U.S. Lodging Industry Update – Q2 2015

Written by Daniel Lesser and Jonathan Jaeger of LW Hospitality Advisors®

The U.S Lodging Industry is currently experiencing peak levels as evidenced by year-over-year growth in many of the major performance indices. After the economic downturn in 2008/2009 when the industry experienced substantial decreases in overall performance and valuation, U.S Hotels have rebounded with many surpassing prior peaks.

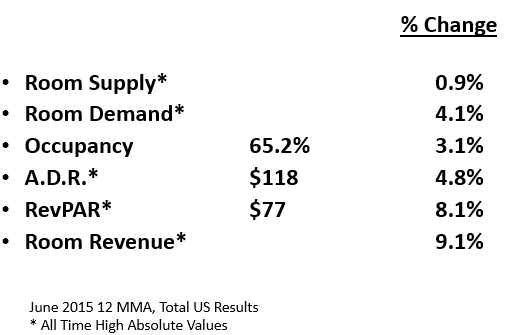

According to data from STR Global, through the first half of 2015, the following performance metrics have reached all-time highs: Room Supply, Room Demand, ADR, RevPAR, and Room Revenue. On a year over year basis (twelve month moving average through June), overall Room Revenue for U.S Hotels has increased 9.1 percent. The following chart displays the twelve month moving average percentage change for each performance metric.

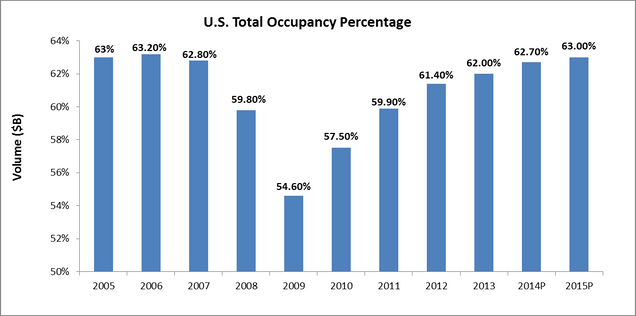

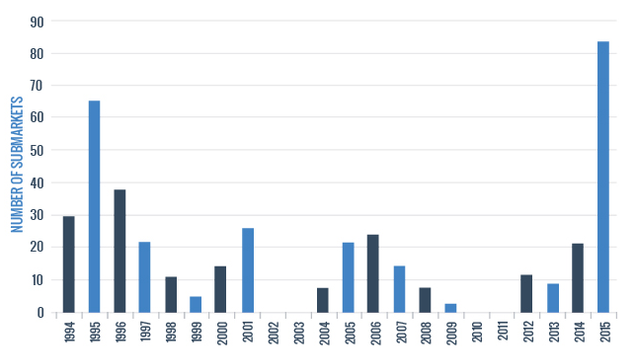

Over the past ten years, the average U.S occupancy rate has ranged between 54.6 and 63.0 percent. As exhibited within the following chart, the 2014 and projected 2015 year-end occupancy is expected to reach peak levels. The next chart presents the number of U.S. submarkets reaching peak occupancy between 1994 and 2015; 2015 has been a banner year with over 80 submarkets reaching peak occupancies.

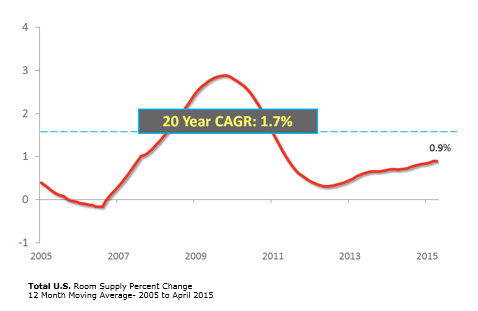

In addition to strong demand growth across the country, another factor leading to increasing occupancy levels is the limited amount of new supply entering the market. Over the past twenty years, the average annual increase in supply has been 1.7 percent. Based on data from STR Global, the 2015 expected increase in supply is 0.9 percent. Overall occupancy levels are expected to remain strong; however growth will be limited due to seasonality constraints. As observed during previous recovery and growth cycles, the supply curve is expected to continue rising over the next several years.

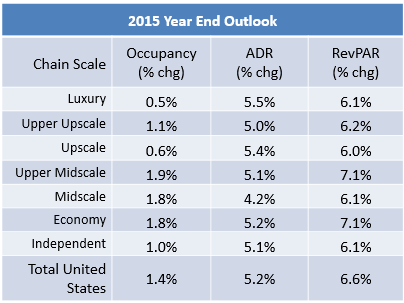

As evidenced by the 2015 Year End Outlook presented below, RevPAR growth in the U.S is expected to ease to 6.6 percent. The Upper Midscale and Economy segments are anticipated to achieve the highest rates of growth.

