Reasons for Going from Public to Private and the Premium Puzzle of Restaurant Firms

By Melih Madanoglu, Ph.D., Professor of Hospitality Management and Michael A. Leven Endowed Chair, Kennesaw State University – Michael A. Leven School of Management, Entrepreneurship and Hospitality, Michael J. Coles College of Business, and Ersem Karadag, Ph.D., Professor of Hospitality and Tourism, Robert Morris University – School of Business

Owing to their profit-oriented nature, companies of today’s business world are inherently opportunistic. Once firms reach a certain size or scope, some of them aspire to go public to make the most of access to capital markets to fuel their growth. When these benefits dissipate, though, and being public ceases to be advantageous, the very same companies may get ready to become private in the blink of an eye. Common disadvantages of being a public company, especially after the Sarbanes-Oxley Act of 2002 (hereafter SOX), are tight internal control procedures, administrative rules, financial reporting disclosures, and corporate governance rules (Madanoglu & Karadag, 2009). Furthermore, high costs of regulatory, insurance, and compliance costs of being a public company discourage small and medium firms from remaining on the public scene. In the case of restaurant firms, besides the high costs of being public, the executives of numerous restaurant companies tend to believe that capital markets undervalue their firms. This is partly because of low market capitalizations of restaurant stocks, which hinders their coverage by equity analysts. In addition, in the past ten to fifteen years, the SOX has made it more time-consuming and expensive for firms to function as public companies due to extensive audit and compliance requirements that start from $300,000 a year and can grow to more than $1 million. These figures may turn out to be an unbearable expense to shoulder for small publicly listed restaurant firms that have a market capitalization of $10 to $50 million.

Netting out the costs and benefits

In the second half of the 20th century, going public was a very popular strategy for many firms including restaurant firms. The landscape began to change in the 1990s and marked a tectonic shift in U.S. equities moving away from public markets to private markets controlled by buyout and venture capital firms. Going from public to private trend was substantial as the number of publicly listed companies dropped by half (i.e., 52%) between the late 1990s and 2016 (Galleher, 2020). Today’s market conditions are more conducive for private companies as they enjoy advantages just like public companies do. Going public still has its fanfare and is widely regarded as a sign of legitimacy and thus, a lucrative dream for entrepreneurs and their startups. However, after the initial public offering (IPO) honeymoon is over, some firms come to realize that they need to meet the filing requirements and regulations of the Securities and Exchange Commission (SEC). As noted, these rules have become even more stringent by the SOX, which altered the business environment for publicly-listed firms on US exchanges.

Going from private to public has some major benefits as following:

- Raise funds from new investors with a lower cost of capital

- Enhance company reputation and public image

- Shares can be traded through a public market

- Owners can sell their shares easily

On the other hand, going from private to public is a costly process and companies bear some additional costs to remain public.

Some costs include:

- Upfront IPO (Initial Public Offering) fees for listing on the exchange market and underwriter fees

- Extensive audit and compliance requirements

- Compliance obligations and expenses related to mandatory disclosures

- Risk of revealing strategic information such as financial reports, executive compensation, and corporate governance practices

- Potential for lawsuits against the directors and management

- Partial loss of control over the resources and management

In addition, executives may feel the onus of delivering short-term results, having a higher profile in the media, and subjecting themselves to the scrutiny and potential action of activist investors. These costs made it much less likely for firms to be listed in public markets compared to the 1990s. Hence, many companies prefer to remain private or if they are already publicly traded, begin considering going private.

The primary reasons why some companies would choose to stay private are:

- To exercise greater control over their own equity,

- To enjoy the sense of autonomy and relative ease when it comes to financial reporting.

- No obligation to respond to the questions of large shareholders and govern the firm with strict rules like public firms.

- Unlike public firms, the value of a private company remains insulated by the negative effect of market volatility in the short term.

