Closing Lodging Transactions through COVID: An Overview of The Hospitality Real Estate Finance Markets

By: Mark Owens, John Avanzino & Robert Webster, CBRE Hotels

Introduction

The Hospitality Industry has experienced many shocks, none as severe as the COVID-19 virus. This article focuses on COVID’s impact on the U.S. hospitality real estate finance market, providing insight into the state of the market pre-pandemic, lending community sentiment, lender engagement and market participation, and the COVID transaction market. The reader will also learn about the transactions being capitalized, lenders actively deploying capital, and common borrower and lender considerations.

Macroeconomic Overview

“Unprecedented,” is a word commonly used to describe the last twelve months, and not without justification. The global pandemic has impacted every human, community, country and business. US GDP whipsawed in 2020, plunging by an astounding 31.4% in Q2 (annualized), then growing by 33.1% (annualized) in Q3, resulting in an anticipated year-end 2020 GDP contraction of 4.0%. Commercial real estate (CRE) is amongst the sectors most impacted by the pandemic, with hotels at the forefront.

CBRE Economic Advisors anticipates a significant rebound in 2021, with 4.5% GDP growth in 2021, the strongest increases occurring in Q2 and Q3 at 5.5% and 5.6%, respectively (annualized). The US GDP is anticipated to return to Pre-COVID levels in Q3 2021. CRE’s anticipated rebound will lag the broader economy, with hotels following the other CRE asset classes.

Congress’s $2.2 trillion economic stimulus package in March 2020 was extremely effective in stabilizing the U.S. economy and assisting the lodging sector. The pace of recovery slowed in Q3 due to the lack of bipartisan consensus on further stimulus measures. The post-election focus on additional stimulus will lay the foundation for a more rapid recovery across property types, including hotels, while the increased savings rate through COVID is anticipated to bolster leisure spending as travel restrictions ease. Increasing government debt levels do not pose an immediate danger to developed economies given their ability to fund the debt obligations and the surplus of global savings that flows into sovereign debt. The Federal Reserve’s recently announced “lower-for-longer” stance is anticipated to create downward pressure on long-term cap rates. The accommodative policy’s impact to the dollar may also result in increased global appeal of U.S. CRE, particularly in gateway markets, already evidenced by foreign capital’s significant interest in transactions on both the debt and equity side of our hotels’ practice.

While CRE, and hospitality, will likely lag behind the broader economy, we expect the recovery of CRE to commence at the end of 2021. Furthermore, the anticipated $1.9 trillion COVID-Aid bill, currently drafted on Capitol Hill, allocates $350 billion of federal stimulus to local and state governments. If passed, the municipal support may reduce pressure to raise real estate taxes, a significant concern for CRE investors at the time of publication.

State of the Hospitality Capital Markets

Total domestic CRE investment volume in 2019 was $597 billion, a 3% increase over 2018. Broader CRE investment volume decreased 32% in 2020 to approximately $405 billion. Q2 2020’s quarterly decrease of 64% year-over-year was sharper than any decline witnessed through the Global Financial Crisis (GFC).

Unlike 2019’s CRE increase, hotel investment volume decelerated by 11% to $38 billion. Q4 2019 volume decreased approximately 19% from the same period prior year. The trend continued into Q1 2020, with activity decreasing by 37% versus Q1 2019. As the pandemic became national news and concerns grew throughout the U.S., 2020 activity essentially halted with hotel transaction volume plummeting 90% in Q2 2020. While a staggering decline, activity was stronger than the 96% decline in Q4 2008 during the GFC. 2020’s total hospitality transaction volume was just $12 billion, declining more than 68% from 2019.

Liquidity drives pricing power. Debt, typically ranging from 60%-70% of the lodging capital stack, is a critical component of the value equation. CBRE’s Lending Momentum Index quantifies the depth of the CRE finance markets. Prior to COVID, the Index closed December 2019 4.2% above 2018 levels. Growth continued through February 2020 before the initial market volatility and widespread onset of the pandemic. 2020’s year-end index declined 16% versus 2019 and 24% as compared to February 2020. The Index, like GDP, whipsawed in Q4 2020 increasing dramatically, by 38.2% over Q3 2020, as the market began to stabilize.

