COVID-19’s Impact on the U.S. Hotel Sale Transaction Market

By: Daniel H. Lesser, MAI, LW Hospitality Advisors

We live in extraordinary times as there are only a limited number of periods in America’s 245-year history which have been as transformative as 2020 (i.e., 1776, 1865, 1929, 1945, 1968, 2001). The confluence of a global pandemic, mass civil disobedience, and the transfer of power will undoubtedly affect how we live and work in 2021 and beyond.

The COVID-19 pandemic which commenced in early 2020 represents yet another demarcation in life “before” and “after.” 2020 began as geopolitical tensions spiked on January 3rd, and the U.S. stood at the brink of war when an American drone strike near the Baghdad International Airport in Iraq killed Iranian major general Qasem Soleimani. In addition to the human tragedy of illness and death produced during a global plague, the U.S. president was impeached by the House of Representatives, the nation has endured wide-ranging civil unrest, deadly wildfires that burned millions of acres throughout the western U.S, and a divisive nation elected a new president. The year culminated in yet another infamous day in American history, namely the shocking and unprecedented event at the U.S. Capitol in Washington DC on January 6th, 2021.

Since the onset of the deadly COVID-19 pandemic, citizens throughout the globe have experienced dramatic changes in everyday life. As of February 1, 2021, nearly 200 countries and territories around the world have reported a total of more than 100 million confirmed cases of the coronavirus COVID-19, and a death toll of more than 2.2 million. This once-in-a-century, worldwide pandemic has caused more than half the world’s population to have endured shocking and incomprehensible full or partial lockdowns. The result has been a swift, wide, and deep economic recession that has decimated key travel and leisure-related industries including airlines, car rentals, cruise lines, ridesharing, tour operators, and transient lodging facilities.

Hotel industry metrics realized an unprecedented, sudden, and significant decline, all within just days of all-time highs, and after a ten-year rally. Nearly one year into the COVID crisis the U.S. lodging sector continues to experience negative stress as all segments of travel demand experience a sharp and sustained decline which continues to significantly lag behind pre-pandemic levels.

As we enter 2021, the U.S. is experiencing a record surge in coronavirus cases and continued government restrictions on travel and trade resulting in an astonishing economic crisis. That is the bad news; the good news is there are several reasons for optimism. In addition to the recent $900 billion second stimulus package for COVID-19 relief, a third round of $1.9 trillion appears to be on the horizon. Due to a reduction of spending in the services sector, the U.S. personal savings rate has increased dramatically. Combined, these elements should fuel consumer spending during the second half of 2021. Additionally, low interest rates are anticipated to endure for the foreseeable future. Furthermore, Democratic administrations tend to generate infrastructure investments to stimulate the economy. Finally, during the midst of one of the worst human and economic crises we have seen in our lifetimes, the Dow Jones Industrial Average (DJI) closed at a record high on January 20, 2021.

There have been several significant economic downturns over the past forty years, and with the benefit of hindsight, each has presented wonderful investment opportunities. It appears that this downturn may very well produce a period that rivals the very best in both returns and depth of opportunity. Given the widespread reduction in corporate, group, and leisure travel across the U.S., the lodging industry has been one of the hardest-hit sectors by the coronavirus pandemic. Many property owners, seduced by historically low interest rates, entered this era with healthy levels of leverage. Now with severely impacted net incomes for most property types (specifically larger, full-service hotels), the seeds for broad distress are now planted. Like prior downturns, many anticipate deep distress will produce increasing levels of loan defaults, which will likely continue for some time. While the coronavirus pandemic will ultimately wane and the beginnings of growth should be lined up for strong U.S. and global economic expansion, the reality is that no one knows how the effects of this crisis will continue to evolve, and how and when they will ultimately sunset.

The LW Hospitality Advisors (LWHA) Q1 2020 Major U.S. Hotel Sales Survey included 30 single asset sale transactions over $10 million, none of which are part of a portfolio. Allocations of individual prices from a portfolio sale transaction do not necessarily reflect market value for each asset and thus are not considered in the survey. The survey data reflects hotel sale price data prior to any impact of the COVID-19 spread across the U.S.

Q1 2020 major hotel sale transactions totaled $1.97 billion and included approximately 7,600 hotel rooms with an average sale price per room of $259,000. By comparison, the Q1 2019 survey identified 39 transactions totaling roughly $2.7 billion including 7,900 hotel rooms with an average sale price per room of $339,000. Comparing Q1 2020 with Q1 2019, the number of trades decreased by approximately 23 percent while total dollar volume declined roughly 27 percent and sales price per room dropped by 24 percent.

