GEGI Launches China Energy Finance Database

The Global Economic Governance Initiative (GEGI), a research initiative at the Frederick S. Pardee School of Global Studies at Boston University, recently launched the China Energy Finance Database an interactive web portal that allows users to search and display the overseas lending of the China Development Bank and the Export-Import Bank of China.

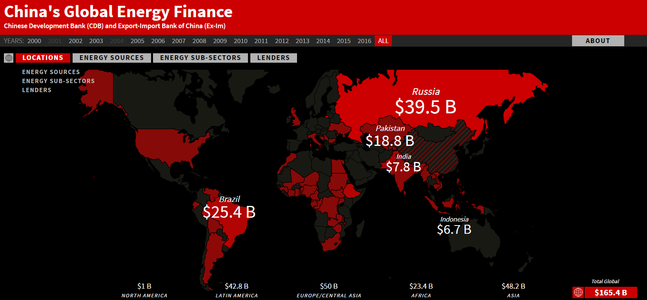

Since 2000, China’s global development banks have provided roughly $160 billion across the world. The China Energy Finance Database allows users to search and display the overseas lending of the CDB and Ex-Im over time, across regions and within countries, and by type of energy source for the period 2000 to 2016. Roughly 60 percent of the $160 billion in energy finance provided by these banks over the period was concentrated across the Asian continent, with Latin America (25 percent) and Africa (14 percent) receiving the bulk of the rest. While some of the financing is earmarked for the extraction of various energy sources and power transmission, 80 percent of all the finance is for power plants. 93 percent of the power plant financing is in the coal (66) and hydroelectric (27) sectors.

The China Development Bank (CDB) and the Export-Import Bank of China (Ex-Im) do not uniformly publish these data. Since 2011, GEGI and other university-based research groups have been attempting to estimate the scope and characteristics of Chinese development finance in Africa and Latin America. The database is is the first attempt at a global estimate of China’s overseas energy finance. Drawing on the early work of the China-Africa Research Institute (SAIS-CARI) at the Paul Nitze School of Advanced International Studies maintains and makes publish a database on China-Africa Finance. GEGI, along with the Inter-American Dialogue mimicked the SAIS-CARI methodology and publishes an inter-active China-Latin America Finance database.

The Financial Times published an April 4, 2017 on the database entitled “China Dominates Energy Infrastructure Finance as US Pulls Back.“

From the text of the article:

A new database, published on Tuesday by Boston University’s Global Economic Governance Initiative, shows that lending by China’s two global development banks rose 40 per cent last year to $48.4bn, a figure estimated to be several times the total funds allocated to energy infrastructure by the World Bank and other western-backed lending agencies.

“China is . . . exporting its model of infrastructure-led development abroad to those countries that are demanding energy and infrastructure but can’t get the financing from traditional sources,” said Kevin Gallagher, a Boston University professor and co-director of the Global Economic Governance Initiative.

He estimated that China’s lending to overseas energy projects was close to triple the average annual energy finance of $16.9bn provided by the World Bank and three other institutions, the Asian Development Bank, the Inter-American Development Bank and the African Development Bank, between 2007-2015.

View the interactive database.