Hospitality Branding in the Age of the Millennial

By Allen Adamson and Chekitan S. Dev

The Exponential Growth in Both Hospitality Brands and the Millennial Audience Requires an Exponential Shift in Brand Portfolio Strategy

The past decade has seen exponential growth in hospitality brands making for an often confounding proliferation of options for travelers. According to Smith Travel Research, from hard to soft, boutique to lifestyle, consumers are looking at a choice of almost 1,000 hotel brands globally [1].

While the number of brand names has increased, the number of holding companies has decreased, the result of several significant mergers within the hospitality industry. The Marriott/Starwood merger is among the most recent example of holding companies combining assets to create larger brand families. According to the Marriott website, prior to merging with Starwood, it had “more than 4,400 properties in 87 countries and territories, with reported revenues of more than $14 billion in 2015.” In addition to 19 of its own hotel brands, Marriott stands to add 11 of Starwood’s brands to its portfolio upon the completion of the $12.2 billion merger.[2] As another example, in late 2015, hotel companies AccorHotels and Fairmont announced their merger. As stated on the Fairmont website in December, 2015, “We [Fairmont] are excited to share the news that FRHI Hotels & Resorts and our three leading brands, Fairmont Hotels & Resorts, Raffles Hotels & Resorts, and Swissôtel Hotels & Resorts, will soon join the AccorHotels group. AccorHotels is a global leader in the travel industry with a diverse portfolio, located in 94 countries, with over 3,800 properties and 20 recognized luxury, mid-scale and economy brands including Sofitel, Pullman, MGallery, Grand Mercure, and Novotel.” The transaction, expected to close in mid-2016, was completed for a percentage of Starwood’s price tag, a comparably modest $2.9 billion, but resulted in an equally impressive unification of hotel industry power players. In a similar vein, Intercontinental Hotels Group and Kimpton merged in 2014, a $430 million deal, which added nine InterContinental brands to Kimpton’s 59 hotels in 30 U.S. cities.[3]

In addition to this trifecta of hospitality’s large brand consolidations, boutique hotel groups Commune and Destination Hotels merged in the beginning of 2016, as well. As per Destination Hotels’ press release, “The combined company will manage over 90 hotels and resorts in seven countries with approximately $2 billion of total property revenues under management, and will look to opportunistically broaden the geographic reach of its brands both domestically and internationally in urban and resort markets”.[4]

This combination of fewer holding companies, each with extra brand names in their portfolios, presents a challenge for consumers, not simply in terms of the myriad names, but the inability to distinguish the inherent differences in one brand from another. According to a 2015 article in Skift, “Vacationers once relied on big-name hotel brands to signal the kind of experience they could expect. People knew what Holiday Inn, Hilton, Hyatt or Marriott meant. Familiarity bred a sense of comfort. No longer. The world’s 10 largest hotel chains now offer a combined 113 brands at various price points, 31 of which didn’t exist a decade ago. And there’s no sign of this proliferation slowing down.”[5] As companies assemble more and more brands under their corporate ‘umbrella’ organizing these brands in a clear, cohesive and compelling way in the new challenge facing these multi-brand hotel companies.

