Hospitality’s Immense Opportunity in the New Senior Living

By Bob Kramer, Co-founder & Strategic Advisor, NIC

A Mammoth Market That Nobody Owns

A market for new models of lifestyle-driven senior living has begun to emerge. Innovative housing communities focused on engagement, and delivering quality lifestyle experiences, will attract millions of seniors many years before they need today’s care-focused products, which they actively avoid. As baby boomers age, their needs, expectations, and aspirations, coupled with numerous factors already driving change, will usher in a period of significant disruption in the senior living industry, generating huge opportunities for innovators, and major challenges for those who fail to adapt.

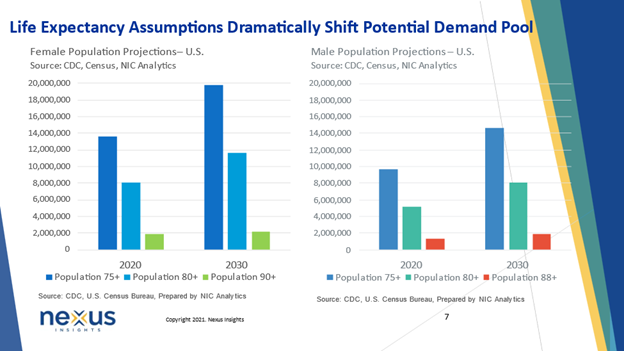

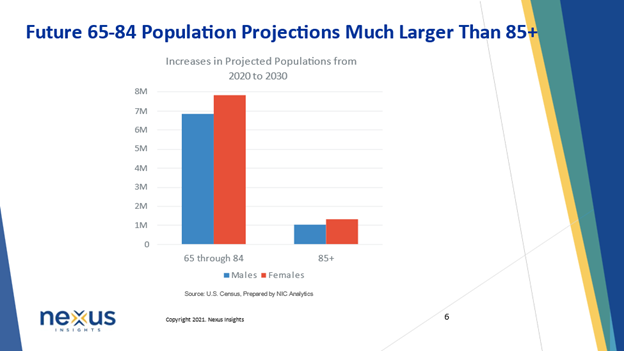

Demographics alone will drive change. Many senior living models today assume that demand will come from the 75+-year-old population. By 2030 that population is projected to rise to 19.8 million females and 14.7 million males. But we know that most seniors today put off moving into senior living communities until their last five years of life. Assuming move-ins at that age, the senior living industry’s market only rises to 2.2 million females aged 90+ and 1.9 million males aged 88+ by 2030. That gap represents a very significant opportunity, but only for those who are able to meet the new needs and expectations of an entire generation who demand far more out of their increasingly long lifespans than their parents did.

There will always be a need-based demand for care in the last few years of life. Many providers today provide excellent care of this type to those who most need it. However, the vast majority of baby boomers won’t be needing care-dominated senior living properties until their late 80s, beginning about a decade from now. Generation X’ers, the oldest of whom are 57 today, will continue the trends set by their parents as consumer expectations around longer lifespans continue to rapidly evolve.

There is ample opportunity to create senior living models that will appeal to older adults long before they or their adult children are ready to consider care-intensive assisted living, memory care, independent living or even skilled-nursing properties in their last few years of life. It is possible to offer them highly attractive models that will meet their needs and aspirations many years before they might, if at all, require care-driven settings. This is where the opportunity is.

When organizations catering to the needs and aspirations of older adults manage to attract, rather than repel them, and to do so while their customers are still relatively young, their models will become dominant. The hospitality industry, potentially in partnership with senior living providers, is in a position to design and market “enhanced lifestyle-driven” housing that will appeal to boomers today, and future generations tomorrow, instead of waiting until they are in their mid- to late-80s.

A Time of Disruption

Across senior living, economic and demographic factors are already driving a process that Harvard Business School professor Clay Christenson famously called disruptive innovation. During this period, newer, smaller companies with fewer resources are able to successfully challenge established incumbent businesses that are so focused on delivering their products and services to their seemingly most reliable customers, that they ignore the needs of other prospects.

Disruptors deliver what Christenson called “more-suitable functionality” and frequently, at lower prices. Incumbents, having lulled themselves into believing in their inherent and permanent market superiority, tend not to respond vigorously. But new entrants will deliver the product and performance that the incumbents’ mainstream customers require, while preserving the advantages that drove their early success, like originality, creativity, and scrappiness. This process will come to define the senior living industry.