Therefore, private companies are presented with the opportunity to focus on creating more value for the owner(s). On the other hand, public firms need to take into account the market volatility, which can quickly become a distraction for the company executives and employees where many company employees are also shareholders of the firm.

Another important aspect why some companies prefer to remain private is the strength and resources of private equity. While going public used to be the primary option for medium-sized businesses of the past, private equity now provides many of these same benefits with fewer drawbacks. For instance, in 2017 US companies raised $3.0 trillion in private markets compared to $1.5 trillion in public markets (Bauguess et al. 2018). The climate in the business world changed the way investors invest and how companies raise capital. These developments have important implications for holding periods of assets, the perceived volatility of their returns, and their liquidity. Similarly, in 2018, private equity firms invested $130.9 billion in biotech and tech companies alone. By comparison, IPOs brought in $50.3 billion. With so much money at stake and far fewer constraints, it should come as no surprise that more private companies are choosing to go with the private equity option.

Other than circumnavigating complex regulatory issues and compliance costs of the federal security laws, the fundamental nature of private-equity work gives freedom to the CEOs of private-equity firms to focus on strategic goals rather than keeping up with quarterly earnings expectations. Additionally, avoiding litigation risks associated with being public is another significant factor that is favoring private companies.

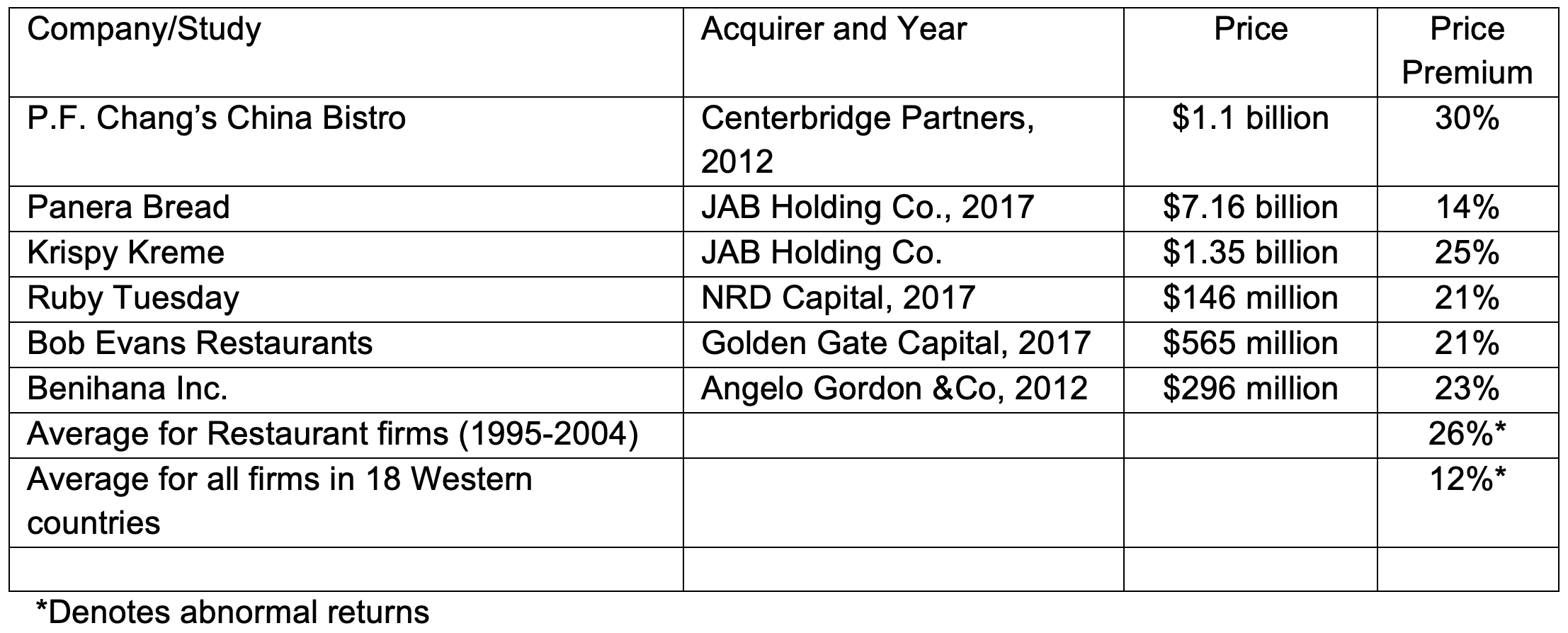

Gleaning into going private premiums and their factors

The previous section outlined the reasons why being publicly traded on exchanges is not favorable for some firms. These factors are applicable to the public U.S. restaurant firms, which can help explain why some restaurant companies are going private. Scholarly research demonstrated that announcements related to going from public to private transactions lead to shareholder gains of firms leaving the public scene. Those gains are called a price premium is the percentage by which a share’s price exceeds its market value. For example, in the 10-year period between 1995-2004, the average price premium for restaurant firms that went private was 26% (Madanoglu and Karadag, 2009) which is more than double the average premium (i.e., 12%) for going private transactions in eighteen Western countries between 1997 and 2011 (Boubaker et al., 2015) (See Table 1). It is worth noting that these studies used abnormal returns rather than raw returns to estimate price premiums. Abnormal returns are the positive or negative deviations from an investment’s expected return. In the case of going private transactions, the announcement news about these unexpected events triggers positive abnormal returns. However, the question of why going-private restaurant companies are able to command a higher price premium compared to firms in other industries remains unanswered. This question remains a puzzle almost 20 years after the SOX regulations. Before uncovering the pieces of this puzzle, we will first review some notable going private transactions of restaurant firms in the past 10 years.