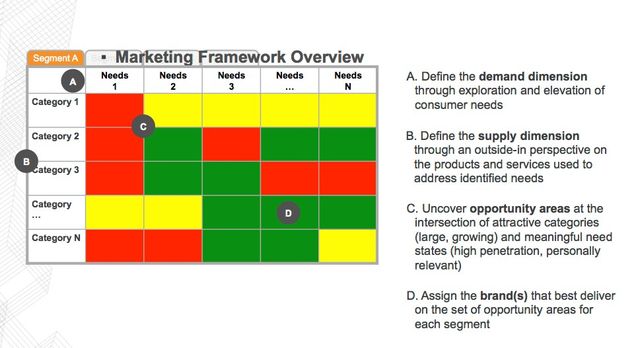

Traditionally, this proliferation of brands – the creation of an enormous brand portfolio – would be dealt with in two interrelated ways; consumer segmentation and brand architecture. By way of explanation, segmentation is an analytical tool that allows marketers to take a large, diverse population and organize it into manageable, homogeneous groups which makes it possible to more fully understand, prioritize and address the individual needs of these groups rather than trying to address an entire population.[6] Segmentation is valuable because in its efforts to mean a lot to many people, a brand can easily begin to mean very little to very few. Segmentation allows brands to focus intimately on understanding the barriers, desires, needs, and aspirations of a specific group. Through segment identification, the brand can provide customized messages and products to fit the needs of the segment, focusing on those needs which both differentiate and unify the target segment.

Relative to segmentation and the hospitality industry, this might include breaking down hotels into unique segments of hotels, one that might offer limited service, another full service, and another luxury service. Further segmentation might then break these groupings into venues that are more appropriate to a business traveler, to a family traveling with children, or as a honeymoon destination. By way of example, within the IHG portfolio, brands are segmented by the need that they fulfill for the consumer, such as “Family Time,” “Romantic Getaway,” or “Rest and Go.” The brands are then further differentiated on a price point spectrum, from mid-scale to luxury. This allows IHG to better identify the target market—and the needs—in alignment with their various hotel brands.

Given the exponential growth of hotel brands, however, there are no longer enough stratas of segmentation to make this tool feasible. In one Bloomberg article, travel industry analyst Harvey Harteveldt, considering the differences between brands Element and Aloft, ironically notes, “I think one uses blue a little more in its color palette, and one uses green a little bit more,” a statement which perfectly nails the challenge. As Gary Leff writes on View From The Wing, “A consumer might know a brand, like a brand, and choose hotels flying that flag because the brand tells them just what they’re going to get – that consistent experience they’re comfortable and familiar with and feel favorably towards. But with too many brands, and brands that don’t clearly distinguish themselves, it’s hard for guests to ‘get’ the brand idea. With conversion brands, or brands whose story is that they’re unique to their locations, there’s not really even a clear brand idea to start with.”[7]

Brand architecture, on the other hand, has been utilized to fine-tune the segmentation by way of focusing on a brand’s organization and the resulting branding strategy. Again, traditionally, architecture would become the platform for expansion and innovation within the brand portfolio, while providing direction for that growth.[8] By way of explanation, there are generally four meaningful structures within brand architecture: master-branded, shared, endorsed, and no affiliation. Using Marriott as an example, “master-branded” would be simply Marriott; the name stands alone. Then, “shared,” would be Marriott Courtyard, whereby each name is given a fifty-fifty share of ownership in the consumer’s mind. “Endorsed” would be Courtyard by Marriott, giving Courtyard the majority ownership in the consumer’s mind, but giving consumers the assurance that it’s part of the Marriott family. “No affiliation” is just that. The hotel property gives no evidence of being anything but independently owned.

The old model of structuring a growing brand portfolio, using segmentation along with architecture to “scaffold” the segmentation, worked well for many years, especially in a world largely based on one-way communication wherein the brand was able to control the messages, if not always the experience. Now, however, traditional segmentation is no longer robust enough to handle the huge number of brands. There are simply not enough ways to slice and dice consumer segments by need, effectively or efficiently, and, equally important, in a way that is understandable to consumers. Even the most nuanced architectural overlay model is not sufficient to support the myriad brand names in the marketplace. There are too many brands for the required infrastructure.

The current scenario? Fewer hospitality holding companies and more brand names, few which are distinguished by any unique brand story. In the first chart below is the traditional segmentation approach, inclusive of the pruning and consolidation of properties; hotel names neatly divided and subdivided by target, occasion, price point or location. It is rigid in structure, components fixed in place based on conventional marketing segmentation strategies.

