The Financial Communication Challenges of New Mobility

New strategies for providing mobility using on-demand shared vehicles, electric vehicles, and the prospect of fully automated vehicles are revolutionizing surface transportation. There is good reason to believe that new systems can increase options for mobility for everyone, cut costs, increase safety, and minimize environmental hazards. Capturing their full potential, however, will require innovations not only in the underlying technologies but in the payment systems that support them. The new systems will link billions of individuals and vehicles, highway signals, electric charging facilities, and the electric grid. An optimized system must be able to send control signals in real time – information that will often be based on price signals. Some of the responses to these signals will be made by individuals but it is likely that they may also be made automatically following preference settings set in advance by individuals and businesses. Making this work will require changes in regulatory policy that can encourage interoperability and protect privacy while driving innovation.

“Capturing their full potential, however, will require innovations not only in the underlying technologies but in the payment systems that support them.”

The transportation system has always been an amalgam of private and public investment and management involving roads and highways built and operated by government organizations and vehicles owned and operated by individuals and private companies. But this long-standing tradition will have to change to accommodate new mobility systems – possibly in dramatic ways. It is entirely possible, for example, that instead of selling vehicles, a new generation of transportation companies will be selling mobility as a service, possibly in close partnership with public systems. Governments will need to reinvent the way roads communicate with vehicles – including ways to charge variable fees for using the roads. Electrification of vehicles will require new types of communication with electric utilities.

Interoperable communication standards lie at the heart of making any new system function. The technology for connecting people and things with each other is already very sophisticated and the emergence of 5G wireless will push it to a new level. What has not emerged is an agreed way to package and deliver content, including mobility requests by riders, price signals, and payment requests. Mobility systems will depend critically on three communication systems:

(i) systems letting individuals (and possibly shippers) understand their travel options and order services

(ii) systems allowing seamless payments for the trips chosen – even if the trip involves several different transportation modes

(iii) systems designed to ensure that the operation of new, electric-powered transportation are drawing power from the electric grid in ways that minimize costs. Electric grid operators may need to communicate real-time price information to customers and make it easy for customers to make payments wherever their vehicles are being charged.

All of these systems will rely on continuous, real-time market transactions at an enormous scale.

Cashless Initiatives

The new mobility-related systems will not be made in isolation. They will need to acknowledge a number of fast-moving initiatives to promote cashless economies, systems to support demand-side management for grid operators, and in other areas. Grid initiatives will be highlighted in the discussion of electric vehicles below.

Several initiatives are underway that would make it easier to develop a single, seamless payment system for a variety of transportation systems. They might also be used to pay for electric vehicle charging, but this isn’t mentioned in their materials. Proponents of cashless payment systems (such as Mastercard) argue that they are more efficient and more resistant to criminal activities than cash transactions.

- The Near Field Communication Forum (NFC Forum) is sponsored by a number of major information companies (Google, Intel, Apple, Samsung) and consumer credit companies (Visa, Mastercard) with some participation from automobile firms (GM, Daimler). Its goal is to “..make life easier and more convenient for consumers around the world by making it simpler to make transactions, exchange digital content, and connect electronic devices with a touch. NFC is compatible with hundreds of millions of contactless cards and readers already deployed worldwide.” They are partnering with public transportation systems around the world to make payments easier and seamless across different platforms. Transport for London introduced a network-wide contactless payment system that covered 17 million journeys per week and estimated that it reduced the cost of fare collection by a third.

- With use of credit cards and ATM machines far behind the U.S. and Europe, China has launched a massive program to encourage a “cashless society”. The WeChat and Alipay platforms using cell-phone apps have captured 90% of the Chinese payments, with Apple Pay and others struggling to gain share. In 2017, cashless transactions in China reached $15.4 trillion and are expected to reach $26 trillion by 2019. More than two-thirds of transactions in China are now based on mobile payments. The “Chinese Uber” company DiDi, bike sharing companies, railways, and bus and subway systems in some cities have become major users. Vendors have been reported as having difficulty making change for people using cash. Panhandlers and street musicians accept WeChat payments in major cities. The rapid growth in cashless payment, however, threatens to increase the gap separating prosperous urban centers from the poor, particularly the rural poor where only 30% of the population can use cashless systems.