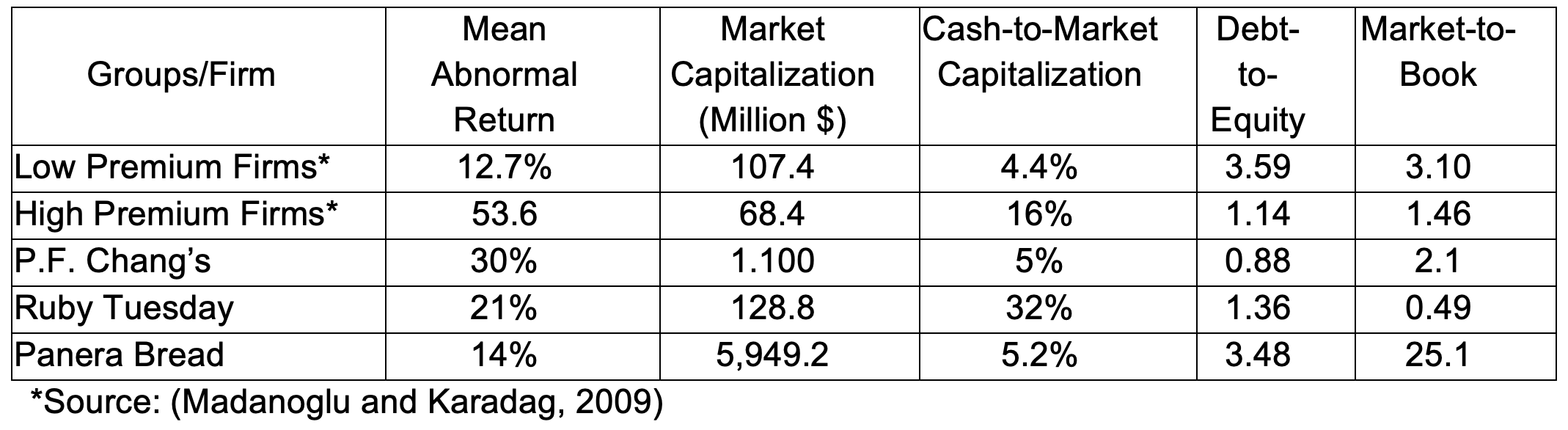

A quick look at some more recent going-private transactions in the U.S. restaurant industry reveals that the proverbial “20% price premium” is alive and well for the past ten years (See Table 1). The raw premiums of some of the restaurant companies that went private between 2010 and 2020 range between 14% (for Panera Bread) and 30% (for P.F. Chang’s China Bistro). In finance, it is conjectured that firms that are undervalued and have a lower level of debt would realize higher bid premiums. A study of restaurant firms confirmed these claims by considering these two factors along with firm size and cash holdings. In a study conducted by Madanoglu and Karadag (2009), the authors separated the going private restaurant firms in two groups: high-premium firms (mean premium of 53.6%) and low-premium firms (mean premium of 12.7%). It is worth noting that restaurant firms that were in the low-premium category still had abnormal returns that are on par with returns reported by Boubaker et al. (2015) for all industries in eighteen Western countries (i.e., mean abnormal return of 12%). In the restaurant industry, Madanoglu and Karadag (2009) identified four characteristics of high-premium firms:

- larger firms

- higher levels of cash holdings (relative to market capitalization)

- lower debt-to-equity ratio

- higher degree of undervaluation (i.e., lower market-to-book ratio)

In this study, we briefly analyze restaurant firms that were subject to going private transactions after 2010 to assess whether they possess some of the four financial characteristics reported by Madanoglu and Karadag (2009) (See Table 2). We obtained data from the archived annual and quarterly SEC filings before they went private. What we find is that P.F. Chang’s China Bistro, the company that enjoyed the highest price premium of 30% on the announcement day in our small sample, had a low debt-to-equity ratio (0.84), which was in line with the average debt-to-equity ratio of high-premium restaurant firms (1.14). However, P.F. Chang’s China Bistro had a level of cash holdings ratio (approximately 5%) which was similar to the cash holdings ratio of low-premium