Already, major players from an array of sectors are threatening to disrupt the senior living industry. Big tech companies such as Amazon and Alphabet, as well as retail giants such as Walmart, Best Buy, and CVS, are focused on major initiatives designed to meet the healthcare needs of millions of seniors as they age and address their desire to remain in their homes as long as possible. Others are targeting the housing market. Novel developments, such as the wildly popular Latitude Margaritaville model, and the just-announced plans for Disney-themed and -operated 55+ communities, indicate that hospitality thought-leaders are already recognizing the business potential of an opportunity to attract aging baby boomers and successive generations, long before the last five years of their lives.

New Offerings

The offerings most likely to appeal to this important cohort will not look like the senior living – or hospitality offerings – of today. Instead, like Latitudes Margaritaville and Disney, they will likely leverage both the expertise and experience of hospitality providers who already understand what prospective customers will want as well as senior living leaders who are prepared to design models of housing with services that meet older adults’ needs and demands. New models will be informed by an entirely different way of thinking about aging.

Because 80% of those over age 65 have at least one chronic condition and two-thirds have two or more, services that help proactively manage multiple chronic conditions will be necessary, particularly for those who wish to live fulfilled, engaged lifestyles despite their ongoing health conditions. The most successful businesses will appreciate the value of reaching these dynamic new customers long before they reach their late 80s and feel forced to bring care services into their homes or spend their last years in a more traditional assisted living or skilled nursing facility. This outlook supports the case for seizing this unprecedented opportunity now.

Where We Are Now

The first types of modern senior living products, developed from the 1960s to the 1990s, were board and care homes and the first continuing care retirement communities. The growth of these products was spurred by not-for-profit organizations, particularly faith-based ones that saw it as their mission to care for widows and others needing care late in life. Through the same period, thousands of skilled nursing facilities sprang up, funded largely through Medicaid and Medicare programs, to meet the needs of a population that hadn’t expected to live as long as they did. During this period, people who expected to live until their mid- or late-60s began to live into their 70s and 80s.

As millions of female baby boomers entered the workforce, they drove the development of a second generation of product: private-pay senior living. From the 1990s to 2020, assisted living and memory care communities rose to meet the needs of the adult baby boomer daughter who had little interest in placing her parent in a nursing home. Now in the workforce and unable to care for aging parents at home, she wanted an attractive setting for a mother or father in need of care. Originally, these properties were about community and engagement, both of which were important selling points for the oldest daughter, who is commonly the decision-maker. This approach shows that the daughter felt better about putting her mother in a place that focused on lifestyle as much as care, and that promised to provide companionship and engagement.

These products reflected the societal understanding of aging and retirement; and that there was a need for care for the last few years of life in a setting that offered safety, security, and comfort. They were designed to meet the needs of “accidental longevity,” unplanned and unexpected additional years beyond previous generations’ average lifespans. All too often families only turned to these products as a result of a suddenly arising care need, such as the onset of Alzheimer’s, or a fall resulting in a broken hip. Viewed as necessary only in these later years, the private pay senior living industry of this period has never managed to grow beyond an 11% penetration rate of the 75+-year-old population, according to data from NIC.

Much of the marketing of these communities targeted the adult child in need. As a result, the quality of life desires of the resident often became secondary to the care concerns of the adult daughter. Residents living in these communities increasingly became separated from the rest of society with little intergenerational contact. As more seniors fled older nursing homes for these more attractive communities, and the great recession caused many to wait as long as possible to make the move, age and acuity levels rose. By 2020, these models that had originally promoted lifestyle, community, and connection had become largely about meeting their increasingly frail residents’ care needs. By the time Covid-19 swept through these increasingly frail populations, the focus on care and safety was dominant with lifestyle and engagement becoming much less important except as marketing tools.

The Third Generation of Senior Living Product

Today, we’re beginning to enter the third generation of product development. From 2020 to 2050, new models will be driven by a new type of customer, and a new way of thinking about retirement and aging. This generation of senior living products will attract younger seniors with products that deliver engagement, connection, and fulfillment, and will draw residents who still have decades to live. The business potential of such a market is significant.

Baby boomers are the first generation that has lived through having to make housing and care decisions for their parents due to lengthening lifespans – and they didn’t like what they saw. Today, they overwhelmingly view current “senior living” offerings negatively. Their opinions of such offerings, which fail to appeal to their desire to remain engaged and fulfilled in their lives, have been further worsened by the recent storm of negative media that has shone an unsympathetic spotlight on the industry throughout the ongoing Covid-19 pandemic.