- The Mobility Open Blockchain Initiative (MOBI) defines its mission as “a nonprofit organization working with forward-thinking companies, governments, and NGOs to make mobility services more efficient, affordable, greener, safer, and less congested by promoting standards and accelerating adoption of blockchain, distributed ledger, and related technologies.” Partners include GM, Ford, Renault, and BMW. The blockchain standards are designed to facilitate a broad range of mobility-related payments – though apparently not including payment for charging electric vehicles. Stated “use cases” include:

- digital identity and history location in space and time supply chain congestion fees

- car and ride sharing usage-based insurance

- car and ride sharing usage-based pollution taxes

Trip planning and trip payments

The long-term goal of mobility as a service systems is to create a single mobile app that would give individuals information about alternative ways to get to their destination; place an order to implement a trip selection if one is needed (taxi, Transportation Network Company such as Uber or Lyft, a parking place, or a bicycle); and make any needed payments. Users would be able to understand the cost and travel time of each option and possibly the environmental impacts or health impacts of each choice (walking or biking would earn health points). Choices that involve publicly owned transportation could increase incentives to use low-emission transportation modes during pollution alerts and public subsidies to low-income individuals through the payment systems.

There is enormous interest in these systems but, with the possible exception of the Finnish system Whim, few systems provide all of the desired services.

Trip Planning

Progress has been fastest in the development of apps for planning trips. Standards for reporting public transportation schedules are possible because of standardized XML formats. The European Service Interface for Real Time Information (SIRI) was developed by a consortium of European countries, while the widely used U.S. system Google General Transit Feed Specification was developed by a private company. Inclusion of commercial ridesharing and car sharing firms has proven difficult because of their reluctance to share data.

Another major barrier is the fact that traditional transit systems are often not designed to interoperate; firms operating bus systems in suburbs may not be coordinated with inner-city schedules, for example. The trip planning tools can make transfers easier to understand but can’t improve coordination.

- Google maps provides travel options that include driving, bus, rail, walking, and biking, plus detailed scheduling and estimated travel times. As is the case for all of the travel apps, the driving times don’t include time required to find parking. It also provides links to Uber and Lyft.

- Moovit provides similar guidance and includes bike rentals. It is a wiki-like approach that is constantly updated by its 400,000 local editors.

- The Canadian Cowlines app, available in a number of Canadian and U.S. cities, covers a wide range of transportation modes and also allows comparison of the greenhouse gas emissions associated with each option. It includes one car-sharing company and 39 taxi companies. Users can specify the maximum distance they want to walk. The app also lets users compare the cost of purchased mobility services to the cost of making the same trip in a privately-owned automobile.

Interoperable Payments

While the apps just described allow users to compare the cost of most travel options, none allow use of the app to pay for the services identified or to make reservations. Users typically must subscribe to several online payment schemes and purchase fare cards. The complex legacy fare structures of legacy transit systems present enormous barriers. They include complex ticketing schemes based on a hodge-podge of zones, discounts, fare ceilings, day passes, and other mechanisms that are different in every city

Public systems can use these payment tools to simplify the delivery of transportation subsidies to students and underserved parts of the population. Some cities are exploring ways to adjust payments in ways that change travel behavior – offering lower fares or other rewards if they increase use of public transit during environmental alerts or decrease use during peak hours. There is still much to be learned about the kinds of incentives that actually shape behavior. Well designed systems could also greatly facilitate emergency evacuations in cases of hurricanes or other natural disasters.

Privacy and security are obvious concerns and some public regulation is likely to be essential. There’s also a need to ensure that the services are available to people who lack bank accounts or access to mobile devices.

Multiple systems that address these challenges are being offered and there is a real risk of balkanization and confusion.

