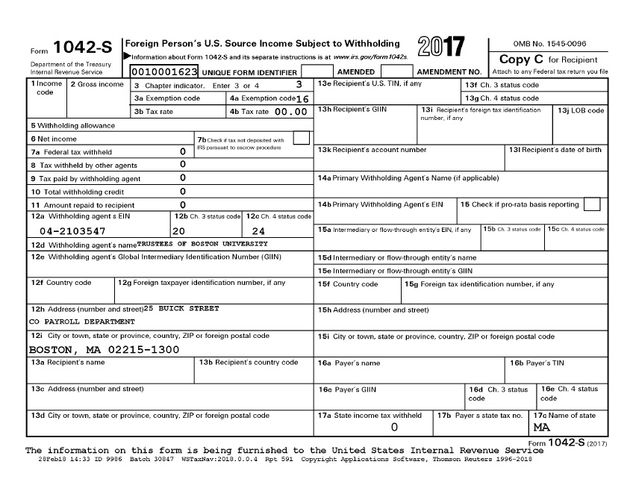

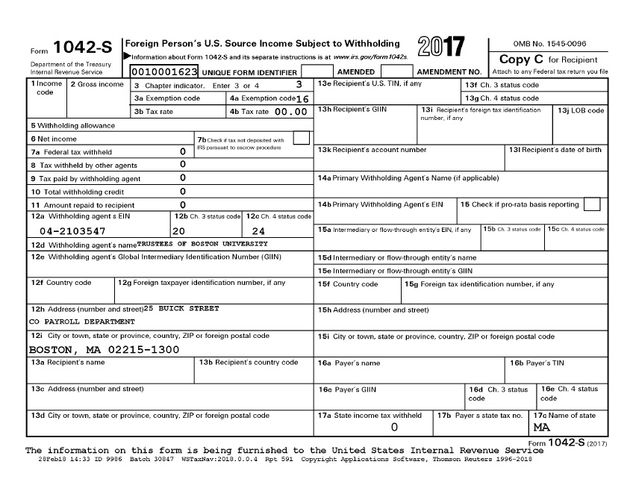

Understanding your 1042-S

Due to the new withholding and reporting obligations under Chapter 4 of the Foreign Account Tax Compliance Act (FATCA), Form 1042-S underwent substantial changes in 2014. The changes are designed to accommodate reporting of information relating to both Internal Revenue Code Chapter 3 withholding at source on payment to non-U.S. individuals and Chapter 4 FATCA information and reporting.

Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding):

The form must be issued by Boston University to both the Internal Revenue Service (IRS) and the nonresident alien no later than March 15.

Explanation of Boxes

Box 1 - Income Code

- Boston University primarily uses the following income codes:

- 10-Industrial Royalties

- 16-Scholarships and Fellowship Grants

- 17-Compensation for independent personal services (Independent Contractor, Honorarium)

- 18-Compensation for dependent personal services

- 19-Compensation for teaching (including some research income)

- 20-Compensation during studying and training

- 23-Other Income (Awards and Prize Payments)

Box 2 - Gross Income

- The total dollar amount of paid to the individual by Boston University in the calendar year.

- If an employee had a tax treaty, the entire amount paid that was exempt from federal income under the tax treaty; the portion of the wages that were subject to federal income tax withholding is reported on IRS Form W-2.

Box 3 - Chapter 3 Withholding

- On each Form 1042-S, either box 3 Chap 3. or box 4 Chap 4. must be checked. Chapter 3 withholding is checked for Non-Resident Alien withholding. Wages, fellowships or scholarships, honoraria, awards and prizes, and royalty payments are all reported under Chapter 3 withholding.

- Box 3a – Ch. 3 Exemption code:

- 00 – Indicates that these payments were not exempt from federal income tax withholding.

- 04 – Indicates that these payments were exempt from federal income tax withholding under a tax treaty.

- Box 3b – Ch. 3 Tax rate: either 0, 14, 0r 30 based on the percentage of the payment that were withheld for federal taxes.

Box 4 - Chapter 4 Withholding

- On each Form 1042-S, either box 3 Chap 3. or box 4 Chap 4. must be checked. Chapter 4 withholding is checked for FATCA withholding.

- Box 4a – Ch. 4 Exemption Code:

- 16 – Excluded non-financial payments, including wages, scholarships, honoraria, and awards/prizes.

Box 7 - Federal Tax Withheld

- The total dollar amount of federal income tax that was withheld from gross income. Equals the Box 3b tax rate multiplied by the amount in Box 2.

Box 10 - Total Withholding Credit

- The total dollar amount of federal income tax that was withheld from gross income.

Box 12 - Withholding Agent Information

- Box 12a – Employer Identification Number (EIN); Boston University’s IRS-issued tax identification number.

- Box 12b – Ch. 3 Status code; Boston University’s status code is 20 (Tax Exempt Organization).

- Box 12c – Ch. 4 Status code; Boston University’s status code is 24 (Section 501(c) Entities).

- Box 12h-12i – Employer/Withholding Agent’s name and address.

Box 13 - Recipient Information

- Box 13a – Recipient’s name, address and country; the name and permanent address Payroll has on file.

- Box 13b – Recipient’s country code; the country of residence for tax purposes and associated IRS country code.

- Box 13e – Recipient’s U.S. TIN; this box lists the recipient’s U.S. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Note: If no SSN or ITIN has been provided to Payroll, then this box will be blank. Foreign nationals who do not have a U.S. SSN or ITIN are subject to having their individual tax returns rejected by the IRS as well as being potentially subject to assessments by the University for IRS penalties incurred on their behalf. Non-citizen individuals are strongly urged to apply for a U.S. SSN or ITIN and to report the number to the Payroll Office immediately upon receipt to avoid any tax complications or assessments.

- Box 13k – Recipient’s account number; the recipient’s Boston University ID number; for formatting reasons, the BUID is preceded by a zero.