A segmentation based architecture paradigm is ineffective when the largest purchasing audience engages and consumes in radically different ways. For a target market—the millennials– for whose new travel priorities include an increasing demand for authentic experience-based travel, a segmentation based brand architecture is inadequate, if not useless. There are eighty million millennials in the United States, alone, representing about one quarter of the population, with $200 billion in buying power. “Over the next five to ten years, millennials will become the biggest customer segment for hotels worldwide, and hotel brands are rushing to meet and exceed the needs of these travelers,” said Signature Travel Network Vice President Ignacio Maza. In fact, by 2025, Gen Y will account for 75 percent of the workforce, according to a 2014 study by Deloitte.”[9] Beyond sheer numbers, a study conducted by Goldman-Sachs states, “Millennials have come of age during a time of technological change, globalization and economic disruption. That’s given them a different set of behaviors and experiences than their parents.”[10] No matter how luxe or legacy a brand, the millennial consumer is not impressed unless a brand differentiates itself and proves its worth and experiential value. For millennials, more often than not, it’s all about the experience—along with the resulting Instagram or Snapchat photo.

A study by Havas’s Hashtag Nation reported in Adweek noted that, “Today’s youth are significantly more apt than their elders to recognize—and value—the role brands play in their lives.” But this can be a tricky relationship to maintain, the study notes, as 40 percent of respondents ages 16-24 complain that brands don’t take them seriously enough. Brands also need to recognize that they’re now dealing with a generation of consumers who are much savvier than their parents were at that age,’ the study concluded. “Young people have an innate understanding of marketing and of their value as consumers. And they’re significantly more likely than older generations to believe they have the capacity to help a brand succeed or fail. And why would they think that? Virtually every day they see some evidence of the power of ordinary people to effect change, whether it’s using Twitter to foment a rebellion in the Middle East or using social media to compel a company to behave better.”[11]

Before we unveil our new approach, we are finding there are three key millennial traits that must be taken into consideration as they move forward in their challenge to identify an effective brand portfolio model:

1.Millennials don’t fall into neat hospitality buckets. They can’t and won’t be segmented. They move fluidly from business to pleasure. They don’t compartmentalize their lives the ways in which their parents did. Recognizing this and providing the opportunities to do so is paramount to success according to a series of reports aggregated by consumer research firm Sprinklr, “Brands need to stop marketing to millennials in the same way they’ve marketed to previous generations… they’re looking for brands that embody them.”[12]

2. Millennials seek unique experiences – and they love to share these experiences. Millennials don’t like big brands. They don’t want to wake up in a hotel room that looks the same whether it’s in Prague or Peoria. They want just the opposite. More than this, millennials are a generation that want to co-create the product and the brand with you. Companies that understand this and figure out ways to engage in this co-creation relationship millennials will have an edge. An example of a company that understands and has successfully tapped into this new paradigm, is American Express, with its Nextpedition campaign. As detailed in its 2011 press release, “[Nextpedition offers] a new way to travel targeted to travel enthusiasts in their 20s and 30s. Through Nextpedition, American Express Travel offers consumers the exciting opportunity to take a vacation where the destination and itinerary are unknown until the actual journey begins and is revealed day by day via a customized Smartphone. The “mystery trip” is customized to reflect the traveler’s personality traits, providing an opportunity for him or her to explore the world in an unexpected and intuitive way.”[13] In this synopsis of its campaign, American Express captures precisely the elements of the travel and hospitality experience that millennials crave. As noted in the same report by Sprinklr, “Research shows that millennials influence the shopping behavior of their parents, who are increasingly mimicking the demands of their children for a seamless customer experience.” A seamless experience may include elements such as customized offerings, including better, faster, more personalized service, a single, streamlined customer experience, and integrated IT platforms.[14]

3. For millennials, technology and social media are part of their DNA. This is in good part what makes traditional architectural models ineffective. Millennials operate in a digital, transparent world. They can see everything and share everything. That a hotel brand is “shared” or “endorsed” doesn’t matter. They’ll get to the who and what behind a brand on their own, holding whomever is responsible, good or bad experience, accountable. That high-tech and word-of-mouth play an essential part in today’s marketing strategies is an understatement. In fact, 40% of millennials share details of a trip to social media while traveling.[15] While traditional media may still have some role in building a brand, the old top-down, mass marketing dynamic is very quickly being replaced by the top-down, bottom-up approach – a conscious mix of your messaging and their The not-so-secret to success, however, is giving them something worth talking about.

