The Current State of the New England Lodging Market: New England Falls Short of the Nation in RevPAR Growth in 2013

By Rachel Roginsky and Matthew Arrants

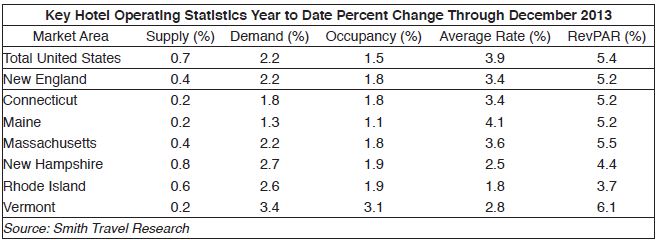

Revenue per available room (RevPAR) for the New England region grew 5.2 percent compared to growth of 5.4 percent for the country as a whole. However, there is still plenty of good news:

- The region was only slightly behind in terms of RevPAR, exceeding the national growth rate for occupancy and recording the same rate of growth in demand;

- Two states (Massachusetts and Vermont) outpaced the national growth rates in RevPAR and occupancy; and

- Demand growth in all but two of the New England states was equal to or above the national average.

While this is the second year in a row when the region finished behind the nation in terms of RevPAR growth, it was much closer, lagging only 0.2 percent behind versus 1.2 percent last year. One reason for the region’s slow growth is that it has been outperforming the rest of the country in terms of absolute figures. In 2013 occupancy for the region was 62.5 percent compared to 62.3 percent for the country as a whole and the average daily rate was $131.46 versus $110.35.

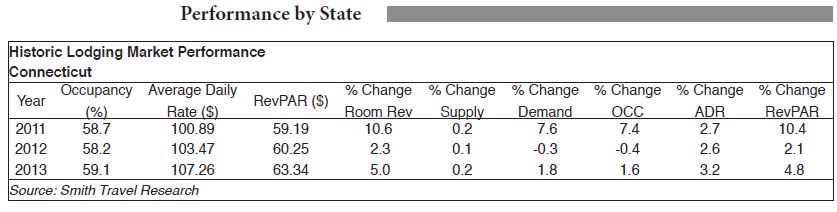

Connecticut

As a whole, the state of Connecticut did not experience the same levels of growth as the rest of the country, but it did see a significant improvement over 2012. The table presents key performance metrics for the state over the last three years.

As the table indicates, Connecticut experienced a strong recovery in 2011 followed by two years of more moderate growth. In fact, demand actually declined in 2012. Fortunately supply growth has been very limited, which has helped statewide occupancy grow.

A review of the top four markets in the state indicates that only the Stamford/Danbury market outperformed the statewide averages. RevPAR growth for that market area grew by a strong 6.3 percent due to strong growth in both occupancy and average daily rate (ADR). The New Haven/Waterbury market did well in terms of RevPAR growth; however, it was due in part to a decline in supply that helped increase market occupancy.

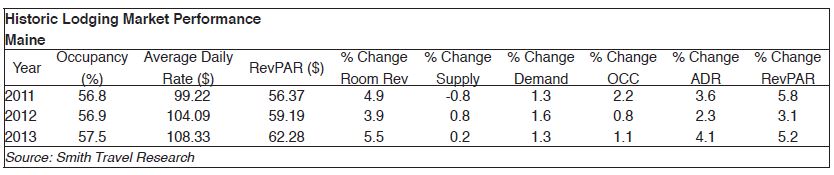

Maine

Maine finished the year with an occupancy rate of 57.5 percent, an increase of 1.1 percent over 2012. Average rate of growth was the strongest of the last three years increasing by 4.1 percent. The table presents the state’s performance over the last three years.

The top performing market in the state was Portland, which experienced RevPAR growth over 10 percent with the growth fairly evenly distributed between both occupancy and average rate. Helping that market’s performance was the closure of the Eastland Park, which was undergoing renovations for most of the year. Bangor did not perform well relative to the rest of the state or to other markets due to new supply that pushed occupancy levels dow.

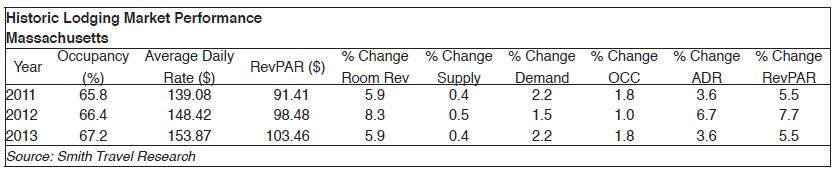

Massachusetts

The Massachusetts lodging market is traditionally the strongest in the region. In 2013 the state finished with an average rate almost 40 percent above the national average. The table presents the state’s performance over the last three years.