A number of “mobility as a service” initiatives are underway around the world, though few seem to be using these high-level initiatives. Most involve systems that provide both trip planning tools and seamless payment systems. They include:

- The Finnish system Whim allows users to use a wide variety of transportation options and pay for them through their app. The tool provides access to private as well as public services. They compare themselves with Netflix, through which users can purchase videos from many different vendors through a single resource. They have designed the tool to be compatible with many national systems and are aggressively targeting international markets. They now operate in several European cities and in Birmingham England. The service includes an option specifically aimed at weaning customers off car ownership – unlimited access to Whim partners for a monthly price below that of typical car ownership (taxi rides are limited to 5km).

- The Los Angeles Transit Access Pass or TAP system, based on Salesforce, now supports 29 million transactions a day. TAP’s designers explain that it provides a “one-stop shop for payment and program signup. [A user] can connect with any number of programs this way, such as bike-share, micro-transit, fare subsidy programs, parking, ride-hailing, electric vehicle charging, car-sharing, lots of different programs.” TAP has explicit plans to encourage transit use on “bad air” days. They directly address the problem of non-banked customers by allowing customers to use cash to add value to their cards using devices located in stores located through the LA area.

- Chicago’s Transit Authority has introduced the Ventra, allowing access to the entire transit system. It uses the Open Standards Fare System. It includes an app that allows customers to add value to their cards. Its long-term goal is to allow use of a wide range of fare media, including reloadable cards, contactless debit and credit cards, European EMV contactless systems, and cell phones using Near Field Communication – while always providing devices allowing un-banked people to buy cards with cash.

- Transport for London (TfL) operates all public transportation systems and its traffic signals and made its data available to the public a decade ago. More than 600 apps use this data, and 42 percent of Londoners use at least one of them.

- Japan Pasmo provides a single payment system for most of Japan’s enormous rail transportation systems. 33 million cards have been issued.

- 14 percent of UberPool trips begin or end near a Metro station in Los Angeles, and 10 percent of UberPools begin or end at Bay Area Rapid Transit stations.

- 25 percent of Lyft riders say they use the service to connect to public transit. In Boston, 33 percent of those rides start or end near a T station. And transit hubs like Chicago’s Union Station, D.C.’s Union Station and Boston’s South Station are among the most popular destinations for its users, Lyft finds.

- There’s evidence that people are using transportation network companies and bike sharing as integral parts of transit trips. At present, however, about half of ridesourcing services are used for recreation or social purposes while only about 20% of trips are for commuting.

- There is growing evidence that bikeshare users are using bikes to commute to transit hubs.

On average, 20 percent of the time people spend on buses is waiting for people to pay and board. Boarding with a mobile phone app takes about two seconds per person while cash averages six seconds. An additional 10% time savings can be gained if people pay before getting on the bus. It might be possible to further streamline the process (and avoid random checks of payment) by having vehicles recognize cell phones or other devices when they enter or leave.

Perhaps the most glaring defect in these systems is their inability to seamlessly integrate public transportation options with private providers that can address the pressing problem of getting people to and from transit stops (the first- and last-mile problem). Off-peak trips are best provided by eliminating large buses and encouraging walking or biking or using a shared van to take riders directly to their destination. But during peaks, optimized systems would use these resources to get people to and from transportation hubs.

The Whim system does integrate taxi and bike sharing, but at present does not appear to include most transportation network companies. The system cannot provide the key service of coordinating the scheduling of “first- and last-mile” pickups with transit schedules. Mobility providers can provide these services but are typically reluctant to collaborate with mobility apps showing travel alternatives if their competitors also appear. Efforts by public transit companies to provide first- and last-mile shuttles have not been successful. In fact, the Whim app was developed after the Helsinki government’s attempt to introduce government-run on-demand bus services failed. Kansas City experimented with a similar system, but it failed when the private partner went bankrupt. Very few people used the system.