In terms of the current hotel investment climate, U.S. hotels continue to attract domestic and foreign investors and a surge of institutional capital continues to be deployed into single assets and portfolios. Robust investor appetite is expected to continue, with greater participation from a wider array of equity sources. The stars continue to remain aligned and the fundamentals of the U.S. lodging industry are simultaneously favorable to buy, sell, and develop a variety of lodging product types.

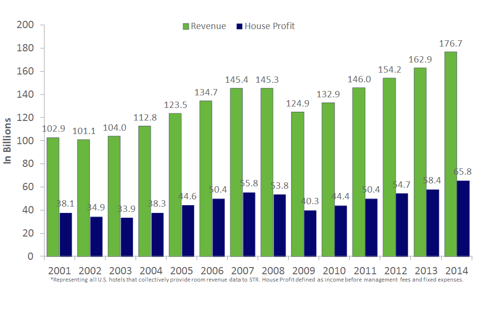

One of the reasons for increased activity in the hotel transactions market is the improving profitability of U.S Hotels over the past five years. Total revenue for the industry reached a reported $176.7 billion in 2014, while House Profit was recorded at $65.8 billion according to STR Global. As observed on the chart below, profitability levels for U.S. Hotels have been increasing each year since 2009.

In addition to following national trends in the industry, LW Hospitality Advisors® (LWHA®) also tracks hotel transactions across the country. The Q2 2015 Major U.S. Hotel Sales Survey includes 56 single asset sale transactions over $10 million, none of which are part of a portfolio. These transactions totaled roughly $4.5 billion, and included approximately 16,800 hotel rooms with an average sale price per room of $267,000. By comparison, the LWHA Q2 2014 Major U.S. Hotel Sales Survey identified 42 transactions totaling roughly $4.5 billion including 12,800 hotel rooms with an average sale price per room of nearly $354,000. Comparing Q2 2015 with Q2 2014, the number of trades has impressively increased while total volume has remained steady. It is important to note that while the quarter over quarter 33 percent per room price decline appears dramatic, the Q2 2014 numbers were skewed due to inclusion of the $1.73 billion trade of the 2995 room Cosmopolitan of Las Vegas.

With 16 major hotel sales, Florida has been by far the most active transaction market followed by California with 9 major hotel sales. Million dollar plus per room trades are now occurring on a more frequent basis in top markets including the Q2 2015 sales of the Bardessono Hotel & Spa in Yountville, CA, and the Marker Waterfront Resort in Key West, FL which also set a new record for per room pricing metrics in Key West. The Waldorf Astoria Chicago trade of $600,000 per room is also a new record for the City of Chicago. Conversely, a record low trade has also occurred, the Revel Hotel and Casino, a bankrupt Atlantic City boardwalk property that originally cost $2.4 billion to build traded for $82 million ($59,000 per room), or 4 cents on the dollar.

U.S. hotel industry fundamentals are anticipated to accelerate during the second half of this year, and remain strong through at least 2016 as domestic corporate travel remains strong and sustained group momentum drives compression across the major markets. Wide open debt markets coupled with abundant sums of available low cost equity from around the globe should continue to fuel a hyper active transaction market. Clairvoyant investors who acquired assets between 2009 and 2011 will continue to bake in dramatic appreciation gains as a result of increasing U.S. hotel values. It is during robust markets like today that the hotel investment arena attracts newcomers to the sector. Many of these investors underwrite deals based upon an automatic assumption of rapid sale price increases during a one to three year horizon. Furthermore, they do not consider the ever present possibility of unforeseen market disruptions resulting in a need to hold on to an property during a down and/or turbulent market. Savvy investors know and understand that fundamentally hotels are long term investments, and while no different than their newbie brethren hope to realize rapid short term appreciation, they acquire assets that are market priced based upon traditional holding periods of five to ten years.

Daniel H. Lesser has more than 30 years of expertise in a wide range of hospitality operational, investment counseling, valuation, advisory, and transactional services. He currently serves as the President and CEO of LW Hospitality Advisors®, based in New York City. Mr. Lesser is a leading authority on hotel feasibility and valuation, and is highly sought after to speak at lodging and real estate events, as well as lectures at prestigious institutions of higher education, including Cornell University, Columbia University and New York University. He is widely published and quoted, and serves as a quarterly columnist for HotelNewsNow.com and GlobeSt.com. Most recently, Mr. Lesser created and served as the Senior Managing Director-Industry Leader of the Hospitality & Gaming Valuation Advisory Services Group at CB Richard Ellis Hotels (CBRE). Prior to joining CBRE, Mr. Lesser founded and led the Hospitality & Gaming Group at Cushman & Wakefield and was a founding member of the team at HVS International. Mr. Lesser has also held operational and administrative positions with Hilton Hotels Corporation and Eurotels-Switzerland. He earned a Bachelor of Science degree in Hotel Administration from Cornell University, and also attended the Ecole hôtelière de Lausanne, Switzerland and Baruch College- City University of New York. Mr. Lesser holds the following professional designations: MAI (Member of the Appraisal Institute), FRICS (Fellow of The Royal Institution of Chartered Surveyors), CRE (Counselor of Real Estate), and CHA (Certified Hotel Administrator).