The negative feeling is almost universal: according to AARP, 90% of today’s seniors wish to stay at home, even when they need daily assistance or ongoing healthcare access. Unlike their parents, for whom lengthened lifespans came largely as a surprise, baby boomers have had time to consider the realities and opportunities of aging beyond traditional retirement milestones. They are already rejecting the old view of retirement upon which today’s models are built. They want to experience purposeful longevity, which means thriving in their additional years, rather than the accidental longevity of their parents, for whom sheer survival was a success for which to be grateful.

The D-Word

The old view of retirement was all about the “D-word.” It was driven by a focus on the deficits of aging and started with “declinist,” which described the general view of aging. Until now, retirement meant you disengaged, disconnected, and became dependent until your disappearance or death. Senior living communities in the future will be driven by a focus on growth and continued productivity and contributions in life. They will be integrated with their surrounding neighbors, neighborhoods, and communities, or else many older adults, both today and in future generations, will not want anything to do with them. That old model will inevitably be replaced by an “E-word” model, based on “empowerment,” and with it will come engagement, enrichment, experience, and enjoyment.

What Older Adults Want

Many older adults in their 50s, 60s, and 70s want to be purposeful about their longevity. Beyond having their physical needs met, they are hoping to retain their health – and wealth – to go with their expected long lifespan. A new understanding of health, focused on wellness rather than medical interventions, is arising. Driven by the growing understanding of what leads to good health outcomes, and by the payers for healthcare who see the value of prevention, engagement, and wellness over reactive sick care, the healthcare system is moving from a volume-based, fee-for-service model to a value-based care model driven by outcomes. Preventative care, as well as the proactive management of chronic conditions, is enabling older adults to have a fulfilling lifestyle even as they adjust to age-related limitations. New models of health will be predictive, and participatory, and will focus on avoiding acute care settings. The next generation of older adults – those in their 50s, 60s, and 70s today – will insist on remaining socially connected and engaged in their lives and will have specific lifestyle goals in mind as they plan for their futures.

These older adults want nothing to do with what they see as a condescending, and patronizing model of “senior care,” which, in their eyes, may equate with “infant care” and “childcare,” all models of dependence. Instead, they will turn to senior living models that are aspirational, connected to society, and that enable them to live with as much independence and fulfillment as possible. They are seeking lifestyles and settings that will enable their health span to match their lifespan as closely as possible. For the innovator, this view is an opportunity to capture their customer not only when they need care, but when they desire to get the most out of their 8,000 bonus days of longevity, potentially decades before the current senior living industry is even on the radar.

Health vs. Healthcare

It has only been in the last few years that we, as a society, have begun to understand that “health” does not equal “healthcare,” but that “health” is a confluence of wellness and well-being. Wellness is about diet, exercise, and having a healthy lifestyle. Well-being is about having a sense of purpose: a positive reason to get up the next day. For most people, this means having relationships that matter in which they feel needed. In this new environment, healthcare, hospitality, and senior living organizations are increasingly finding themselves reaching beyond traditional silos and partnering together as they overlap and impact each other in providing for the health and well-being of older Americans. An innovation that improves healthcare outcomes by enhancing human connection, for example, is likely to be rewarded by those holding the risk for the health dollar spending for those older adults. It is a situation ripe for disruptive innovation.

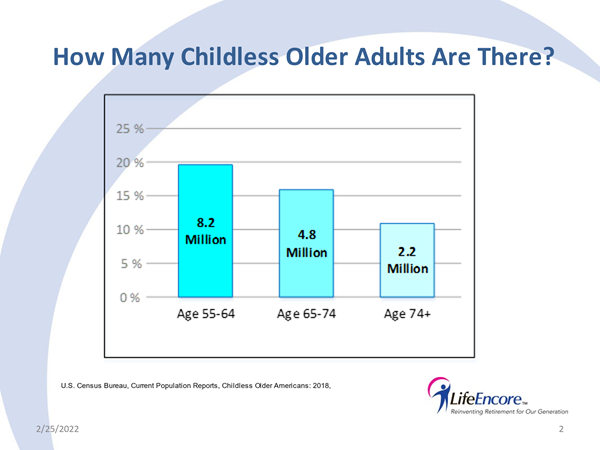

Here, again, demographic realities will drive change, as will awareness of the importance of lifestyle on health outcomes. One such factor is the rising number of “solo agers” in America. For numerous reasons, Americans today are having fewer children, getting divorced more often, pursuing careers instead of family life, and generally becoming older without having a spouse or family caregiver in their homes. 40% of childless adults, a cohort with sharply rising numbers, now live alone. This trend towards living alone will create a vibrant market for various forms of community living, particularly as chronic loneliness has been identified as a major health threat, comparable to smoking three-quarters of a pack of cigarettes a day.