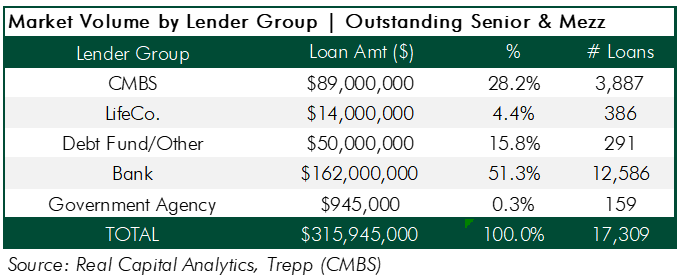

Pre-pandemic the estimated outstanding hospitality debt domestically was $316 billion. The adjacent table illustrates the composition of the hospitality lender universe, with nearly 80% of market liquidity coming from two sources: banks and the CMBS market.

2019 hospitality debt transactions totaled approximately $107 billion, an increase of 5.7% from 2018. Similar to lodging trends above, hotel financing activity in 2020 was just $35.3B, down 67.0% from 2019.

Stages of the Pandemic

While lodging sales activity was decelerating before the onset of COVID, hospitality lending activity remained robust in early 2020. CBRE Hotels was actively marketing over $1 billion in hotel debt, mezzanine, and preferred equity transactions, with portfolios and multiple single asset hotel and resort loans in the closing process. The all-in cost of debt financing was nearing historic lows for hospitality, notably illustrated by a 3.75% all-in rate for a non-recourse, 70% leverage acquisition loan for an east coast lodging portfolio (limited, extended stay, and full-service properties). Additional examples include multiple hotel construction loan closings, with all-in rates ranging from 5.0% and 5.3%; branding, market, and sponsor dependent (independent and lifestyle properties); and numerous transitional refinancing assignments with little to no historical cash flow, pricing just under 4.0% at similar leverage points (independent and soft branded full-service hotels). Most transactions were interest only.

As news of lockdowns and cases in Europe became more widespread, and the U.S. case counts started to increase, volatility in the equity markets impacted the banking sector. Public and private lenders immediately began assessing in-progress transactions and slowing closing processes to avoid increasing exposure to the lodging sector. Concerns continued to spread across the lending industry and executed term sheets were terminated, and quoting activity also slowed as lenders of all types tried to assess risk. An extremely liquid hospitality (and CRE) lending market froze.

The change in sentiment is illustrated by 2020 hospitality debt transaction volume decreasing by an astounding 67.0% to $35.3 billion. The figure is further skewed as most of the reported transactions were assumptions, modifications or extensions of existing loans versus new loan originations.

As the initial shock subsided, the weeks and months that followed are best described as periods of discovery and assessment, adaptation, normalization, and resumption. Lenders immediately shifted focus and began assessing the rapidly evolving situation. What are the most vulnerable industries? What is the lending exposure to those industries? How will asset values be impacted? How well capitalized are those borrowers? What are the liquidity implications to the institution (from a regulatory perspective and exposure perspective, how much liquidity is needed to protect the lender’s position and/or carry assets)? In-depth lender portfolio reviews commenced. Firms undertook multiple analyses to draw parallels to prior event-driven impacts; 9/11, SARS, GFC, etc. Equity investors and brands to operators, consultants and advisors also began similar analyses. The speed and depth of the crises united lenders, borrowers, advisors, industry groups and economists in record time, with all stakeholders sharing information to provide visibility during an opaque period.

In advance of, and concurrent to the above, the Federal Government implemented a series of measures to stabilize the markets. Such essential measures as accounting treatment guidance to lending institutions for COVID impacted industries were quickly released. The relaxation of certain rules, allowing lenders to modify loans without triggering increased capital reserve requirements, eased lender concerns about their own liquidity positions. Without the Fed’s guidance, broader market volatility was a significant risk. Congress also worked swiftly to pass stimulus measures, including the Payment Protection Program and the Main Street Lending Program, among others.

The American Hotel & Lodging Association, Asian American Hotel Owners Association, Mortgage Bankers Association, Commercial Real Estate Finance Council, and the International Council of Shopping Centers, amongst others, initiated regular dialogue in an effort to develop a liquidity solution that would aid borrowers across all commercial property types. A cross-sector proposal, working within the nuanced framework of complex structured transactions, CMBS pools, and traditional balance sheet loans, had the potential to further mitigate borrower and lender strain, avoid defaults, and reduce potential value impairment. Without stability, reluctant CMBS bond buyers could significantly reduce the amount of capital to lodging going forward, impacting liquidity and increasing interest rates. While proposed legislation was introduced via H.R. 7809 (The Hope Act of 2020) in July 2020, it stalled due to lack of bi-partisan support.

