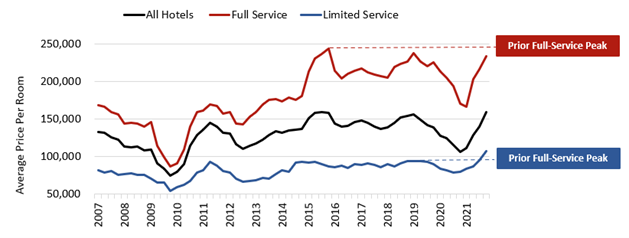

Back in the early summer of 2020, we thought the industry would be four years away – on average – from value recovery. However, by the end of 2021, values had surpassed early 2020 levels in many corners of the industry. Many, if not most, extended-stay, limited-service, resort, and select-service hotels fully recovered earnings before interest, taxes, depreciation, and amortization (EBITDA) levels in the latter half of 2021, setting the stage for an EBITDA recovery for the full calendar year of 2022. Buyers jumped on these assets, driving the recovery in value. The four-year recovery timeframe was shortened to less than two for these sectors.

Other sectors within the industry are still on a four- or five-year recovery timeline. Those hotels are more dependent on large-scale convention demand and mega-groups. High-volume transient accounts from major CBD office tenants will also experience an extended recovery. Not all buyers and owners will want to wait it out, as more transactions are occurring with buyers anticipating conversions to housing. This follows several such conversions that started last year.

Two recent examples of these trades in early 2022 include the 278-room Hotel Tucson, a central Tucson property that will be converted to 210 apartments this year. Another example is the 1,220-room Sheraton Boston; this property also just sold in early 2022, and it is highly anticipated that a portion of its room count will be converted to student housing. New York City has several properties similarly converting, such as the 600-room Watson Hotel in Hell’s Kitchen. Yellowstone Real Estate is in the process of converting half of its room count to residential use. We will likely see more of this trend in 2022 and 2023 in many key CBDs throughout the U.S., where market dynamics support the conversion to micro-apartments or student housing.

Well-performing assets coming to market are at 2019 values or higher. If a property is located in a high-barriers-to-entry market and is well branded, buyers are willing to pay significant premiums, ultimately driving cap rates to new lows. Portfolios are trading at premiums given transaction and anticipated operational cost savings.

Source: Real Capital Analytics

Rising development costs due to supply-chain disruptions, labor shortages, and overall inflation are leading to a general contraction in new hotel openings. Moreover, development challenges are intensifying for major CBDs, attributed to slow office reopenings, a lag in larger convention bookings, higher operating/labor costs, and even higher construction costs than the average project. Accordingly, major CBD development remains difficult. This should contribute to further increases in pricing for well performing assets.

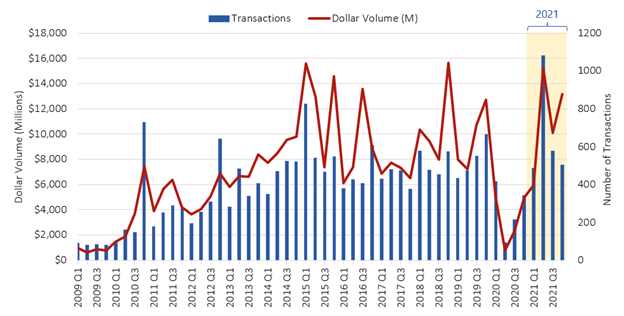

Brokers we are talking to are generally expecting 2022 to be even busier for transactions than 2021, despite 2021 being a record year for most brokerage firms. The amount of capital raised over the last two years remains heightened. Coupled with improving T12 performance and an even better projected year-one forecast, the gap between seller and buyer expectations is narrowing, which will lead to an increase in transactions.

Transaction Volume Came Back Strong in 2021

Source: Real Capital Analytics

Distressed sales and strategic capital raises are expected to increase in 2022; hotels still represent the highest commercial mortgage-backed securities (CMBS) delinquency rates, and courts are ramping up capacity. Some select-service owner/operators are migrating to full-service opportunities given the potentially higher returns and the compressed cap rates for select-service and extended-stay hotels. Lastly, some owners who have projects currently under construction are considering selling immediately upon completion given the buyer demand for newly constructed/turnkey assets.

In Closing

While there are still some clouds in sight, the skies look much brighter now than they did a year ago. New supply is waning, and RevPARs are rising quickly, leading to favorable T12s transitioning into even more attractive year-one forecasts. Buyers are plentiful, and debt is returning to the market. With more assets, both distressed and well performing, expected to come to market this year, 2022 will be an exciting year for the industry.

Acknowledgments

We would like to acknowledge Jonathan Katz for the peer review of this article. This article has been accepted for publication by Kaushik Vardharajan, Editor of the Real Estate issue.