Redefining Age and Retirement

Evolving demographic realities, as well as awareness and desirability of new lifestyle options, will do nothing less than redefine aging and retirement. Older adults will exhibit new behaviors around work and consumer consumption by retiring later and later, or not at all, and by demanding a lifestyle that reflects their needs and desires. Baby boomers, in particular, have already had a huge impact across many aspects of our society throughout their lives. As they age, they will largely reject being told how they must live, whether by their families or the culture at large.

To borrow a phrase from Marc Freedman, the founder of Encore.org, which helps people 50+ find meaning in new careers, retirement for boomers will be one part purpose, one part passion, and one part paycheck, in varying combinations, depending upon their position in life. Some will have to work, and the paycheck will be a necessity. Others will choose to work out of a sense of purpose, perhaps to make a difference in people’s lives such as by teaching, mentoring, and caregiving. For others, work will be driven by passion; “I’ve always wanted to do X, Y or Z.” That means ten years from now one-third of those in their 70s will still be working, and in twenty years, so will more than half.

Access and Affordability

Just as the next generation of older adults desires for their health span to match their lifespan as closely as possible, they worry that their wealth span will not match their lifespan. In other words, they fear that their financial resources will not be sufficient for their long lives. They have good reason to be concerned. A landmark analysis, “The Forgotten Middle,” conducted just prior to the Covid-19 pandemic by NIC and NORC at the University of Chicago, together with researchers at Harvard Medical School and the University of Maryland School of Medicine, found that slightly less than half of all middle-income adults 75 and older will be able to afford private-pay senior living by 2029. Further underscoring the challenge that affordability will present for the next generation of older adults is that the study also found the middle-income cohort will nearly double in size before the end of this decade to over 14 million, the largest of the three income cohorts among older Americans. In addition, the study does not reflect the economic impact of the Covid-19 pandemic on many older Americans. These factors will conspire to create massive need and massive demand – further incentivizing many older adults to do whatever they can to maintain their health and creating huge opportunities for innovators to step forward with new models focused on wellness and well-being.

Lifestyle Trumps Care

Much has already been written about the need for senior living to change. Most of the public debate, particularly through the Covid-19 pandemic, has focused on the obvious need to better integrate healthcare services into the places that our oldest, and most frail, elders call home, whether they live in a single-family house or a senior living community. Major players in tech, retail, healthcare, insurance, and other sectors are already investing in opportunities to leverage their brands, locations, technologies, access to consumers, and other advantages to disrupt today’s senior living industry and healthcare delivery system.

These disruptors are mostly focused on improving healthcare outcomes by reducing falls and hospitalizations, reducing spend, preventing acute care episodes, and generally looking at the opportunity from the point of view of healthcare delivery. Many are designing solutions based on the fact that the consumer prefers to age in place rather than opt for the alternative, which is assumed to be a nursing home – but few are thinking about other options. There is a real opportunity to not only disrupt traditional senior living and improve the care setting for the oldest and most frail adults but also to seize the market for lifestyle-based communities that appeal to much younger older adults, years before a care-driven setting becomes a need.

The Right Place

Many of today’s disruptors view consumers’ options as binary: home or the nursing home. Innovators willing to ask what “home” for an aging baby boomer might look like, feel like, and offer, in terms of engagement, community, and lifestyle, will be able to redefine what aging in the right place might mean. The family home may, in fact, not be an ideal location to age. Home can become a prison when friends die or move away, or when you face mobility issues. Many residential locations can frustrate the desire to remain engaged and connected with others.

As a new generation of customers comes into the market, a new generation of “enhanced lifestyle residential” products will quickly dominate to meet their needs and demands. Indeed, some are already being planned and others are now in the market. Companies such as Upside Hōm and Silvernest offer alternative living arrangements that have great appeal, especially for solo agers looking not just for a place, but for the opportunity to form new friends and simplify their daily lives. These products represent an enormous opportunity for the housing and hospitality sectors, which should play a key role in their design, construction, and operation.

Organizations that understand the new demand for self-control and choice are already beginning to develop lifestyle products based on the new perspectives not only on longer lifespans but on extended health spans and wealth spans too. New models will deliver engagement, potentially with residents contributing in material ways to their communities’ success, while managing their health in a more proactive, preventative, and wellness-oriented framework.