Learning from earlier misadventures, the city of Los Angeles is launching an ambitious new initiative designed to link “MicroTransit” with their existing system: “Metro is issuing a request to the private sector to team with Metro to plan, design, implement and evaluate a brand new service…Unlike a standard bus, the service will follow turn-by-turn instructions from a navigation system that uses live traffic conditions and real-time requests for picks-up and drops-offs to generate the most efficient possible shared trips for Metro customers. The service will be used for short trips under approximately 20 minutes in duration in defined service zones, and utilize vehicles that are smaller than traditional transit vehicles…the new service will be intuitive, user-friendly, and designed to encourage the use of multiple modes of public transportation.”

A variety of other experiments are now underway using existing technology. In spite of the limits placed on using public funds for using services that may not conform to the insurance or driver clearance process used by public transport, a variety of municipalities have experimented with using Transportation Network Companies to provide “first- and last-mile” services. These include Orlando and Pinellas Florida. The Pinellas system offers a 50 percent fare subsidy to riders using Uber or United Taxi service. The subsidy is roughly the same as the subsidy paid for the existing transit system.

These hybrid systems clearly face challenges and there is growing concern that their use will prevent cities from deploying far superior solutions: “Emerging mobility providers can have a major analytical advantage given their laser focus on their own operations, flexible financial resources, and technical talent pool. This puts poorly resourced agencies at risk of becoming reliant on those providers to conduct trustworthy analysis to inform policy decision-making”.

Electric Vehicles

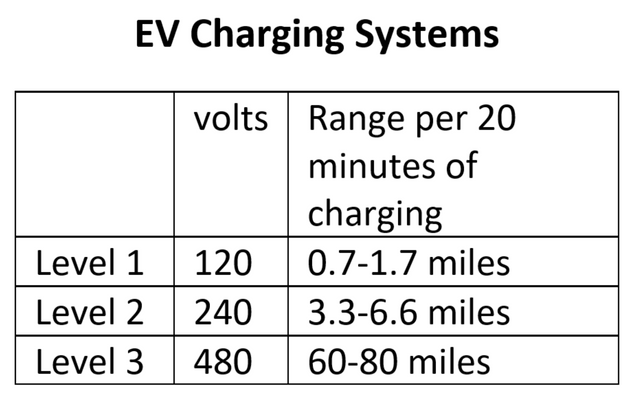

Electric vehicles are adding a new dimension to the planning and operation of new mobility systems. Mobility systems will be integral parts of the systems that generate and deliver electricity. Meeting climate goals will require rapid introduction of electric vehicles in coming decades and they could become 20 percent of the loads served by electric utilities and, unless corrective strategies are put in place, an even higher fraction of the peak load. The most immediate challenge will be faced by electric distribution systems (the comparatively low voltage networks delivering power to homes and offices). Large numbers of electric vehicles could exceed the capacity of these systems if users elect to charge at the same time of day – particularly if they use fast charging systems that draw large amounts of power. The challenges created by electric vehicles will contribute to the already daunting range of new complexities faced by utilities, challenges that include managing large amounts of intermittent renewable power, distributed generation, electric storage systems, and demand-side management in buildings and other large loads.

The most obvious way to manage the situation is to give purchasers incentives to charge their vehicles at locations, times, and charging rates that minimize overall system charges. This includes minimizing utility investment in new equipment (generation and transmission/distribution) and maximizing use of charging facilities. Large numbers of electric vehicles connected to charging equipment can create operational problems for grids (such as voltage and frequency instability), but they can also provide services (frequency and voltage regulation, short-term storage) that can be assets to utilities. Optimized systems will require efficient, real-time communication between utilities and charging facilities.

Many utilities in Europe are collaborating in the development and use of an Open Charge Point Protocol (OCPP) that addresses charging issues. The group defines its mission as follows: “OCPP is a universal open communication standard to answer the challenges associated with proprietary networks. OCPP enables seamless communication between charging stations and vendor central systems. An extension (the Open Smart Charging Protocol or OSCP) allows sophisticated communication with smart grids. The closed nature of proprietary charging networks has led to unnecessary EV driver and asset owner frustration over the years, fueling widespread industry support for an open model. With more than 40,000 installations in 49 different countries, OCPP has become the defacto open standard for open charger to network communications.”