The Q2 2020 survey illustrated a transaction market dramatically slowed to a crawl, with only six major U.S single asset hotel sale transactions over $10 million, none of which are part of a portfolio.

Q2 2020 major hotel sale transactions totaled $246 million and included approximately 1,459 hotel rooms with an average sale price per room of $169,000. By comparison, the Q2 2019 survey identified 35 transactions totaling roughly $2.6 billion including 9,100 hotel rooms with an average sale price per room of $286,000. Comparing Q2 2020 with Q2 2019, the number of trades decreased by approximately 83 percent while total dollar volume declined roughly 91 percent and sales price per room dropped by 41 percent.

The Q3 2020 survey included 12 single asset sale transactions over $10 million, none of which are part of a portfolio.

Q3 2020 major hotel sale transactions totaled $829 million and included approximately 2,700 hotel rooms with an average sale price per room of $307,000. By comparison, the Q3 2019 survey identified 40 transactions totaling roughly $3.725 billion including 13,100 hotel rooms with an average sale price per room of nearly $283,000. Comparing Q3 2020 with Q3 2019, the number of trades decreased by approximately 70 percent while total dollar volume declined roughly 78 percent and sales price per room increased by roughly 8 percent.

The Q4 2020 survey included 32 single asset sale transactions over $10 million, none of which are part of a portfolio.

Q4 2020 major hotel sale transactions totaled $2.3 billion and included approximately 7,700 hotel rooms with an average sale price per room of $295,000. By comparison, the Q4 2019 survey identified 54 transactions totaling roughly $9.1 billion including 19,900 hotel rooms with an average sale price per room of roughly $450,000. Comparing Q4 2020 with Q4 2019, the number of trades decreased by approximately 41 percent while total dollar volume declined roughly 75 percent and sales price per room decreased by roughly 35 percent.

The paucity of arm’s length hotel sale transactions during Q2 and Q3 2020 hindered price discovery and market participants struggled to determine applicable discounts to pre-COVID levels. Q3 2020 was the second consecutive quarter during which U.S. hotel market transaction activity remained anemic with a relatively wide bid-ask spread. Generally, sellers expressed willingness to consider a 10 to 15 percent discount to pre-COVID pricing while buyers have been interested in transacting at a 20 to 40 percent reduction to pre-COVID values.

Although dramatically lower than 2019, during the last three quarters of 2020 the number of trades and total dollar volume dramatically increased while sales price per room decreased by roughly 4 percent.

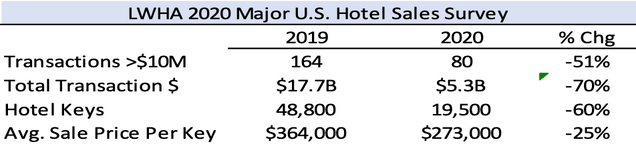

For the year 2020, the LWHA Major U.S. Hotel Sales Survey included 80 single asset sale transactions over $10 million, none of which are part of a portfolio.

2020 major hotel sale transactions totaled $5.3 billion and included approximately 19,500 hotel rooms with an average sale price per room of $273,000. By comparison, 2019 saw 164 transactions totaling roughly $17.7 billion including 48,800 hotel rooms with an average sale price per room of $364,000. Comparing 2020 with 2019, the number of trades decreased by just over 50 percent while total dollar volume declined roughly 70 percent and sales price per room decreased by roughly 25 percent.

During the Q2 and Q3 2020, a half dozen U.S. hotel sale transactions produced market-based evidence of pandemic-induced value erosion.

- The Buccini/Pollin Group (BPG) acquired the 622 room Renaissance Baltimore Harborplace Hotel in Baltimore, MD for $80 million or $129,000 per unit. In January 2020, BPG signed a contract to purchase the hotel for $100 million. During March 2020 when the COVID-19 crisis hit the U.S. in earnest, the seller, Sunstone Hotel Investors Inc., agreed to lower its clearing price resulting in a 20 percent decline.