firms (4.4%). In addition, P.F. Chang’s had a poor operating performance before it was taken private. As a result, the high price premium realized on the day of the announcement cannot be fully attributed to factors reported by previous studies. On the other hand, Ruby Tuesday fits the bill of high-premium firms by virtue of its high cash holdings ratio of 32% and severe undervaluation by capital markets with a market-to-book ratio of 0.49, which is well below the mean market-to-book ratio of high-premium firms (1.46) as reported by Madanoglu and Karadag (2009). Last, we look at one of the best performing restaurant firms for the past 20 years, Panera Bread, whose stock return for the period between 1996 and 2016 was more than 7,000%. This astounding performance is approximately 35 times the return of S&P 500 Index for the same period. As can be seen in Table 2, Panera Bread has the characteristics of a low-premium firm given its cash holdings ratio (5.2%) and high debt-to-equity ratio (3.48). The most notable statistic about Panera Bread is its “sky high” market-to-book ratio of 25.1%, which is six times higher than the market-to-book ratio of low-premium firms. Hence, one can discern that Panera Bread was valued fairly by the investors before going private but was still able to fetch a premium of 14% on the day the announcement was made.

The present analysis thus far confirmed part of the four characteristics of high-premium restaurant firms as reported by Madanoglu and Karadag (2009). Yet, it is difficult to explain why restaurant firms’ going-private announcements produce shareholder gains that are higher than the average for all industries. In this section, we will briefly illustrate some industry-specific factors that may identify the pieces of the puzzle.

Market heterogeneity – Most of the restaurant firms that go private operate in several U.S. states and numerous markets (big and small). As a result, acquiring firms can view the locations of a restaurant chain as a portfolio diversification strategy. Such market heterogeneity can lead to stabilized revenues based not only on the locations of restaurant units but also based on low seasonality.