Lodging performance in Massachusetts, as a whole, is heavily impacted by activity in Boston. More than half of the hotel rooms in the state are located in Greater Boston with approximately one-quarter in the cities of Boston and Cambridge alone. The Boston market performed very well in 2014. Market occupancy reached a record 80 percent due to strong convention demand during the first quarter, and strong playoff runs by the Red Sox and the Bruins. The strong market occupancy pushed demand out to the suburbs helping to increase occupancy levels for those markets.

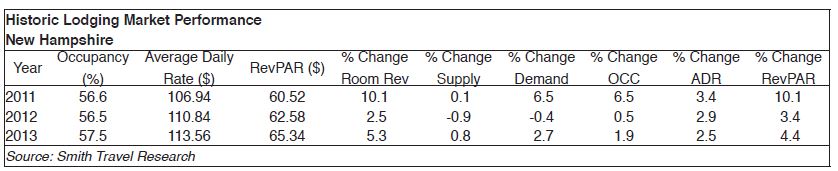

New Hampshire

The New Hampshire lodging market was one of the weaker performers in the region in 2013. RevPAR grew by only 4.4 percent with occupancy up 1.9 percent and ADR up 2.5 percent. The relatively slow growth in RevPAR in the last two years could be attributed to the very strong growth experienced in 2011. The statewide occupancy is lower than the national average, but given the seasonality of demand in the state, this is reasonable. The state’s ADR of $113.56 in 2013 is on a par with the national average of $110.35. The table presents the statewide lodging performance over the last three years.

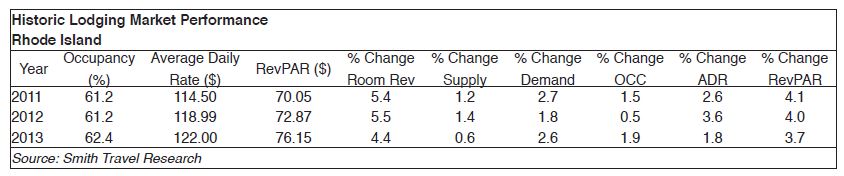

Rhode Island

Rhode Island’s RevPAR growth was the weakest in the region in 2013, increasing by 3.7 percent compared to 5.2 percent for all of New England and 5.4 percent for the country as a whole. Demand in the state grew at a respectable rate of 1.9 percent, however occupancy growth was limited by new supply, which grew at a rate of 0.6 percent. Average rates for the state grew by 1.8 percent, its lowest rate over the last three years and the lowest in the region. A look at some of the individual markets in the region suggests that Providence held the market back due to negative growth in ADR and only minor increases in occupancy. Warwick on the other hand performed well with significant increases in both occupancy and average rate. Newport’s performance was mixed with occupancy basically flat and ADR up over 2.5 percent.

Vermont

Vermont was the top performing state in the region with RevPAR growth of 6.1 percent. Driving the state’s strong performance was a demand growth of 3.4 percent compared to 2.2 percent for the region and the country as a whole. Average rate growth in the region was less impressive in 2013 increasing at only 2.8 percent.

Several markets are poised for some changes over the next 12 to 18 months:

- Providence, RI – There are new additions to supply anticipated in Providence in 2014. The Biltmore is expected to complete a major renovation that will help to reposition the property and allow it to increase its rates. While fewer conventions are expected, there are more convention related room nights due to a large event at the end of November.

- Hartford, CT – The downtown market continues to slowly dig its way out of the recession with an increase in RevPAR of 4.0 percent due to growth in both occupancy and average daily rate. The absolute numbers, however remain relatively weak with occupancy at 57.2 percent and ADR at $101.96. Outside of downtown, the owners of the Delamar in Greenwich and Southport continue to work on a boutique hotel project in West Hartford.

- Portland, ME – The Portland market is bracing for a major increase in supply. In December, the former Eastland Park hotel reopened as the Westin Eastland with 289 rooms after being closed for a year and a half. A 130-room Hyatt Place and a 131-room Courtyard by Marriott are both expected to open in May of this year along with a 35-room addition at the Hilton Garden Inn at the airport. Next year a 110-room boutique hotel affiliated with Marriott’s Autograph collection is expected to open.

- Boston and Greater Boston –The Cities of Boston and Cambridge, and the suburban Boston lodging market, should continue to show very strong numbers in 2014 due to capacity constraints caused by limited new supply. In addition, 2014 is expected to be a strong convention year for the Boston Convention and Exhibition Center.

While RevPAR growth for the region was slightly below the country as a whole in 2013, we remain optimistic about the prospects for the regional lodging market in 2014. Only one market (Portland, ME) is expected to experience significant growth in supply. Limited supply growth in the region coupled with moderate growth in demand will result in higher occupancy levels and allow operators to increase their rates at above inflationary levels.