Developers will incorporate technology throughout these new products to allow self-management and self-direction. Advanced technology and use of data can also be used to help deliver most efficiently the types of highly personalized and customized experiences that will attract this new generation of customers. Services that once were provided in packages will be à la carte or on-demand to further emphasize self-control and independence. Some communities will provide access to thriving, intergenerational communities, encouraging engagement, and offering opportunities to interact in more natural, fulfilling ways with the broader community.

Developers are already building models that will appeal to baby boomers who seek fun, such as the “Margaritaville” model. Other models may offer aging boomers continued involvement in activism or a return to the college experience, the defining coming of age experience for many boomers, as the war was for their parents. Others might seek to give back in their later years, in a “serviceville” type of community model. Some “wellnessville” communities will focus primarily on offering a healthy lifestyle as vital to positive health outcomes. The options for product design are as varied as the interests and affinities that attract their customers.

ULI Lifestyle Residential Council

The Urban Land Institute recently formed its “lifestyle residential council, 55+” “to share best practices, explore and lead innovation, and influence the creation of communities, residences, lifestyles, and opportunities that captivate, strengthen, and intrigue 55+ customers.” Those in the hospitality space, who already understand the importance of designing experiences that delight customers are well-positioned to fully leverage and help shape this powerful disruption. Their insights on delivering tailored experiences for targeted customer profiles, potentially in a tiered offering that spans all economic profiles, will be key. They will develop enhanced lifestyle housing models that will appeal to a new generation of customers who have unmet needs, are more numerous, possess more wealth, and view the process of their own aging very differently than previous generations of older Americans.

The Next Stage

We are about to see the emergence of “next-stage” communities for this new generation of older adults who are determined to avoid the “end-stage” communities that served their parents. They will not accept a view of their future that is shaped by deficits and defined by decline, increasing irrelevance, and isolation from the rest of society. Rather, they seek settings and products that are shaped by a purposeful longevity and defined by growth, productivity, and contributions in the next stage of their lives with opportunities for new relationships and new community. The challenge for those disruptors, whether they are coming from the housing, healthcare or hospitality sectors, seeking to serve this next generation of older adults is to deliver personalized experiences that are metaphors for being alive rather than signals that meaningful life is over. The demand will be huge, but this product is yet to be delivered.

References

21 comments

Fantastic article highlighting what matters most. Thank you, Bob Kramer, for continuing to shine a light on opportunities to shake up what it means to age well. – Anne Doyle, President, Lasell Village, Newton, MA

Thank you, Bob, for highlighting Solo Aging in this excellent and comprehensive article on what boomers will want for their own senior living.

What a futuristic and realistic thoughtful article. A huge business opportunity as well.

Excellent article.

I think it will bring great effect to the elderly. The spider solitaire 2 suit service will be even more perfect when the elderly know how to take advantage of it

Your writing is quite helpful, especially considering how important and current it is. I appreciate you sharing this fantastic information. Be ready for some intense fighting as you compete against other geometry dash meltdown gamers.

Thanks for helpfulll writing. this article very important and amazing. have a good day. Best Hair Transplant in Turkey

I read many articles every day. Among them, I really like your blogging style. I will be launching a website soon and your articles will be very useful to me. 토토사이트

It is interesting to see how the hospitality industry is becoming more involved geometry dash with the Senior Living and care space.

AirportTransfer.com is a global marketplace offering personalized private airport service worldwide. It provides private transfer service to passengers from end to end (airport to point or point to airport). It provides reliability with a 100% refund guarantee and free cancellation up to the last 48 hours. All suppliers of AirportTransfer.com have professional, licensed and local drivers. The drivers have high communication skills with English speaking and understanding proficiency tailored to the needs of each passenger. It guarantees you experience a perfect transfer process with its comfortable, fast, punctual and extra services (red carpet, baby seat and seat belt, space for ski and cycling equipment, elderly care assistant, disabled vehicle and more).

AirportTransfer.com: It has a wide range of vehicle types suitable for all travel types and budgets, such as SUVs, Minivans, Sedans, executive people carriers, minibuses, buses, and limousines. Prices are fixed, you are not expected to pay extra, and there is no obligation to tip the driver.

In just a few simple steps (by entering pickup and drop-off locations, flight arrival time and the number of people), you can make your online reservation with one of the payment methods such as Credit card, PayPal, or Apple Pay.