This massive and incredibly influential consumer group is upsetting the whole framework which marketers have heretofore utilized to manage large portfolios, specifically being able to build on segmentation based brand architecture strategies. Given all of the above, this article proposes that a shift in thinking is required to succeed in hospitality branding, especially as brands pivot to reach and break through to millennials. More specifically, it proposes that what is needed is a fundamentally different brand portfolio model, tailored to meet the needs of millennials, not their parents.

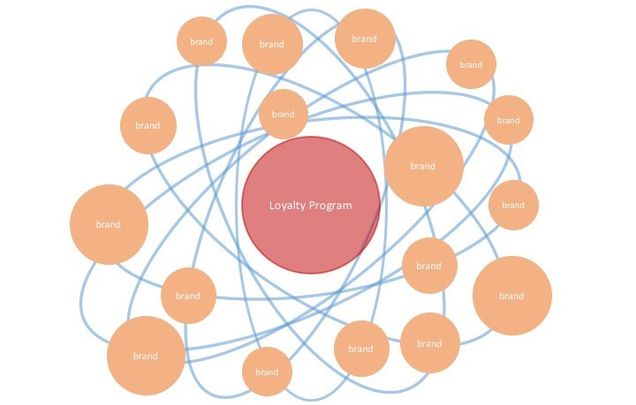

The context for this shift in thinking can best be appreciated by looking at the accompanying chart representing a different systematic approach. The proposed model is created to take into account all of the aforementioned challenges, especially those presented by the millennial consumer.

Resembling more of a “solar system,” this model is organic, fluid, and dynamic with components moving in and out, taking on different values predicated on constantly changing consumer and market circumstances. At the core of this solar system is a membership-based loyalty program, not branded with a specific hotel name, but an entirely agnostic entity.

The ideal hospitality brand portfolio model must also take into account that there must be an organizing principle for all of the properties, along with a “gravitational force” that compels consumers to choose one hospitality group versus another. Ergo, the loyalty program at the core of this solar system model. However, rather than the traditional discount-based loyalty program which rewards multiple stays with an extra night or a room upgrade, to be effective, this proposed loyalty program must be based on what is relevant to millennials. Far beyond financial rewards, it should be perceived as a “brand experience enhancement program.” Rather than a conventional buy-one-get-one loyalty program, it must be a program built on surprising and delighting the user in, both, a personalized manner and a manner unique to each of the properties. Whether checking into property A, B, or C, the user experience should be customized in some meaningful way. According to a study by Loyalty One, personalization is a critical factor for these travelers, with 79% of millennials saying they would even pay for rewards that correspond to their specific needs. A program with “brand experience enhancement” at its core will allow smaller brands to retain their authentic and unique quality, and larger brands to acquire the associative status of being in the same program. As is their preference,users control the price-value equation relative to their need. Millennials, and their ilk, get to discover new experiences, calling the shots – and taking the shots – to share with others.

The nature of this proposed solar system model is elliptical in form, properties, some large, some small, moving in and out, back and forth, each having its own “value” based on the needs of the user at a given point in time. The orbits of these planets are not preordained. In this model, segmentation is irrelevant. Architecture is irrelevant. Marketing strategy and media budgets are used to support the core program, to ensure its message is differentiated in a way that is meaningful. By ensuring a powerful and compelling story for the core program, and by delivering on this story, you no longer have to look at which properties in the solar system get the biggest share of the media buy. By creating extraordinary experiences within the solar system, millennials will do the heavy lifting given their affinity for social media.