Lender Engagement

The rapid education, adaptation, and collaboration promoted stability, preserved asset values, and provided insights necessary to reignite the lending market. CBRE Hotels Debt & Structured Finance began tracking hospitality lender sentiment. As stay-at-home orders increased across the country, hospitality lending came to an abrupt halt, with little guidance as to when underwriting would resume. Unlike the GFC, within two weeks, conversations with the two groups pivoted from research and broader market updates to targeting clients with eminent maturities or non-refundable deposits on upcoming acquisitions.

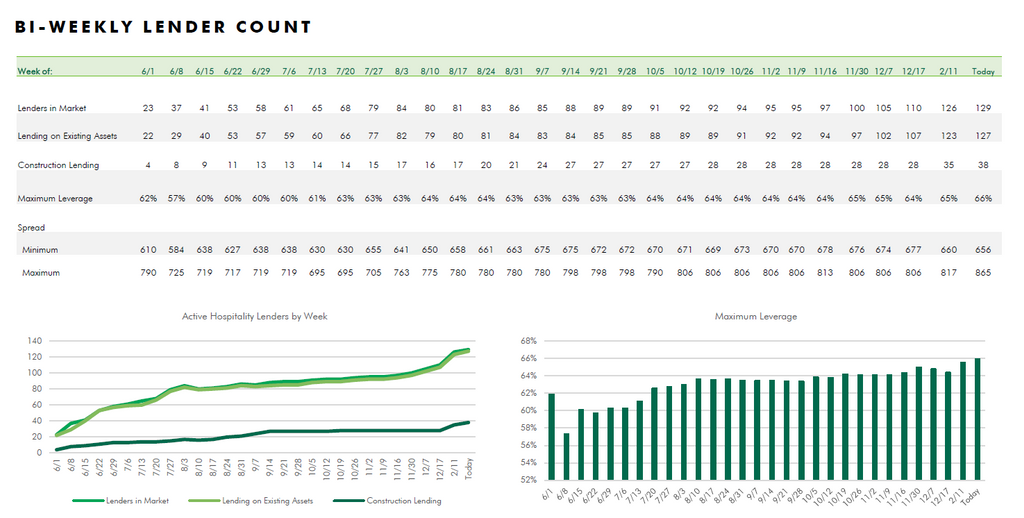

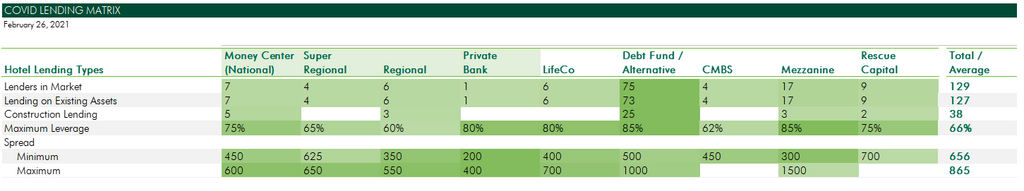

By June 2020, 23 lenders were willing to underwrite hospitality, 60% in the debt fund category. Five banks, one money center bank, and four super-regionals, were reviewing transactions for existing clients or targeted institutional prospective clients. Unlike prior periods of dislocation, a life insurance company was among the first to begin underwriting hospitality. Hundreds of weekly conversations identified common themes: strong sponsorship, drive-to locations, leisure transient or extended-stay demand, branded, well-maintained, fee-simple assets in right-to-work states were preferred. Leverage was conservative with 55% to 65% replacing the historic 75% level. Lenders were using various metrics to triangulate proceeds: historical debt yield, anticipated stabilized debt yield, and per key metrics, with valuations being secondary given the lack of trades and visibility into discount and cap rates.

In July 2020 the lender universe nearly tripled, with 61 lenders willing to underwrite hospitality. By November, 100 lenders were willing to underwrite the sector, with the aforementioned preferences continuing to resonate among the broader set.

Hospitality lending’s rapid return was unexpected, and lender appetite versus sentiment was also unproven given the minimal transaction activity. Three transactions below, all closed in 2020, have different characteristics providing the reader with a range of considerations. The transactions illustrate the market’s depth and breadth, challenge components of the lender preferences mentioned previously, and are instructive in understanding transaction size and its impact on processes.