AirportTransfer.com has a professional customer support team available 24/7. Do not hesitate to contact the Whatsapp support line at +44 7459 550273!

https://airporttransfer.com/blog/jfk-airport-to-lga-airport

If you are looking for driving directions from point A to point B or you are planning a road trip, mapquest driving directions is the best tool to help you do that.

Cześć podróżnicy! ✈️ Odkryłem ostatnio świetny sposób na zwiedzanie – transport lokalny! To nie tylko oszczędność, ale i wspaniała okazja, by poczuć puls miasta i poznać jego prawdziwe oblicze. Dołącz do mnie w tej przygodzie! #Podróże #TransportLokalny #OdkrywajMiasto https://www.rabbittranspoland.com/sv/pricing

Thank you for sharing this information with me. I can’t wait to use the information. https://www.senelplastikcerrahi.com/bodytite/

We currently provide you with hourly, daily & weekly boat, gulet, motor yacht, catamaran and sailing rental services, we also organise activities such as blue cruises, fishing, daily sightseeing and swimming tours, hen & stag parties, marriage proposals, birthdays, corporate meetings and dinners.

https://tekneveyat.com/

Your attention to detail is unparalleled, ensuring that every project you undertake is executed retro bowl 2 flawlessly.

Szpitale są bardzo istotne w, ale nie mniej jak udane wakacje. Zapraszam na moją stronę gdzie poznasz najlepsza ofertę transferów https://www.rabbittranspoland.com/pl/gokart-gdansk-e1gokart

Emotivci Turkish Series English Subtitles provider.

mestlife: Your Personalized Private Airport Transfer Service in Turkey

Mestlife offers personalized private airport transfer services across Turkey, especially in cities like Antalya, Istanbul, Kayseri, Izmir, Dalaman, Bodrum, and Ankara. We provide end-to-end private transfer services (from the airport to your destination or vice versa) with a 100% refund guarantee and free cancellation up to 48 hours before the transfer. All Mestlife suppliers have professional, licensed, and local drivers. Our drivers have high communication skills with English proficiency tailored to the needs of each passenger. They guarantee a comfortable, fast, punctual, and excellent transfer process with extra services (red carpet, baby seat and seat belt, space for ski and bike equipment, elderly care assistant, disabled vehicle, and more).

A Wide Range of Vehicles for Every Travel Type and Budget

Mestlife offers a wide range of vehicle types for every travel type and budget, including SUVs, minivans, sedans, executive transport vehicles, minibusses, buses, and limousines. Prices are fixed, no extra payment is expected, and there is no obligation to tip the driver.

With just a few simple steps (entering pick-up and drop-off locations, the arrival time of the flight, and the number of people), you can make your online reservation using one of the payment methods such as credit card, PayPal, or Apple Pay.

Mestlife has a professional customer support team available 24/7. Feel free to contact us via the WhatsApp support line at +905079313788!

https://www.mestlife.com/

Hayatın pek çok farklı alanında forklift kullanmak zorunludur. Tercih edeceğiniz forkliftin çalışma şekli, motoru ve yakıt tercihi sizi yakından ilgilendirmelidir. Amaç sadece çalışmak değil, aynı zamanda doğaya zarar vermemektir. Bunun için geliştirilmiş ürün olan İMOW lityum akülü forklift iş makineleri içinde çok özel ve önemli bir yere sahiptir. Bu durumu anlamak için EP Equipment lityum akü teknolojisi hakkında bilgi sahibi olmak gerekir. Kusursuz bir teknolojinin ürünü olan İMOW lityum akülü forklift; lityum iyon akülü forklift

Articolul oferă o perspectivă fascinantă asupra peisajului în evoluție al vieții pentru seniori și subliniază o schimbare critică către modele centrate pe stilul de viață, care rezonă cu dorințele seniorilor de azi pentru angajare și împlinire. În timp ce ne gândim la viitorul vieții pentru seniori, este incitant să ne imaginăm diversele moduri în care tehnologia și timpul liber se pot combina pentru a îmbunătăți viețile persoanelor în vârstă. De exemplu, implicarea în experiențe interactive, cum ar fi jocurile online, ar putea fi o modalitate nouă de a menține mintea activă și de a oferi un sentiment de comunitate și distracție. Ați auzit de Gates of Olympus Demo? Este un joc online care combină strategia și divertismentul, oferind o abordare proaspătă asupra interacțiunii digitale, care ar putea atrage atât adulții tineri, cât și pe cei în vârstă. Astfel de abordări inovatoare ar putea fi esențiale în modelarea următoarei generații de medii de viață pentru seniori.