REBRANDING THE IHG REWARDS PROGRAM [15]:

Kirk Kinsell, former President of the Americas for Intercontinental Hotels Group (IHG), led a session at the 2013 Cornell Hospitality Brand Management Roundtable by sharing IHG’s effort to restructure its’ brands around its loyalty program: PriorityClub Rewards. Noting that IHG had been an umbrella brand for only ten years, Kinsell shared a recent history that includes 30% growth through a relentless brand-building program and the industry’s first loyalty program. The most recognizable IHG brand is, of course, the Holiday Inn brand family, which enjoys broad recognition. As he put it, when employees go through customs and say they work for IHG they are often greeted with a blank stare. But if they then add that it means Holiday Inn they are given a warm “Welcome!”

The key to his brand portfolio management effort is the re-launch of the priority program and simplification of brand communications, which has included adopting orange as the signature brand color. Now called IHG Rewards Club, the program offers a range of amenities including free Internet access to club members at all properties. If you’re a club member near an IHG property, you need not even be an overnight guest to access the Internet in the facility. More broadly, IHG is focusing on using the rewards program to provide better guest recognition and leveraging the program to solve corporate challenges such as capturing a portion of the $2 billion cross-selling potential, and reducing the costs of using online travel agencies (OTAs) which cannot extend PriorityClub benefits to their customers.

In summary, our proposed new model for organizing hospitality brand portfolios is in direct response to the fact that the traditional approach is no longer relevant. While it used to be possible to place brands, targets, and target requirements into neat boxes and buckets, the world has become far too complex for this linear framework. This is especially true for those with a millennial mindset, be they millennials, themselves, or the growing number of audiences influenced by this mindset. Millennials simply can’t and won’t be segmented, and they don’t hew toward brands that represent the usual segments. They morph fluidly from business to pleasure and, at the same time, seek out unique experiences. To succeed, hospitality branding professionals need a model that can incorporate the growing number of small, idiosyncratic brands and the attitude toward these brands, inclusive of the desire for discovery and personalization.

Allen Adamson, founder and CEO of BrandSimple, was most recently Chairman, North America, of Landor Associates, a global brand consulting and design firm, where he was responsible for operations and overseeing branding efforts. Under his leadership, the company partnered with a wide array of iconic brands, including Accenture, GE, Johnson & Johnson, FedEx, HBO, Marriott, MetLife, and Verizon. Additionally, he provided guidance for non-profit organizations including the 9/11 Memorial & Museum, the Central Park Conservancy, the Council on Foreign Relations, and Iraq and Afghanistan Veterans of America (IAVA). He is the author of three books — The Edge: 50 Tips from Brands that Lead, BrandDigital, and BrandSimple, and writes a monthly column for Forbes.com about the impact of general business and cultural trends on branding. A sought-after industry commentator and has appeared on NBC’s Today Show, CNBC’s Squawk Box and Closing Bell, Fox Business Network, and has been quoted in The New York Times, the Wall Street Journal, Advertising Age, USA Today, the Washington Post, and Forbes.

Allen Adamson, founder and CEO of BrandSimple, was most recently Chairman, North America, of Landor Associates, a global brand consulting and design firm, where he was responsible for operations and overseeing branding efforts. Under his leadership, the company partnered with a wide array of iconic brands, including Accenture, GE, Johnson & Johnson, FedEx, HBO, Marriott, MetLife, and Verizon. Additionally, he provided guidance for non-profit organizations including the 9/11 Memorial & Museum, the Central Park Conservancy, the Council on Foreign Relations, and Iraq and Afghanistan Veterans of America (IAVA). He is the author of three books — The Edge: 50 Tips from Brands that Lead, BrandDigital, and BrandSimple, and writes a monthly column for Forbes.com about the impact of general business and cultural trends on branding. A sought-after industry commentator and has appeared on NBC’s Today Show, CNBC’s Squawk Box and Closing Bell, Fox Business Network, and has been quoted in The New York Times, the Wall Street Journal, Advertising Age, USA Today, the Washington Post, and Forbes.