Easy to turnaround – Private equity firms tend to acquire struggling restaurant chains, which are easy to turnaround and sell at a profit. It is possible that private equity firms are willing to pay a high premium because they believe that they can increase the value of the acquired company by 50% or more. It should be noted that there are exceptions to this rule with the going private transactions of Dunkin and Panera Bread.

Growth opportunities via franchising – Most restaurant chains have hundreds and sometimes thousands of units. An important growth vehicle for restaurants is franchising the units in domestic and international markets. As restaurant concepts lend themselves to a relatively easy replication via standardized operations, they are viable targets for private equity firms, which would like to capitalize on the growth potential of restaurant firms.

Concluding thoughts

As the U.S. restaurant industry is still coping with the restrictions imposed by state governments due to the pandemic, time will tell whether public markets or private equity firms will be more generous to restaurant firms. While debt is cheaper than equity in this environment, especially full-service restaurant firms are not able to benefit from lower borrowing costs due to lower cash flows during the pandemic. Therefore, it is likely that private equity will continue to welcome the restaurant firms with open arms as they may be seeking refuge and solace during these difficult times.

Table 1. Price Premiums in Going Private Transactions (2010-2020)

Table 2. Price Premiums and Restaurant Firm Profiles

References

10 comments

I think it’s worth mentioning that business management requires a lot of paperwork, and sometimes, it can be quite complicated and time-consuming.

Transitioning from Public to Private elucidates the nuanced strategies of Restaurant Firms, diving deep into the Premium Puzzle. For those aspiring to grasp this complexity and seeking to buy master dissertation, this transition offers a wealth of analytical insights.

On the positive side, snake 3D offers a variety of skins and customization options to personalize your snake.

That is additionally a very good article that I absolutely loved reading. uncle jack breaking bad coat It is not every day that I am getting to look at something like this. Desire you may have many extra top articles to share with us.

The [4-inch mini chainsaw](https://hardell.com/products/hardell-hdcs0204-mini-chainsaw) has become the preferred tool for woodworking enthusiasts and DIY enthusiasts due to its portability, simple operation, high safety, low cost, and wide application range. In today’s pursuit of creativity and individuality, the 4-inch mini chainsaw is undoubtedly the best partner to achieve various creative projects.

A weed puller is a tool used to remove weeds, usually consisting of a sharp blade and an extension rod. By inserting it into the soil, weeds are pulled out of the soil. The [weed puller tool](https://hardell.com/products/hardell-hdwp0101-weed-puller) is the most common type, and its blade or shovel is usually made of metal, which can be inserted into the soil to uproot weeds, improve work efficiency, and make pulling grass more convenient and fast for users.

Indulge in the epitome of personalized luxury with our Hourly Car Service As Directed. Whether you’re attending a series of business meetings, exploring the city’s landmarks, or celebrating a special occasion, our chauffeur-driven limo service is entirely at your command. Enjoy the flexibility of dictating your own itinerary, with the assurance of a sleek, well-appointed limousine at your disposal. Our professional chauffeurs are dedicated to ensuring a seamless and comfortable journey, providing you with the freedom to make multiple stops, enjoy extended wait times, or change plans on the go. Experience the city on your terms, guided by the elegance and convenience of our Hourly Car Service As Directed – where every moment is tailored to your desires. Travel in style, sophistication, and with the unmatched convenience of having your private limo at your beck and call.

Electric pruning shears are electric tools used for gardening operations to trim branches and leaves. It is mainly composed of batteries, blades, and the main body. When in use, the upper blade is driven by electric power to move back and forth, while the lower blade is fixed to complete the trimming work. The use of [electric pruning shears](https://hardell.com/collections/electric-pruning-shears) only requires pulling the trigger to complete the pruning of branches.

dino game is a speed game that was first made for Google Chrome. The game was added to Google Chrome in 2014 as a “Easter egg” to keep people busy when they can’t get online.

Win-Tek Pick-and-Place machines have been a game-changer for our manufacturing operations. We rely on their precision and efficiency to meet our production demands.