- BentallGreenOak (BGO), Flank Management LP (Flank), and Geolo Capital (Geolo) announced in June the acquisition of the Hutton Hotel in Nashville, Tenn., in an all-cash $70 million or $280,000 per room purchase price. The seller, Watermark Lodging Trust (formerly known as Carey Watermark Investors Inc.), reportedly acquired the property in 2013 for $73.6 million and The Wall Street Journal recently published that, “The 250-room hotel was valued between $90 million to $100 million before the COVID-19 outbreak, according to people familiar with the matter.” The most recent trade indicates a decrease in value of more than 20 percent.

- Magna Hospitality Group purchased the 310 key Embassy Suites by Hilton New York Manhattan Times Square in New York, NY for a reported purchase price of $115.1 million or roughly $371,000 per unit. The seller, Ashford Hospitality Trust Inc. (AHT), acquired the property in early 2019 for $195 million, representing a 41% erosion of value during their 18-month hold.

- A joint venture comprised of Highgate and Rockpoint Group, sold to MCR the 168-room Royalton New York hotel for a reported $40.8 million or $243,000 per unit. During the past decade, the property has sold twice, representing a decline in pricing on each occasion. The current seller had acquired the asset for $55 million in 2017 from FelCor Lodging Trust Inc., and who in turn had paid $88 million for the property in 2011. Although due to a variety of reasons the Royalton New York hotel was financially challenged prior to the pandemic, the most recent sale represents a more than 25 percent decrease in value.

- Mansueto Properties, an entity created to hold the real estate holdings of Joe Mansueto, Founder and Executive Chairman of Morningstar, acquired from Walton Street Capital the 215-key Waldorf Astoria Chicago for $54 million or $251,000 per unit. During September 2019, a seller-sponsored debt fund foreclosed on a defaulted $90 million loan encumbering the property which previously sold in 2015 for approximately $112 million or more than 50 percent lower than the most recent trade.

- In April 2020, Xenia Hotels & Resorts terminated a proposed $100.5 million sale of the 492-key Renaissance Austin Hotel. During November 2020, the Axton Group acquired the property for $70 million which represents a 30 percent deterioration of value within a seven-month period.

A remarkable Q3 2020 trade was Blackstone’s sale of the 299-key Residence Inn by Marriott Arlington Pentagon City in Arlington, VA. Acorn Development LLC, a subsidiary of Amazon, acquired the asset for $148.5 million or nearly $500,000 per unit and the 24-year-old high-rise hotel is currently being demolished to incorporate the 1.5-acre site into the HQ2 PenPlace Development. In mid-2019, Blackstone purchased the property for $99.1 million from Host Hotels & Resorts, Inc. (HST). The latest transaction represents an approximate 50% profit within one year for Blackstone. What is intriguing about the most current sale is that Amazon’s HQ2 plans were widely known when HST sold the asset to Blackstone for nearly $50 million less only one year ago.

Although the near-term travel market appears bleak, the hotel investment market has seen a surge of interest from a broad array of sophisticated institutional and high-net-worth sponsors who are familiar with the sector and know how to assess risk(s) associated with capitalizing lodging assets. Pre-COVID hotel investor returns generally reached new lows as asset prices were relatively high. Today, with mounting operational losses, especially for larger, full-service assets, and the continued requirement to service debt(s), pressure is intensifying on owners to capitulate to realistic property values, which will ultimately enhance returns on lodging investments for buyers in the market today.

Numerous institutional investment firms have raised significant amounts of leverageable capital in anticipation of a coming wave of distressed commercial properties including hotels that will come to market in 2021 and 2022. Given the amount of available dry capital, the most compelling opportunities will be “bid up” and although numerous transactions will be spurred on by distress, many will not necessarily reflect distressed pricing. Long-term opportunistic investors that bet big, at the right basis, and early in the cycle will likely reap tremendous financial rewards, particularly contrarian sponsors who acquire large urban corporate and group meeting/convention hotels at fractions of their replacement cost.

History has proven that early-cycle contrarian, well-capitalized, value-oriented investors with proven long-term track records over multiple prior cycles, invariably acquire lodging sector loans, assets, and operating companies at an attractive basis that ultimately realize outsized returns on investment. The fact is that over a long-term basis, commercial real estate and particularly hotels, offer superior risk-adjusted yields compared with other investment classes focused on value-add opportunities.