Chekitan S. Dev is Associate Professor of Strategic Marketing and Brand Management in the School of Hotel Administration at Cornell University. His articles have appeared in numerous leading publications including Journal of Marketing and Harvard Business Review. He received the John Wiley & Sons Award for Lifetime Contribution to Hospitality and Tourism Research in 2002. Professor Dev holds a Ph.D. from Virginia Polytechnic Institute and State University, a master’s degree from the Institut de Management Hotelier International at ESSEC, and a bachelor’s degree from the University of Delhi. Email csd5@cornell.edu

Chekitan S. Dev is Associate Professor of Strategic Marketing and Brand Management in the School of Hotel Administration at Cornell University. His articles have appeared in numerous leading publications including Journal of Marketing and Harvard Business Review. He received the John Wiley & Sons Award for Lifetime Contribution to Hospitality and Tourism Research in 2002. Professor Dev holds a Ph.D. from Virginia Polytechnic Institute and State University, a master’s degree from the Institut de Management Hotelier International at ESSEC, and a bachelor’s degree from the University of Delhi. Email csd5@cornell.edu

Resources:

-

http://www.strglobal.com/Media/Default/Documents/STRGlobalChainScales2016.pdF

-

http://www.bloomberg.com/news/articles/2015-11-17/why-there-are-so-many-hotel-chains

-

http://www.usatoday.com/story/travel/roadwarriorvoices/2016/02/26/ihg-ceo-pledges-let-kimpton-maintain-its-identity/80989290/

-

https://www.destinationhotels.com/media-center/press-releases/destination-hotels-press-release

-

https://skift.com/2015/04/13/behind-the-boom-of-new-hotel-brands-from-major-chains

-

Philip Kotler and Gary Armstrong, Principles of Marketing, 2014, p. 381.

-

http://viewfromthewing.boardingarea.com/2015/04/15/simple-truth-there-are-too-many-hotel-brands-and-well-keep-getting-more/

-

Kevin Lane Keller, Building, Measuring and Managing Brand Equity, 2013, p.359.

-

http://travel.usnews.com/features/Millennial-Appeal-5-ways-hotels-are-engaging-Gen-Y/

-

Goldman-Sachs, “Millennials: Coming of Age.” http://www.goldmansachs.com/our-thinking/pages/millennials Accessed August 14, 2016.

-

Hoffman, Melissa. Adweek. “Attention Brands: This Is How You Get Millennials to Like You: Looking at what resonates with most marketers’ dream demo.” http://www.adweek.com/news/advertising-branding/attention-brands-how-you-get-millennials-you-160575 Accessed August 14, 2016

-

Sprinklr. “Marketing to Millennials: 6 Studies & Reports You Need to Read” <https://www.sprinklr.com/the-way/marketing-to millennials-studies-reports> August, 2016.

-

http://about.americanexpress.com/news/pr/2011/nextpedition.aspx

-

“Marketing to Millennials: 6 Studies & Reports You Need to Read” <https://www.sprinklr.com/the-way/marketing-to millennials-studies-reports> Accessed August 14, 2016.

-

Taken from Chekitan S. Dev (2013), “Challenges in Contemporary Hospitality Branding,” Cornell Hospitality Proceedings, 5(6), page 10.

22 comments

Vender pela internet é negócio da atualidade. https://Indicacurso.com/maquina-de-vendas-usa/

Thanks for the articles you produce and upload for us.

Teeth Cleaning Clinic In Jaipur

this is really nice to read. Informative post is very good to read..thanks a lot!

Buy Sofa Set Online

This is a perfect post. I like your writing style. I have been looking for this information for quite some times. Will look around your website.

