Pushing Out or Pulling In? The Determinants of Chinese Energy Finance in Developing Countries

While carbon emissions are showing signs of stabilizing in some advanced economies, emissions from most developing countries continue to rise as nations strive to raise their standards of living. The energy sector is pivotal from both a climate and development perspective, especially in the case of China, which is now one of the world’s largest financiers and investors in the global electric power sector.

While a number of important qualitative analyses have examined the determinants of Chinese energy finance, a new journal article published in Energy Research & Social Science by Zhongshu Li, Kevin P. Gallagher, Xu Chen, Jiahai Yuan and Denise Mauzerall deploys novel data to perform the first econometric analysis examining the determinants of Chinese overseas financing for electric power plants. Drawing on earlier work, the research team examines a number of ‘push factors’ –incentives in China that facilitate investment abroad—and ‘pull factors’ –incentives in recipient countries that facilitate Chinese investment into their country.

On the push side, the researchers find domestic overcapacity in China plays a key role in facilitating China’s development finance in these plants. On the pull side, the size of local demand for new power projects and the resource potential for electric power in recipient countries are significantly correlated with the size of Chinese financing. Additionally, existing Chinese involvement in past power projects is likely to facilitate new Chinese overseas financing.

Main findings:

- In large part, the team corroborates many of the qualitative research findings that have been published in this journal and beyond—that Chinese energy finance is largely driven by pull factors in recipient countries.

- Chinese foreign direct investment (FDI) in the power sector is likely to be market driven, pulled by demand for electric power in developing countries and in regions where such a ‘customer base’ is building over time.

- Only in the case of development finance is there a significant push factor determinant, where China’s policy banks provide outlets for sectors that are facing overcapacity in mainland China, and to make inroads into countries that have abundant energy capacity but that are not yet market competitive. Only in one qualitative study was overcapacity seen as a push factor, in coal.

- China’s activities in other developing countries can have huge implications on local countries’ energy development pathways.

- The study’s results provide insights on how both Chinese FDI and development finance could facilitate renewable energy transitions in developing countries. Solar and wind projects accounts for 14 percent of all overseas power projects receiving Chinese FDI, by capacity.

- Chinese globally competitive renewable energy companies have already been investing in developing countries where they have established distribution networks or where the renewable power market is attractive.

- While there has also been overcapacity in Chinese solar and wind industries since the early 2010s, only 2 percent of Chinese development finance in the power sector has been devoted to renewable projects, indicating the existence of other factors impeding Chinese development finance flowing into overseas solar and wind projects.

- While a smaller portion of finance has been devoted to renewable energy, there is an opportunity for developing countries to pull more Chinese FDI into renewable projects as the cost of solar and wind power continues to decrease and becomes more economically competitive.

- For Chinese development finance, the analysis suggests that a push from Chinese overcapacity in domestic industries is important in driving Chinese development finance outward in other renewable energy industries.

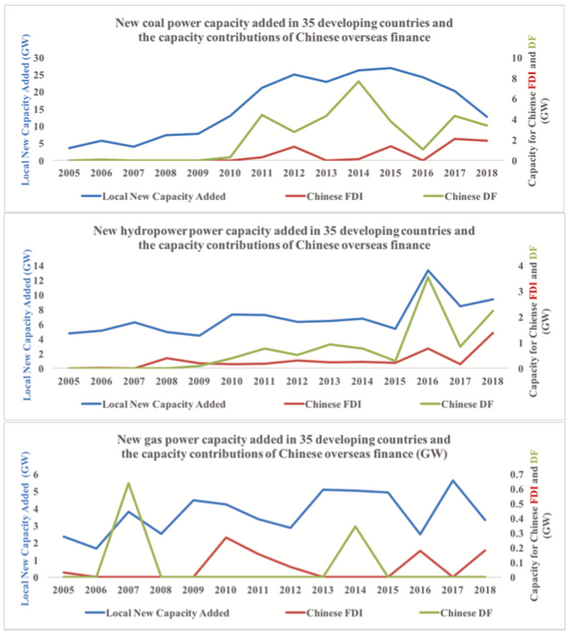

Figure 2: New Power Capacity

The future build out of power infrastructure will have a decades-long effects on global carbon emissions. All existing and proposed energy infrastructure already commits the world to more carbon emissions than the global carbon budget allows under the 1.5-degree target; two-thirds of the global carbon budget is already committed under the two-degree target. Therefore, the researchers argue it is crucial to substantially slow or even halt Chinese FDI and development finance contributions to new carbon-intensive power projects overseas. From a non-climate perspective, coal power projects are also important sources of air pollution and water pollution, which have severe public health impacts in many developing countries. Directing Chinese overseas finance away from coal plants would benefit not only climate, but also water, air quality and public health.

Read the Journal Article