The uncertain macroeconomic environment presented by the pandemic will surely present opportunities to acquire assets from motivated sellers facing near-term pressures. Additional price discovery clarity will emerge in 2021 and 2022 as an increasing volume of market-based U.S. hotel sale transactions comes to fruition. Hotels located in urban markets, particularly group and meeting/convention-oriented properties, have been most negatively impacted and will likely take the longest period to recover. Buyers during 2021 will include open-ended commercial real estate funds, highly leveraged financial institutions, public REITs, and private developers. While the post-COVID-19 environment may meaningfully reduce demand for commercial real estate including hotels, past downturns no matter how painful, have always been followed by recoveries during which new highs were achieved for both rental rates as well as property valuations.

Read more of the Real Estate Issue – April 2021

15 comments

We are really grateful for your blog post. You will find a lot of approaches after visiting your post.

plots in dwarka expressway

During the Covid-19 pandemic, I struggled to take care of my family. In the second wave, the coronavirus affected my entire family, including my eight-month-old baby. That one month is the worst phase in my life. In that situation, Walgreens pharmacy company helped me a lot. I am a regular customer of the Walgreens stores, and I buy all my medicines at Walgreens stores for huge discounts. They are now taking their loyal customer satisfaction survey through an online website called tellwag.com. Every Walgreens customer is eligible to take this survey, and the winner will get a $3000 gift card for free.

Enhancing our health and attaining stability is a goal shared by many. Surprisingly, statistics indicate that a vast majority of individuals confront these same dilemmas. Strikingly, I can personally relate to these difficulties. However, I discovered the transformative impact of TMS psychotherapy from https://goodhealthpsych.com/services/tms-therapy/ which granted me the therapeutic assistance I required. If you genuinely aspire to boost your well-being, you can visit this resource and exploring the diverse array of services they offer.

Because it provides a plethora of career prospects for those with pharmaceutical experience and exceptional specialised talents, the pharmacy business is garnering a lot of interest. As technicians, pharmacists, and pharmacists with higher-than-average college degrees, pharmacists have a high level of education. They also comprehend medications and treatments, as well as technical abilities like information technology strategy, development for organisations, and support. Ultimately, these people are highly sought after in every facet of the pharmaceutical business.

https://wlgreenslistenswin.org/

Customers will feel better as a result, return to the café, and maybe recommend it to their friends and family. Hard Rock thus requests that you provide them with frank feedback so that they can continue to grow.

https://hardrocksurvey.store/

You can enter the TalkToHannaford survey after you shop at the Hannaford store to enter to win fantastic prizes, like the $500 gift card. You can take part in the survey by answering questions about the products and services the store offers. We appreciate your feedback and will use it to inform future choices about the expansion of the store. Your chances of winning the best reward in the sweepstakes are higher the more truthful you are when completing this survey.

https://talktohannaford500.run/

In addition to helping us improve, answering the survey gives you the opportunity to win fun prizes. In the future, we want to provide you with even greater service and hear from you. We appreciate that you choose Wawa!

https://mywaawavisit.us/

Hello

LLBeanMastercard.com/Activate Is The Capital One Platinum Credit Card is a helpful instrument when it comes to travel and other insurance requirements. https://activatellbeeanmestercard.shop/ The card has gained the moniker “people’s best friend” because it has no annual fees and offers incentives to its users. Every six months, the card limit is automatically increased by an astounding amount.

With a reward of $3000 on the website WalgreensListens, this would be a great deal for you too. You can share your experience from your visit to a Walgreens store using the online survey form on the website, and you can also help to improve the customer experience for all other customers and for your next visit.

https://wallgreenslistens.org/

Their online survey attempts to learn about the advantages and disadvantages of their clients as well as enhance shop standards and service. The online poll is called the Walgreens Customer Satisfaction poll, and the official WalgreensListens website is located at WalgreensListens.Com

Lowes Kronos may be accessed through both a desktop and a mobile application. The software is available for download on the Apple Store and Google Play Store.

Myloweslife.com

Throughout America, the Hannaford grocery shop is a well-known supermarket chain. Having been in operation since the 1880s, the firm offers the greatest selection of items at competitive costs. Hannaford Bros.

Talktohannaford.com

سیلی دی ، تولید کننده انواع سیم و کابل نسوز سیلیکونی و اعلام حریق

کابل نسوز

The management of Stop & Shop retail businesses values the time, effort, and faith that its customers have in their goods and services. They work hard to uphold their quality standards and continuously evaluate their performance in order to achieve this.

Talktostopandshop

Lowe’s has grown into a worldwide powerhouse via deliberate development and unwavering devotion. It is well-known for offering a wide selection of products and services that are ideal for both seasoned, expert contractors and do-it-yourself enthusiasts.

Take Lowes Survey