Daniel H. Lesser has more than 30 years of expertise in a wide range of hospitality operational, investment counseling, valuation, advisory, and transactional services. He currently serves as the President and CEO of LW Hospitality Advisors®, based in New York City. Mr. Lesser is a leading authority on hotel feasibility and valuation, and is highly sought after to speak at lodging and real estate events, as well as lectures at prestigious institutions of higher education, including Cornell University, Columbia University and New York University. He is widely published and quoted, and serves as a quarterly columnist for HotelNewsNow.com and GlobeSt.com. Most recently, Mr. Lesser created and served as the Senior Managing Director-Industry Leader of the Hospitality & Gaming Valuation Advisory Services Group at CB Richard Ellis Hotels (CBRE). Prior to joining CBRE, Mr. Lesser founded and led the Hospitality & Gaming Group at Cushman & Wakefield and was a founding member of the team at HVS International. Mr. Lesser has also held operational and administrative positions with Hilton Hotels Corporation and Eurotels-Switzerland. He earned a Bachelor of Science degree in Hotel Administration from Cornell University, and also attended the Ecole hôtelière de Lausanne, Switzerland and Baruch College- City University of New York. Mr. Lesser holds the following professional designations: MAI (Member of the Appraisal Institute), FRICS (Fellow of The Royal Institution of Chartered Surveyors), CRE (Counselor of Real Estate), and CHA (Certified Hotel Administrator).

Jonathan Jaeger currently serves as a Managing Director with LW Hospitality Advisors®, based in New York City. Prior to joining LWHA®, Mr. Jaeger had been with Pinnacle Advisory Group from January of 2008 through January of 2014. He began as a Consultant in the Boston office and was promoted to Vice President and head of the New York Practice. During his tenure, Mr. Jaeger was involved in the execution of over 300 consulting and valuation assignments throughout the United States. Prior to his advisory career, Mr. Jaeger held various operational and accounting/finance positions with Starwood Hotels & Resorts and Kimpton Hotels & Resorts. He graduated with a Bachelor of Science from the Boston University School of Hospitality Administration in addition to a minor in Business Administration from the Boston University School of Management. Mr. Jaeger is a State Certified Real Estate Appraiser specializing exclusively in the evaluation of hotel properties. During his time in Boston, he served on the Emerging Leaders Committee of the Massachusetts Chapter of the Appraisal Institute as well as a Council Member of the Massachusetts Lodging Association Under 30 Gateway Chapter. Beginning in the spring of 2011, Mr. Jaeger joined the adjunct faculty at Boston University, serving as co-instructor of the Hotel Asset Management course. In addition to teaching a course at Boston University, Mr. Jaeger has written several articles for industry wide publications; topics included the Manhattan Lodging Market, Highest and Best Use Analyses, E-Commerce in the Hotel Industry, among others. In New York City, Jonathan is a member of YHIP, the Young Hospitality Investment Professionals Group and also participates with the NYC & Company Hotel Committee in addition to recently affiliating with the Metro NY Chapter of the Appraisal Institute. Mr. Jaeger is a designated member of the Appraisal Institute (MAI); he achieved this designation in June of 2013. In addition, Mr. Jaeger is an active member of the American Hotel & Lodging Association (AH&LA) as well as a Development Coach for the United States Professional Tennis Association (USPTA).

37 comments

Great article, thanks for sharing.

تنظيف شقق

Put Slope Game on Top gg guys!

Your webpage is fantastic; I learned a great deal from it. Many thanks subway surfers

Thank you all for your advice – it’s very helpful for me! I can also advise you to seek written help at best essay writing service australia – professional writers will handle for you any complexity of writing work assigned to you in college or university in the form of homework

They have greater time and capacity to learn quickly as a result of early exposure to multilingual children’s books. So why not begin teaching your child a second language right away? octordle

I recently came across your blog and have been reading along totally agree with what you have said! Nice blog. I will keep visiting this blog very often Slope Unblocked

hellooo ! world, عبارات عن اليوم العالمي للغة العربية

Thank you! I would like to say basically i am working with technology web service by mysite . But facing some problem in it. Hopefully your blog will solve this issue.

This Tower Defense – Fantasy TD includes game modes with specific characteristics, which is a big challenge for Defenders, who is a perfect fan of tower defense games. Along with 40 levels with 3 levels of difficulty for players to conquer.