The protocol allows utilities to use forecasts of electric demand to establish time of day rates that consumers can use to plan their charging strategies. Some cities are experimenting with urban management systems that can use the recommended charging locations to help customers get to charging stations without adding to congestion as a part of a “smart city” traffic management plan. Experiments with variable rates have been successful, but there is evidence that participants complied with recommendations as much out of curiosity as out of economic interest. There was general agreement that the incentive (€0.02/kWh) was too low to create long-term behavioral changes.

New business models will open new opportunities:

- An “aggregator” firm could contract with a grid operator to respond to price signals. The aggregator would then bear the responsibility of controlling charging for its clients. Options might include fixed monthly fees for charging, giving the aggregator control of when charging occurs. Customers could override the limits for a price. Similar services have been provided to aggregate demand management for buildings and the same firms might expand to include vehicle charging. In some systems, the utility itself could be the “aggregator”. European utilities are considering “variable capacity contracts” between distribution service operators (they deliver power directly to customers) and aggregators who would give the distribution service operators an ability to manage charging “within the limits of the agreed variable capacities”.

- Fleet owners could provide sophisticated responses to forecast time of day rates by optimizing both vehicle operations and charging costs. There will be challenges. In a recent survey of Uber drivers operating electric vehicles, half said that they’d have driven 10 hours more each week if they didn’t lose time charging. Automated vehicles would open many more options.

While some U.S. utilities are adopting the Open Smart Charging Protocol, many are not. With its tangle of thousands of regulatory regimes, the U.S. approach to managing EV integration is highly fragmented. Some states prohibit utilities from operating EV charging, while others give them a monopoly. No national policy provides guidance. This is not to say that U.S. utilities are failing to innovate. SDG&E has a program called “Power Your Drive,” which offers a tariff that will have hourly dynamic prices reflecting grid conditions. Prices for the next day for each circuit will be posted on a public website. Consumers can use an app to indicate their preferences, including the maximum price they are willing to pay and desired charge time. The app will provide advice about where and when to charge.

What Now?

Rapid innovation in mobility services, smart grids, and non-cash currencies are creating dramatic new opportunities for a next-generation transportation system. But capturing these opportunities will require them to operate in an efficient, interconnected system. Mobility services and electric utilities share a number of features that make them quite different than ordinary markets: they must operate enormous markets in real time, their costs can be strongly driven by peak loads, and they are typically hybrids of public and private systems and regulated with a strong interest in the public good. There is even speculation that we may need to regulate mobility services and electric services in much the same way.

Premature regulation would be fatal to innovation during this period of dynamic change, but this doesn’t mean that inventive public regulation isn’t needed. The policies that nurtured the emergence of the internet may provide a useful model.

At a minimum, these new systems need to operate in ways that let them communicate vital information in vast quantities at high rates of speed. These communications will need to be highly reliable and highly secure – something that will be very difficult given the huge diversity of equipment and services involved. There is growing evidence that regulators in Europe, China, and elsewhere have been much more creative in building an infrastructure that both provides reliable communication standards and security while encouraging productive competition. The fragmented U.S. systems may leave us in a position where we will need to retrofit our systems to meet international standards instead of taking the lead. U.S. research investments in areas that could encourage effective operation of secure, integrated electric utility and mobility systems has been shockingly small. Since it’s unlikely that the U.S. federal government will exercise any leadership in the next few years, the best approach may be strong state or city partnerships.

Henry Kelly is an expert in technology policy and has worked extensively on energy, information, education technology, and nuclear weapons. He now serves as the Chief Scientist in the U.S. Secretary of Energy’s new Energy Policy and Systems Analysis organization. Dr. Kelly is the Chief Scientist and Industry Partnership Leader at the University of Michigan Institute for Data Science (MIDAS).

The opinions expressed herein are those of the author, and do not necessarily represent the views of the Boston University Institute for Sustainable Energy.