Transaction 1: A sizable off-market acquisition of a Marriott in southern California, the first and largest financing through COVID. The acquisition proved arms-length value (nearly equal to the seller’s 2019 book value), pre-pandemic cash flow was strong and consistent, the readily accessible market also benefits from high barriers to entry, the business plan was complex, and the closing time frame was short. This process resulted in significant lender interest. Apart from CMBS, every lender category participated. The $170 million in proceeds was roundly 68% loan-to-cost and pricing was compressed, closing at an all-in rate in the upper-mid 5% range, inside of expectations. Notably, structural elements to the loan facility were more favorable than those typically achieved pre-pandemic. The lender was an asset manager.

Transaction 2: Originally contemplated as a refinancing, the property is one of Boston’s premier independent hotels with a leasehold interest. This transaction was educational for several reasons: the international gateway and urban core location, unbranded nature, and labor status. Similar to the Marriott process, the market reacted quickly and favorably, with proceeds increasing 8.5% above the loan request and pricing compressing significantly. Mid-process, the transaction pivoted from a financing for the owner to a sale. The fresh equity and arms-length valuation incentivized the lending community to further refine their underwriting. At closing, proceeds of $81 million were 14% above the initial request, an approximate 72% loan-to-cost. Pricing compressed dramatically from initial indications, and the structure was borrower-friendly. The lender was a hybrid life insurance company and global investment fund.

Transaction 3: The fee-simple, arms-length acquisition occurred at Temporary Certificate of Occupancy, in a coastal resort market and provides additional data points. Given the new development, the property had no operating history. Branding selection was in process during the acquisition and financing process. The financing request was sub-$20 million. The proceeds level eliminated numerous lenders from the process, confirming “bigger is better” and a strong desire for lenders to deploy more capital more efficiently. The limited lender pool reduced the ability to drive pricing as efficiently as other processes, even with a strong owner-operator, excellent facility, and attractive basis. The lender was a debt fund.

In addition to the aforementioned transactions, a nuanced ground-up construction loan was closed in Los Angeles, with market participants including debt funds, opportunity funds, and CPACE providers. The most attractive option for our client was a retroactive CPACE financing, which was also the lowest-cost option. Through the pandemic, the CPACE market has become a more common alternative, with pricing and structure becoming more appealing to a broader set of borrowers.

Conclusion

At time of publication, nearly 130 lenders are active in the lodging space. Most notable is the increase in the bank market, with regional, super-regional, and money center banks reengaging since the beginning of February. International banks and debt funds continue to expand into the space. Hospitality financing debt and equity processes, including those in fly-to destinations, are receiving increased attention and selective large-scale construction projects are being underwritten. Sponsorship, location, brand, scale, and quality continue to be of paramount importance to lenders.

With each week, increased vaccinations, and upward adjustments to forecasts, overall sentiment continues to improve. Interest in the hospitality sector and the amount of capital on the sidelines bodes well for continued improvement in the hospitality debt capital markets.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2020 revenue). The company has more than 100,000 employees serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.

Read more of the Real Estate Issue – April 2021

10 comments

Great article!!!

A must read post! Good way of describing and pleasure piece of writing. Thanks!

Indian Astrology Future Career Predictions

Thank you so much for sharing your thoughts. This is exactly what I needs.

Acquire online Astrology Predictions in India

Your blog matches the topic I’m looking for, thank you.

Top Best Website Design Company In Jaipur

I am really happy with articles quality and presentation.

Website Development Company In Jaipur

I finally found the information I was looking for on your blog. You can’t be happier than this. I want to say thank you so much for posting this. Please continue to post good comments.

Best Travel Agency in Jaipur

Modafinil is een middel dat de waakzaamheid bevordert. Ontwikkeld door het farmaceutische bedrijf Lafon Corporation in 1998, beweert het te werken als een niet-verslavende waakzaamheidspromotor en cognitieve versterker. De laatste term verwijst naar het vermogen van verschillende medicijnen om de prestaties van het menselijk brein te verbeteren of te verbeteren. Als zodanig wordt het gebruikt om slaapstoornissen te behandelen, maar het is ook populair geworden onder studenten als studiehulpmiddel of cognitieve versterker. U kunt modafinil en modalert 200mg bestellen bij: modafinil kaufen ohne rezept

Thanks for spreading this knowledge to us. I also write some words about Office chair gel pad cushion supplier must visit my page.

سیلی دی ، تولید کننده انواع سیم و کابل نسوز سیلیکونی و اعلام حریق

سیم نسوز سیلیکونی

I love that! They are just what I need! I appreciate you sharing these amazing and fulfilling experiences with me and with all of you. Have fun with your family and wordle unlimited free.