Cooperating for the Climate: US-China Engagement on Development Finance for Renewable Energy

By Cecilia Springer and Joanna Lewis

A dramatic scaling of renewable energy (RE) is needed to achieve global climate goals, while developing countries are simultaneously facing a financing gap for low-carbon infrastructure that can meet both climate and development goals.

China has emerged as the world’s largest bilateral lender for development finance, and is increasingly committing to a green and low-carbon Belt and Road Initiative (BRI). Meanwhile, the US has demonstrated its ambition for domestic climate policy through the historic Inflation Reduction Act, and last year, President Biden announced the $600 billion Partnership for Global Infrastructure Investment with other Group of Seven (G7) countries.

While both countries are broadly committed to global development and climate policy goals, current US-China engagement overseas has largely been constrained by a competitive framework. However, a new working paper published by the Boston University Global Development Policy Center argues that US-China coordination and cooperation could increase resources available for RE development in developing countries through multilateral, bilateral and triangular engagement. The greatest gains for the climate can be had from the initiatives that require close cooperation and engagement, which underscore the importance of US-China engagement abroad.

The case for US-China engagement

The US and China are the world’s two largest economies and two largest carbon dioxide emitters. There is a scientific, policy and economic imperative for the US and China to take an engagement-oriented approach. Many countries, including developing countries, are increasingly adopting policy targets for RE scale-up that are moving towards science-based climate goals, reinforcing the need for additional financing. At the same time, the geoeconomic fragmentation that is driven by US-China decoupling will raise costs and potentially slow the global energy transition.

The premise of US-China engagement is also underscored by the fact that American and Chinese development finance institutions (DFIs) have many complementary strengths. In the working paper, we categorize the instruments that US and Chinese DFIs use to provide overseas development finance into five broad categories – loans, guarantees, grants, equity and insurance and other diversified products. We found that American and Chinese DFIs have complementary advantages that can benefit developing countries most when they are coordinated and working in parallel.

For example, US DFIs tend to specialize in grant-based development assistance, including technical assistance, feasibility studies and training or capacity building work, while Chinese DFIs provide a wider range of lending instruments. In recent years, the composition of Chinese DFI instruments has shifted from loans towards insurance, while the US has seen a shift towards loans, and has a higher share of bonds and guarantees in its development finance portfolio relative to China. More broadly, US DFIs have a longer history of overseas engagement than Chinese DFIs, and may be able to provide a lower cost of capital. Concomitantly, Chinese DFIs have a different set of experiences and advantages, especially with regards to speed, scale, technology provision and simply more experience financing infrastructure in recent years. Thus, the instruments American and Chinese DFIs deploy are complementary in their relative experiences and advantages abroad.

Opportunities for US-China engagement

Based on these complementarities, there are opportunities for US-China coordination and cooperation across three channels: multilateral, bilateral and triangular.

For multilateral engagement, options for coordination include working within the multilateral development banks (MDBs) where the US and China are both shareholders; intergovernmental forums like the Group of 20 (G20) and multilateral environmental agreements like the Paris Agreement and the United Nations Framework Convention on Climate Change (UNFCCC). These existing platforms and mechanisms are a public and relatively neutral space for indirect US-China engagement, and have also facilitated bilateral cooperation.

For bilateral engagement, there is potential for expanded US-China coordination on parallel investment principles and standards, trade policy, capacity building and direct financing instruments – options that vary widely in terms of current political feasibility. For example, work on parallel investment standards is already underway (including through the Green Investment Principles for the BRI and the G20 Quality Infrastructure Investment principles). On the other hand, direct bilateral financing that capitalizes on the previously mentioned complementarities in Chinese and US DFIs could have large benefits, but would require direct cooperation in a way that is increasingly constrained by broader bilateral tensions.

Finally, opportunities for triangular engagement include joint financing commitments for RE development overseas, trilaterally coordinated project finance and the cofinancing of project funds. Triangular engagement can leverage more resources than bilateral engagement, enhance local capacity when bringing in a local partner, and potentially diffuse bilateral tensions without requiring significant multilateral coordination.

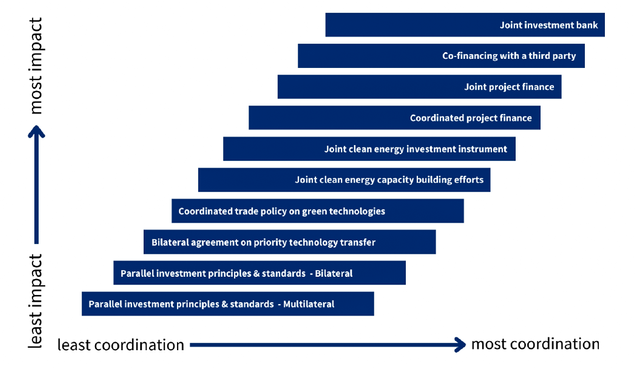

Assessing these channels and options comprehensively, it is important to consider the political viability and level of direct coordination needed for the different options, as well as their potential impact on unlocking resources for overseas RE development. Figure 1 illustrates where the options discussed rank along the continuums of the level of bilateral coordination needed and the potential impact on RE deployment.

Figure 1: Opportunities for US-China Engagement on Overseas Renewable Energy Development Finance – Assessing Coordination and Impact

Policy recommendations

The proposed initiatives that would potentially have the largest impact on RE deployment are the establishment of a joint clean energy investment bank funded by both the US and China, followed by project specific financing and a joint investment instrument focused primarily on de-risking any other investments, though these are among the least politically viable options in the current climate due to the extensive coordination that would be involved. The set of initiatives focused on trade policy would likely have the next greatest impact, followed by technology transfer, yet, these are also politically challenging topics. In contrast, the set of initiatives focused on investment standards and principles rank among the most viable in terms of requiring relatively minimal bilateral coordination, however, such initiatives would likely have less impact if implemented in the absence of a broader set of initiatives focused on finance, such as the other opportunities examined.

To expand US-China engagement on RE finance, American and Chinese DFIs should focus on increasing joint project finance and joint capacity building efforts and implementing parallel bilateral investment principles and standards. These three areas pose a significant potential for accelerating RE development by increasing investment opportunities in the Global South. If initiatives under all three categories are implemented in tandem, a greater impact on RE deployment will be achieved than if only one of the three is implemented.

Even amid a challenging political environment, leaders and officials in both countries should see a common interest and benefit to expanding cooperation and coordination on deploying RE projects and working in tandem with developing countries. With the clock ticking on time to limit the worst effects of climate change, and an immediate need for renewable energy infrastructure for development in the Global South, greater US-China engagement is needed to expand the reach and impact of each country’s individual, insufficient finance efforts.

*

Joanna Lewis is the Provost’s Distinguished Associate Professor of Energy and Environment and Director of the Science, Technology and International Affairs Program (STIA) at Georgetown University’s Edmund A. Walsh School of Foreign Service.

Read the Working PaperNever miss an update: Subscribe to the Global China Initiative Newsletter.