You should experiment with different categories and contexts with contexto until you find at least one “green” word. Take, for instance, animals, everyday objects, and abstract nouns.

4 Effective Ways to Fix Google Drive Video Still Processing · Fix 1. Check Your Internet Connection · Fix 2. Log in to Your Google Account Again.

nice website, i like to read the information you share, i will bookmark this and wait for next article. let me put it here Percetakan Jakarta

You do hesitate in this vid but I don’t judge that overall the video was amazing and I really helped me so thanks! Geometry Dash Scratch

Get CW1 Portfolio help in FY027 with HND Assignment Help

Self Development and Responsibility Assignment

Get help with CW1: Portfolio in FY027: Preparing for Success at University: Self Development and Responsibility Assignment with HND Assignment Help at an affordable price and timely delivery.

This industry has developed significantly. It can bring a lot of benefits. So, the government needs to focus on it. color tunnel

capybara clicker

This is, in my opinion, one of the best posts that you have made. Your work is quite outstanding in both quality and quantity. I am grateful to you for it.

The lodging industry has experienced significant transformations with the integration of logistics company. These companies have brought efficiency, innovation, and sustainability to the sector by offering advanced inventory management systems, improving the guest experience, optimizing supply chain operations, and implementing eco-friendly practices. As the industry continues to evolve, the collaboration between lodging providers and logistics companies will undoubtedly play a crucial role in shaping its future.

Thanks for the update. Let’s see how it will go in 2023 and 2024. I am not so optimistic, at least when it comes to angel numbers though.

Thank you very much for the useful information that the blog has shared. it’s pretty perfect you can try it whenever you want here ( Pizza Tower ).

It is very important to focus on your career for becoming financially independent but students are unable to do so because of burden of assignments and other curricular activities of universities. But do not worry ,

Ask for Assignment Help UK from Instant Assignment Help.

the best reliable site i have come across in issuing drivers license and the documents, i can recommend this site to any one in need.(https://realdocumentproviders.com)

Os melhores apartamentos de caldas novas vocë encontra no Airbnb

Thanks for sharing this information I am James Parker, a proficient academic writer dedicated to assisting students in London, UK. With a passion for education, I offer expert Assignment writing service UK, ensuring students’ success in their academic journeys. Through my writing, I strive to provide comprehensive support, helping learners excel in their studies. With a deep understanding of various subjects and a commitment to delivering high-quality work, I empower students to overcome challenges and achieve their academic goals. My experience and dedication make me a reliable resource for those seeking guidance and excellence in their assignments within the dynamic educational landscape of London, UK.

Incredible blog here! It’s mind boggling posting with the checked and genuinely accommodating data. Jack Torrance Jacket

Nice post. Thank you to provide us this useful information. wolverine jacket

Nice post. Thank you to provide us this useful information. niim

Nice post. Thank you to provide us this useful information. digital marketing

Nice post. Thank you to provide us this useful information College Admission Essay Writing

Cost of Malaysia international movers: Find out the costs of moving to Malaysia, including international shipping and customs fees. cost of malaysia international movers

I appreciate the pleasant post. There is a huge amount of helpful information in this post. Keep going. Visit us if you’re looking for the top ice cream flavor manufacturers information.

Following the economic slump of 2008–2009, when the industry saw big drops in general performance and value. drift hunters

It was not first article by this author as I always found him as a talented author. Han Solo Jackets

Navigating the challenges in the U.S. Lodging Industry can be likened to a strategic business move, similar to decisions around when to file bankruptcy. Much like financial restructuring, the industry undergoes shifts, responding to economic dynamics, changing consumer behaviors, and unforeseen disruptions. Understanding the landscape and making informed decisions, whether in business strategies or bankruptcy considerations, is paramount for sustained resilience and success.

Drift Boss is a popular choice for casual gamers who enjoy quick and addictive gameplay.

Do you have a list of motels this year? flagle

Daniel Lesser and Jonathan Jaeger’s analysis of the U.S. Lodging Industry showcases remarkable growth and resilience post the 2008/2009 economic downturn. It’s inspiring to see performance metrics like Room Supply, Room Demand, ADR, RevPAR, and Room Revenue hitting all-time highs. As Godrej Plots Khalapur, we’re optimistic about the industry’s upward trajectory and the opportunities it presents for stakeholders.

Daniel Lesser and Jonathan Jaeger provide an insightful analysis of the U.S Lodging Industry’s remarkable resurgence post-2008/2009 economic downturn. It’s inspiring to see the industry achieving peak levels in various performance metrics like Room Supply, ADR, and RevPAR, as indicated by data from STR Global. As a member of Experion Elements Phase 1, we’re excited to witness such positive trends in the hospitality sector.