Car Rental Service In Jaipur

This is really helpful for me, I appreciate your efforts.

eCommerce Product Photography In Jaipur

Incredibly useful and detailed information. You are growing rapidly and it shows in your blogs.

Website Development & Designing Company In Jaipur

Great job for publishing such a beneficial website. Your web log isn’t only useful, but it is additionally really creative too.

Best Travel Agency in Jaipur

Yeah! This is very interesting post. I look forward for seeking more on your website.

Online Love Solutions

Hey thank you!!! I was seeking for the particular information for long time. Good Luck

Disturbed Marriage Life Solutions

Good post! Keep up the good writing.

Nidhi Company Registration

Welcome to our Suonerie Gratis , the ultimate destination for the best and most popular ringtones on the internet!

Udaipur Half Day Tour, Book Udaipur Half Day Sightseeing Package by car, Half Day Udaipur City Tour, Best Half-Day City Tours in Udaipur.

Hotel apartments in Dubai Marina , an idyllic oasis nestled amidst the iconic skyline and azure waters of the Arabian Gulf. Our property offers a perfect blend of sophisticated elegance and contemporary comfort, catering to discerning travelers seeking an unforgettable stay in the heart of Dubai’s most prestigious waterfront community.

Buena calidad de publicación. Espero que Parana escorts sea beneficioso para todos nosotros.

Excellent publication and very useful. I hope that thePuerto Plata Escorts agencies learn a lot from these.

Experience the freedom of the road in jaipur with a car rental Jaipur. Book now and start exploring at your own pace!

Car Rental in Jaipur – Now hire a car in Jaipur became easier with Revv, best car rental service provider in India.

The article underscores the need for a paradigm shift in brand portfolio strategy, moving away from traditional segmentation and brand architecture to a more dynamic, experience-focused approach. This shift is crucial in appealing to millennials, who are not only the largest consumer segment in the hospitality industry but also the most diverse and tech-savvy.

The discussion about the restructuring of loyalty programs, such as IHG’s transformation of its PriorityClub Rewards into the IHG Rewards Club, is particularly relevant. It illustrates the importance of personalization and unique experiences in building brand loyalty among millennials. This approach is not just about offering rewards but about creating a sense of belonging and a personalized experience that resonates with this demographic’s values and lifestyle.

For millennials and many modern travelers, the choice of accommodation is not just about a place to stay but an integral part of their travel experience. This is where platforms like Rentler https://www.rentler.com/ become invaluable. Offering a wide range of apartments for rent, Rentler caters to the needs of modern renters, including millennials seeking accommodations that provide both comfort and a sense of local flavor. Whether it’s for short-term travel or longer stays, Rentler’s diverse listings can help travelers find spaces that align with their desire for authentic, personalized experiences.

Suonerie Gratis per Android 2024. Scaricare suonerie samsung, messaggi, canzoni, classiche, whatsapp… Suonerie gratis mp3 per telefono, suonerie gratis senza registrazione.

Suonerie Gratis per Android 2024. Scaricare suonerie samsung, messaggi, canzoni, classiche, whatsapp… Suonerie gratis mp3 per telefono, suonerie gratis senza registrazione. https://suoneriemp3gratis.net/

Nice post. Such a worthy content published.

Discover the convenience of Jaipur Railway Station Self Drive Car Rental. Enjoy the freedom to explore Rajasthan’s vibrant capital at your own pace. With various vehicles available, from compact cars to spacious SUVs, you can easily find the perfect ride for your journey. Experience hassle-free booking and seamless pickup at the station, ensuring a smooth start to your Jaipur adventure. Book your self-drive car today for a memorable travel experience.

Would you like to experience driving a different car? Are you tired of your own car? Have you ever found yourself without a car when you used to have one? Does the thought of rush hour on public transportation scare you? Are you worried about being overcharged by local auto and taxi drivers in a new city? Ncarz offers Affordable Self Drive Cars in Jaipur to help you overcome all these concerns and more.