A Slow Start for “Restored Multilateralism” at the G20 February Meeting

After much anticipation of the post-Trump era of international cooperation on the multiple crises the world is facing, the meeting of the G20 Finance Ministers and Central Bank Governors (FMCBG) on February 26th took place with little fanfare, but notable progress.

Mantras of the importance of multilateralism and cooperation were roundly repeated, but the slow movement on key issues strikes a more subdued tone than the gallant proclamations of the Biden team in the immediate aftermath of the 2020 election. In the midst of the worst global economic recession in generations, where hundreds of millions of people are being pushed into extreme poverty and losing their livelihoods, one would be led to believe that response is actually on track.

During the meeting, the group covered critical issue areas like increasing global liquidity, debt relief, vaccine equity, climate action and international tax, and announced plans for further meetings throughout the year. Below is a review of the updates for these different issue areas, as well as the progress gap in the G20 Finance Ministers’ agenda to keep eyes on in the year ahead.

Special Drawing Rights

The biggest story of the meeting was the progress made on achieving consensus on a new Special Drawing Rights (SDRs) allocation.

In the first months of the pandemic, a growing chorus of voices including heads of state, former Finance Ministers, the G30, the G24 and civil society called for a new allocation of the International Monetary Fund’s (IMF) currency, considering the $2.5 trillion financing shortfall facing lower income countries according to both the IMF and United Nations Conference on Trade and Development (UNCTAD). Under Trump, the US was the only country standing in the way of these proposals, but with a new President in the White House this position was expected to shift.

With the stars aligning for an allocation under Biden, Treasury Secretary Janet Yellen published a letter to the G20 making explicit the US support for a new allocation – a major milestone. However, lacking in her statement and the G20 press release covering the meeting was a proposed sum.

In advance of the FMCBG, around 220 groups and academics signed a joint letter demanding an allocation of $3 trillion, considering that less than three per cent of the new allocation would be available to low income countries, and only around 12 percent for emerging markets more broadly. The challenge with this proposal is that an allocation of more than around $650 billion requires approval by the US Congress and the President’s signature to authorize the legislation. With US support for SDRs and legislation to approve $2.874 trillion of SDRs reintroduced to the House of Representatives in mid-February, civil society demands look startlingly possible compared to the prospects last year.

However, this doesn’t mean celebrations can start just yet. Yellen also suggested that excess SDRs be channeled to recovery for lower income countries, and that the G20 work on developing “shared parameters for greater transparency and accountability in how SDRs are exchanged and used.” There is little detail to understand exactly what Yellen means just yet, but this could be a potential strategy to avoid the congressional route, opting for a lower allocation, but assigning unused SDRs of wealthier countries to poorer countries – with the caveat of conditioning. While such a model would certainly be faster, a one-off allocation of less than $650 billion would not meet the financing needs of lower income countries, and one of the benefits of the SDR route is its lack of conditionality. As this conversation develops in the coming months, it will be vital to retain focus on the how and how much of a new allocation.

One SDR proposal was from the Under-Secretary General of the UN and Executive Secretary of the UN Economic Commission for Africa, Vera Songwe, who advised the G20 and G7 to “voluntarily reallocate their SDRs to an interest-bearing facility to support low-income countries.” Championing such a mechanism, however, seems at odds with the reality of solvency crises either already engulfing or on the horizon for lower income countries around the world. A proposal which generates more indebtedness and throws a bone to private creditors – who are yet to come to the table on debt relief measures – means doubling-down on prioritizing private interests over long-term financial stability and development goals. This could turn an SDR allocation into another fiscal nightmare for cash-strapped countries.

Economist Jayati Ghosh offered another path for the unused SDRs, suggesting instead that this new liquidity be routed into global recovery funds. Without impacting their own finances, wealthy countries could transfer their SDRs to boost global vaccination, create a new Global Social Protection Fund, or indeed pay off the mounting debt facing lower income countries.

Debt Relief

On assessing the coverage of the G20 meeting, however, it might seem that the global debt crisis had been solved, despite numerous shortcomings already emerging from the opaque “G20 Common Framework for Debt Treatments.” Chad, Ethiopia, and Zambia are the first candidates to apply for the Framework, and are being hit with credit downgrades as a consequence. The process doesn’t address the issues with the G20’s Debt Service Suspension Initiative (DSSI): it does not compel all creditors to participate, is not available to all countries facing debt distress, and appears geared towards avoiding any cancellation when it is clear that the economic crush of the pandemic will have long-term consequences for solvency.

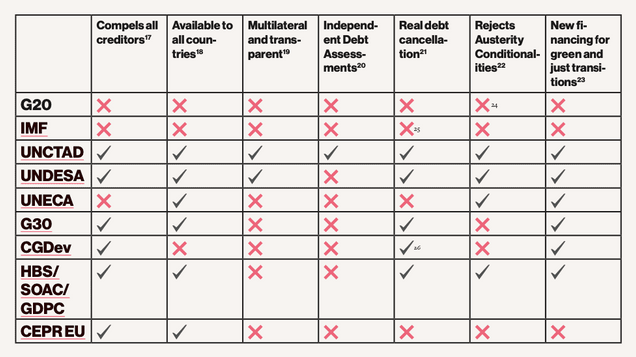

The inadequacy of the G20’s response to the debt crisis was highlighted by Progressive International (PI) in a briefing launched prior to the FMCBG meeting. They detailed the seven pillars that would constitute a just debt workout mechanism:

- compelling all creditors to participate;

- available to all debtor countries;

- not overseen by creditors;

- based on independent debt sustainability assessments that prioritize achieving the Sustainable Development Goals and Paris Agreement Commitments;

- including significant debt cancellation;

- rejecting austerity conditionalities; and

- providing new financing for green and just recoveries.

