Lender of Not-So-Last Resort: New Evidence Shows Chinese Loans Can Serve as Financial Bailouts

Are China’s loans to developing countries merely investments in power plants and highways, or do they serve another purpose of bailing out countries in crisis? If so, is China undermining the International Monetary Fund (IMF)? Despite much heated debate over the consequences of Chinese lending, this basic question has remained unanswered.

On one hand, observers have identified numerous cases where China has lent to economically troubled countries that spurned loans from the IMF, such as Ecuador in the late 2000s. On the other, China has also cooperated with the IMF in crafting rescue packages for Mongolia and Pakistan. And despite charges of “debt-trap diplomacy,” China has actually rejected requests to go deeper into debt from Venezuela and Zimbabwe. These disparate cases have left the scope of China’s challenge to the IMF unclear.

A new working paper offers an answer to this important question: Chinese bailouts are real, but they are not available to all countries. Those that can repay their loans in-kind with natural resources, or are blessed with strategic importance to China, can receive loans from Chinese policy banks when few others will lend to them. Otherwise, China appears to pay more attention to debt sustainability than is commonly imagined.

The working paper uses new data on Chinese lending, as well as econometric methods to tease out cause and effect, to arrive at three key conclusions:

- Large Chinese loans often go to troubled economies;

- Such loans enable governments to avoid beginning an IMF program and;

- This effect is strongest among countries that export large amounts of natural resources.

These key findings are summarized below, following a brief background on the current economic and political context.

In times of economic crises, what’s at stake?

In times of an economic or financial crisis, the stakes are high for all involved. For governments that need to borrow, the IMF has long been viewed as a threat to their sovereignty, usually demanding that borrowers enact various free-market reforms in exchange for a loan. Yet, refusing the IMF’s help can be painful; when a country runs out of euros or US dollars to pay for imports, those goods vanish from stores, including certain foods and medicines. Borrowers thus stand to gain from Chinese competition with the IMF.

Conversely, competition from China would reduce the IMF’s bargaining power. The Fund also depends on its reputation as a somewhat neutral player in order to coax governments to share sensitive data and agree to its recommendations; overt competition from China could fracture this reputation and further paint the institution as a tool of the West.

Finally, sovereign lending has emerged as the most important issue for China’s relations with much of the developing world. Whether China is viewed as a welcome alternative to the IMF, or just another debt collector, will go a long way toward determining many governments’ stances on China.

China’s largest loans go to countries experiencing economic difficulties

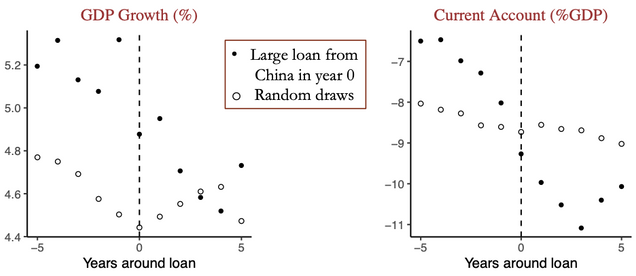

Data on borrowers’ GDP growth and trade balance show that large Chinese loans tend to come as both are declining and follow a particularly steep drop from the year before. Repeating the procedure with country-years drawn at random makes the pattern clear: big Chinese loans go to countries that, compared with their peers, are undergoing an economic reversal of fortune. These are the same conditions that force governments to turn to the IMF, suggesting that China’s loans sometimes function as bailouts.

Figure 1: Borrowers’ Macroeconomic Health (259 Country-Loans)

Source: James Sundquist, 2021.

Chinese loans cause governments to not participate in IMF programs

To check if these loans were actually causing some governments to forego an IMF program, the working paper used a technique known as instrumental variables. In essence, the fact that China’s internal politics and economics drive swings in lending activity created a pseudo-experiment: year-over-year changes in total lending offered an opportunity to measure the effect of these loans. Results were affirmative: a loan equivalent to one percent of GDP was estimated to lower the probability of a country starting a new IMF program by 6 percentage points, which translates to an enormous 60 percent decrease in relative risk for a typical borrower. Practically, this means that the expansion of Chinese lending over the past 20 years has almost certainly helped some countries avoid turning to the IMF – at least temporarily. A well-known example of this interaction is Angola, which exited talks with the IMF at the last minute in 2004 after arranging oil-backed loans with China and several Western banks.

Different stakeholders are likely to have different reactions to this evidence. Those who believe that the Fund’s mission is to set governments on a sound financial footing are likely to complain that China undermines this mission, while critics may be cautiously optimistic, and point out that the IMF itself sometimes operates in a way designed to please Western governments.

The pattern is strongest among natural resource exporters

Since natural resources are known to be a key means by which China (and others) guarantees repayment, countries were divided into two groups: those that averaged over $1.5 billion per year in natural resource exports, and those below that amount. When the model was fit separately for each group, the effect size was found to be much larger for the resource exporters: 12 percentage points versus 4. This supports the idea that Chinese bailouts are easier to come by for countries that are able to credibly compensate China. Practically, this pattern is also visible in Venezuela’s ability to rack up much larger debts from China than Zimbabwe (before being denied additional loans).

Natural resources are an important means of doing this, but not the only one: qualitative case studies suggest that countries of special diplomatic importance to China – by virtue of being nearby, or willing to switch their recognition from Taiwan – can also convince China to offer loans during economically distressed times.

Is China disrupting the IMF’s role as lender of last resort?

Overall, these results confirm what had previously been supported only by anecdotal evidence: that Chinese loans can substitute for IMF assistance. At the same time, it suggests that some variants of the “debt-trap diplomacy” narrative may be painting China with too broad of a brush: loans and debt are part of the country’s foreign policy toolkit, but China has also chosen to pass on opportunities to deepen debt relationships with certain countries. As recently as last summer, rumors erupted that Lebanon would end talks with the IMF to borrow from China. However, as Lebanon lacks mineral resources and is not located in a region core to China’s security, a Chinese rescue seems unlikely.

Finally, a full understanding of China’s behavior requires knowledge of similar behavior by Western countries. The United States has provided balance of payments support to strategic partners such as Egypt, and France protected many West African countries from the IMF for many years. Both countries have also terminated support to client countries whose financial needs began to outweigh their strategic value, as China has with Zimbabwe. However, France and the United States were simultaneously among the most powerful and enthusiastic members of the IMF, meaning that their lending activity may pose less of a systemic challenge to the Fund.

It remains to be seen whether China, which is more suspicious of the IMF and lacks the same degree of informal influence, will use its lending to prompt change at the institution.

James Sundquist is a Global China Initiative Fellow at the Global Development Policy Center and a doctoral candidate in political science at Yale University. His dissertation research explains variation in narratives of China’s rise, while a second body of research centers on China’s loans to foreign governments.

Subscribe to receive notice of future publications and updates from the Global China Initiative.