BU’s Bond Rating Upgraded by Moody’s

Report cites fundraising growth, management savvy

BU’s latest bond rating caps a decade-plus of improving financial grades from outside analysts. Photo by Dave Green

- BU’s bond rating upgraded by Moody’s to Aa3 from A1

- Reflects growth of fundraising and sales of real estate

- A higher bond rating means University can borrow at lower costs

Moody’s Investors Service has upgraded BU’s creditworthiness, citing the University’s formidable fundraising and real estate holdings as well as the administration’s skilled financial management.

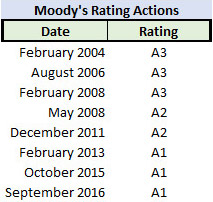

The bond-rating agency graded BU to Aa3, up one notch from the A1 rating that the University has had for almost five years. The rating measures an institution’s ability to repay borrowed capital; the higher the rating, the less it costs to borrow. Moody’s ratings range from Aaa to C, with numbers added within each grade for further differentiation.

Moody’s report on the upgrade cites the University’s “improving financial flexibility through growth of fundraising and real estate monetization.” It also notes that the BU administration’s “careful oversight and expense controls continue to yield strong operations relative to peers, and consistent net tuition revenue growth.”

BU has advanced steadily in the eyes of rating agencies over the last dozen years, with both Moody’s and Standard & Poor’s giving it higher ratings over that time.

The latest upgrade “is largely driven by the successful, sustained improvements in all measures of our core enterprise activities over the past several years,” says Martin Howard, the University’s senior vice president, chief financial officer, and treasurer. “This report validates the continued and effective strategic focus by the University in its teaching, research, and public service mission.”

The upgrade came after the fourth year in a row of record budget reserves for BU, and a 13 percent preliminary return on investment for the $1.9 billion endowment.

BU’s financial position has been strengthened in part by the Campaign for Boston University, the $1.5 billion comprehensive campaign begun in 2012 and running through 2019.

The endowment also received $114 million from proceeds of the sale of University-owned buildings in Kenmore Square last year.

BU’s merger with Wheelock College next June, which will create a new school of education at the University, “will have limited near-term credit impact on Boston University, but does provide some strategic opportunities over the long term,” Moody’s says.

“We expect BU to comfortably absorb Wheelock’s relatively small, $38 million operations and up to 600 full-time equivalent students,” the report says, “and to quickly close any operating deficits [at Wheelock] through operating efficiencies and other measures. Wheelock’s strong reputation in early childhood education will complement BU’s existing undergraduate and graduate education programs.”

Comments & Discussion

Boston University moderates comments to facilitate an informed, substantive, civil conversation. Abusive, profane, self-promotional, misleading, incoherent or off-topic comments will be rejected. Moderators are staffed during regular business hours (EST) and can only accept comments written in English. Statistics or facts must include a citation or a link to the citation.