As it stands, the G20 proposal fails on all seven criteria, described by PI as an ultimatum between renewing “the vicious cycle of indebtedness, austerity and privatization or complete financial meltdown.” There is a risk that without addressing these serious shortcomings, for example with a Global Debt Authority and cancellation in the range of $1 trillion as suggested by UNCTAD, the debt crisis will be prolonged, and the damage to lives and climate irreversible.

Table 1: Comparing Proposals for Debt Relief

Source: Policy Briefing: Debt Justice at the G20, Progressive International, February 2021.

Acronyms: International Monetary Fund (IMF); United Nations Conference on Trade and Development (UNCTAD); United Nations Department on Economic and Social Affairs (UNDESA); United Nations Economic Commission for Africa (UNECA); Center for Global Development (CGDev); Heinrich-Böll-Stiftung (HBS); School of Oriental and African Studies (SOAS); Global Development Policy Center (GDPC); Centre for Economic Policy Research (CEPR EU).

Vaccine Equity

Another item on the G20 agenda was the global vaccination rollout, and to this end the group established a High Level Independent Panel on equitable vaccine access.

At the current rate of vaccination, it will take more than five years for enough people to be vaccinated to avoid further transmission. This is a long time for new, more resistant or more deadly strains to emerge and reinfect vaccinated populations. With the threat of cycles of pandemics lasting for years, wealthy countries have come under fire for hoarding more vaccines than they need. Analysis from the International Chamber of Commerce found that failing to vaccinate people around the world could cost the world around $9 trillion, with more than half of this borne by advanced economies.

In her statement to the G20 meeting, IMF Managing Director Kristalina Georgieva said their first priority should be “to accelerate production and make vaccines available everywhere as fast as possible.” As the Global Development Policy Center and others have argued in the past, the World Trade Organization (WTO)’s upcoming vote on providing a waiver of intellectual property restrictions (called a TRIPS waiver) is the fastest way to increase productive capacity to meet global demand. This potential move, proposed by South Africa and India, co-sponsored by 58 countries and now backed by around 120 countries, will return to the WTO for a vote on March 11. However, wealthy G20 members including the US, UK, EU and Japan continue to block the proposal, instead prioritizing the monopoly profits of pharmaceutical companies who have benefitted from more than $100 billion of public money to develop the vaccines.

Climate Action

Another announcement was for an upcoming Conference on Climate to be held in Venice, Italy in July. On the same day as the meeting, the United Nations released analysis showing that countries are making miniscule progress on cutting emissions. The assessment found that if countries’ current pledges were fulfilled, global emissions would reduce by only one percent by 2030 compared to 2010 levels. The report shows that we need a 45 percent reduction in the next ten years to keep heating below 1.5C. Central to this effort will be the COVID-19 stimulus packages passed by governments around the world, which will shape the post-pandemic world economy.

However, the Greenness of Stimulus Index prepared by Vivid Economics has found that G20 economies are pumping trillions of dollars directly into carbon-intensive and environmentally destructive sectors. While some packages will be rightly going to social protection for affected workers, these brown bailouts mean G20 countries are propping up unsustainable businesses rather than transitioning workers to low-carbon industries. The stimulus packages of 16 of the G20 countries are having a net negative environmental impact, and as it stands, the US package is the most damaging. At the top of the agenda at the July Summit, therefore, should be turning the damage of their own pandemic response around to international climate commitments.

International Tax

Also happening in Venice in July will be a High Level Tax Symposium to – according to the G20 press release – “reform the current system to respond to the new challenges posed by globalization and the digitalization of the economy.” This comes amid widening recognition of the ways the pandemic has accelerated inequalities within and between countries – workers have lost $3.7 trillion in income, while billionaires have increased their wealth by $3.9 trillion. A serious global economic response must tackle this crisis of redistribution, including addressing the race to bottom on taxation.

A report released last year by the Tax Justice Network found that the world is losing around $427 billion in tax income each year to international corporate tax abuse and private tax evasion. These are resources that could be used for pandemic response and recovery, but is instead siphoned into the bank balances of multinationals and the extremely wealthy. However the “Blueprints” to address international tax challenges released by the Organization for Economic Co-operation and Development (OECD) in 2020 were roundly critiqued by the tax justice community, who saw the proposals as superficial solutions that would continue to protect egregious behavior, with some concessions for the richest (incidentally, OECD member) countries.

Instead, a truly multilateral process that stops tax evasion and avoidance from draining lower income countries of much needed public revenue is needed. A new array of global tax levers such as a minimum corporate tax, digital tax, financial transaction tax, and wealth tax could rein in the power of multinationals, and direct money towards the pandemic response, sustainable development and climate action. With growing transatlantic consensus on the need for a digital tax, it is time too to roll back the WTO e-commerce moratorium, which bans countries from applying customs duties on electronic transmissions. UNCTAD has estimated that this moratorium imposed a tariff revenue loss of around $10 billion for lower income countries by 2017.

It is notable that both tax and climate events aim to bring together “policy makers, international financial institutions and eminent representatives from the private financial sector,” and fail to mention the important role civil society and trade unions should have in such international summits. Precluding public engagement in questions of public interest will be a sure-fire way to undermine any chance of building back better in the interests of the many.

In an historic year, with renewed wind in the sails of multilateralism, the G20 could be a key space to accelerate an ambitious transformation in global economic governance in the interest of green and just transitions everywhere. However, with a slow start to the agenda, particularly in the issues of most importance to people who are not represented within the G20, the year ahead will require continued vigilance from civil society and activists.

In the raft of global summits ahead in 2021, bolder, transformative visions of recovery are needed to build a post-pandemic multilateralism where everyone can thrive.